A term sheet outlines the key terms and conditions of a business agreement, typically used in venture capital and investment deals to set expectations before final contracts are drafted. It covers crucial elements such as valuation, investment amount, equity stake, and rights of the parties involved. Explore the rest of the article to understand how a well-crafted term sheet can protect Your interests and streamline negotiations.

Table of Comparison

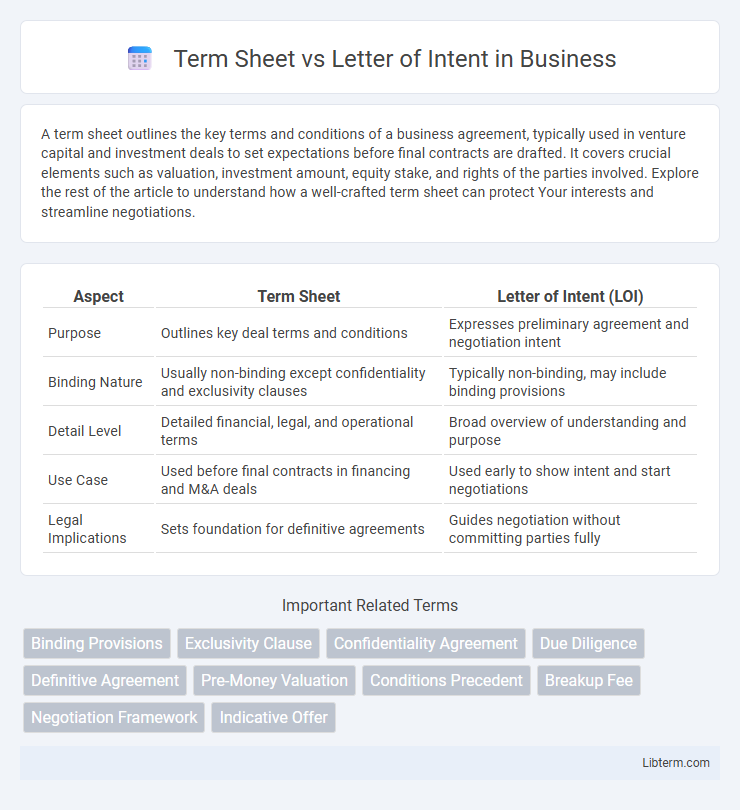

| Aspect | Term Sheet | Letter of Intent (LOI) |

|---|---|---|

| Purpose | Outlines key deal terms and conditions | Expresses preliminary agreement and negotiation intent |

| Binding Nature | Usually non-binding except confidentiality and exclusivity clauses | Typically non-binding, may include binding provisions |

| Detail Level | Detailed financial, legal, and operational terms | Broad overview of understanding and purpose |

| Use Case | Used before final contracts in financing and M&A deals | Used early to show intent and start negotiations |

| Legal Implications | Sets foundation for definitive agreements | Guides negotiation without committing parties fully |

Introduction to Term Sheet and Letter of Intent

A Term Sheet is a non-binding document outlining the key terms and conditions of a potential business agreement, typically used in investment or acquisition deals, providing a clear framework for negotiation. A Letter of Intent (LOI) serves as a preliminary agreement that expresses the parties' intention to enter into a formal contract, focusing on the main points of the proposed transaction. Both documents facilitate early-stage discussions by setting expectations and guiding due diligence in corporate transactions.

Definition of Term Sheet

A Term Sheet is a non-binding document outlining the key terms and conditions of a proposed business agreement, serving as a framework for negotiation before drafting a detailed contract. It includes important elements such as valuation, investment amount, ownership structure, and rights of parties involved in mergers, acquisitions, or financing deals. Unlike a Letter of Intent, which may express a party's preliminary commitment or intention to enter into a transaction, the Term Sheet provides a detailed blueprint guiding the legal documentation process.

Definition of Letter of Intent

A Letter of Intent (LOI) is a preliminary document outlining the basic terms and intentions between parties before finalizing a formal agreement, serving as a roadmap for negotiation. Unlike a Term Sheet that is often more detailed and legally binding in specific provisions, the LOI primarily establishes the framework and mutual understanding without committing to all legal obligations. It is crucial in mergers and acquisitions, joint ventures, and large business transactions to clarify initial agreements and intentions.

Key Differences Between Term Sheet and Letter of Intent

A Term Sheet outlines the fundamental terms and conditions of a business agreement, often focusing on financial details, investment structure, and key obligations, while a Letter of Intent primarily expresses a party's preliminary commitment or interest to enter into a transaction. Term Sheets are typically more detailed and legally binding to some extent, influencing negotiations and due diligence, whereas Letters of Intent serve as non-binding documents to establish negotiation frameworks and confirm mutual understanding. The key difference lies in their level of specificity and legal enforceability, with Term Sheets providing clearer tactical guidance for deal execution compared to the more conceptual and exploratory nature of Letters of Intent.

Legal Binding Nature: Term Sheet vs Letter of Intent

A Term Sheet generally provides a non-binding overview of the principal terms and conditions of a potential agreement, often serving as a foundation for drafting definitive contracts. In contrast, a Letter of Intent may contain both binding and non-binding provisions, with specific sections--such as confidentiality or exclusivity clauses--typically enforceable under law. Understanding the distinct legal binding nature of each document is crucial for parties to manage obligations and risks during negotiation phases.

Common Components of a Term Sheet

A term sheet outlines the key terms and conditions of a potential investment or acquisition, including valuation, investment amount, equity stake, and governance rights. Common components include financing structure, liquidation preferences, voting rights, board composition, and anti-dilution provisions. These elements serve as a foundation for drafting the definitive agreements and ensure mutual understanding before detailed negotiations begin.

Typical Clauses in a Letter of Intent

Typical clauses in a Letter of Intent (LOI) include the scope of the proposed transaction, outlining key terms such as price, payment structure, and timeline. Confidentiality and exclusivity provisions ensure sensitive information remains protected and prevent parties from negotiating with others during the LOI period. Binding and non-binding sections clarify which commitments are enforceable, while conditions precedent and termination clauses define the requirements and grounds for ending the agreement.

Use Cases: When to Use Each Document

A Term Sheet is ideal during early-stage negotiations to outline key financial terms and deal structure before drafting a binding agreement, often used in venture capital or mergers. A Letter of Intent (LOI) serves when parties want to express a formal intention to proceed with a transaction, typically before detailed due diligence or contract finalization. Use a Term Sheet to clarify precise deal terms, while an LOI is better for signaling commitment and setting negotiation guidelines.

Pros and Cons of Term Sheets and Letters of Intent

Term sheets provide a clear, non-binding outline of key deal terms, facilitating efficient negotiations and aligning expectations, but they may lead to misinterpretations due to their preliminary nature. Letters of Intent offer a more formalized expression of intent with possible binding provisions, enhancing commitment but potentially exposing parties to legal risks if ambiguities arise. Both documents serve distinct functions: term sheets prioritize flexibility and speed, while letters of intent emphasize commitment and legal clarity, which can create trade-offs in deal certainty and negotiation dynamics.

Choosing the Right Document for Your Transaction

Selecting the right document for your transaction depends on the level of detail and commitment required; a Term Sheet outlines specific financial terms and conditions, providing a comprehensive framework for the deal. In contrast, a Letter of Intent (LOI) serves as a preliminary agreement expressing mutual interest and basic terms without binding obligations. Understanding your transaction's complexity and objectives ensures that choosing either a Term Sheet or LOI aligns with legal clarity and negotiation efficiency.

Term Sheet Infographic

libterm.com

libterm.com