Basel II is a comprehensive international regulatory framework designed to strengthen the banking sector by enhancing risk management and capital adequacy standards. It focuses on three pillars: minimum capital requirements, supervisory review, and market discipline, ensuring banks are better prepared for financial uncertainties. Discover how Basel II impacts your banking experience and the global financial landscape in the rest of the article.

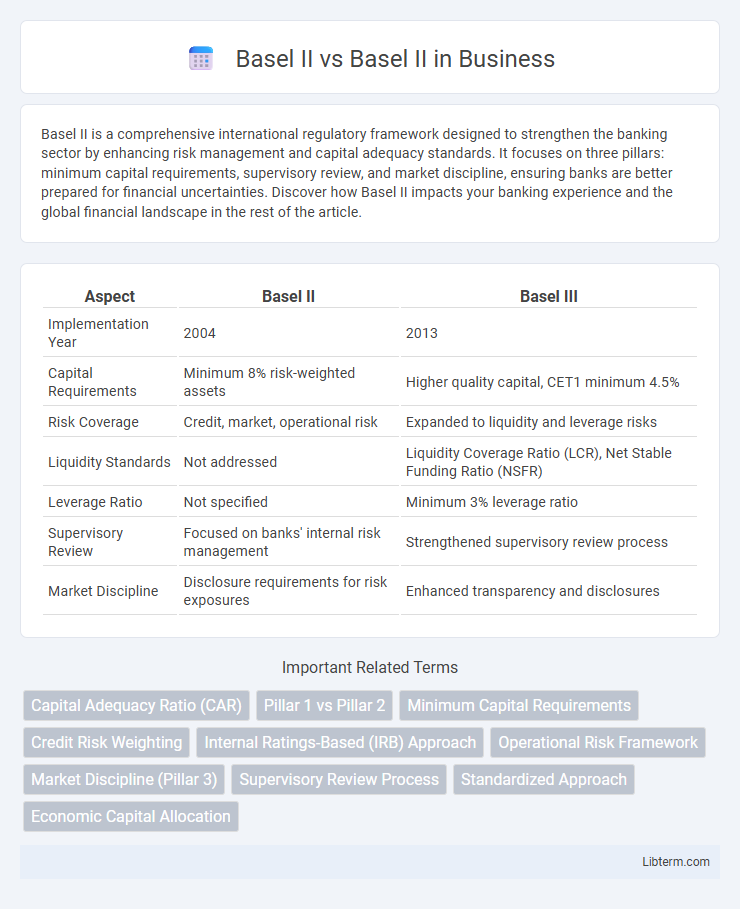

Table of Comparison

| Aspect | Basel II | Basel III |

|---|---|---|

| Implementation Year | 2004 | 2013 |

| Capital Requirements | Minimum 8% risk-weighted assets | Higher quality capital, CET1 minimum 4.5% |

| Risk Coverage | Credit, market, operational risk | Expanded to liquidity and leverage risks |

| Liquidity Standards | Not addressed | Liquidity Coverage Ratio (LCR), Net Stable Funding Ratio (NSFR) |

| Leverage Ratio | Not specified | Minimum 3% leverage ratio |

| Supervisory Review | Focused on banks' internal risk management | Strengthened supervisory review process |

| Market Discipline | Disclosure requirements for risk exposures | Enhanced transparency and disclosures |

Introduction to Basel II

Basel II is an international regulatory framework designed to enhance banking supervision by improving risk management and capital adequacy requirements. It introduces three pillars: minimum capital requirements, supervisory review, and market discipline, aiming to create a more resilient financial system. Basel I, in contrast, focused primarily on credit risk with fixed capital requirements, lacking the comprehensive risk sensitivity and supervisory oversight of Basel II.

Overview of Basel III

Basel III is a comprehensive regulatory framework developed to enhance the Basel II accord by strengthening bank capital requirements, introducing more rigorous liquidity and leverage ratios, and improving risk management standards. It mandates higher quality capital reserves, including common equity Tier 1 capital, to reduce the risk of financial crises and promote long-term stability in the banking sector. Basel III also incorporates stress testing and macroprudential measures to address systemic risks and ensure greater resilience in the global financial system.

Key Objectives: Basel II vs Basel III

Basel II aimed to enhance risk sensitivity by introducing a three-pillar approach: minimum capital requirements, supervisory review, and market discipline, focusing on credit, market, and operational risks. Basel III strengthened these objectives by increasing capital quality and quantity, introducing stringent leverage and liquidity standards to improve bank resilience and stability post-2008 financial crisis. While Basel II emphasized risk-sensitive capital adequacy and transparency, Basel III expanded the regulatory framework to address systemic risks and ensure long-term financial system sustainability.

Capital Adequacy Requirements Comparison

Basel II and Basel III both establish capital adequacy requirements, but Basel III introduces more stringent norms to enhance bank resilience. Basel III increases the minimum Common Equity Tier 1 (CET1) capital ratio to 4.5%, compared to Basel II's lower thresholds, and adds capital conservation and countercyclical buffers, raising overall capital quality and quantity. Risk coverage under Basel III is expanded through stricter definitions of capital and enhanced treatment of market, credit, and operational risks, improving the financial stability framework.

Risk Management Enhancements

Basel II introduces advanced risk management enhancements by emphasizing three pillars: minimum capital requirements, supervisory review, and market discipline, which significantly improve the assessment and management of credit, market, and operational risks compared to Basel I. It adopts more sophisticated approaches such as the Internal Ratings-Based (IRB) method for credit risk and the Standardized Approach for operational risk, allowing banks to align capital allocation more closely with actual risk profiles. Basel II's enhanced regulatory framework improves transparency and encourages stronger governance practices within financial institutions.

Leverage Ratio and Basel III Innovations

Basel III introduced a leverage ratio requirement to address the shortcomings of Basel II by limiting the buildup of excessive leverage in banks, set at a minimum of 3% for Tier 1 capital relative to total exposure. Unlike Basel II, which primarily focused on risk-weighted assets for capital adequacy, Basel III's leverage ratio acts as a non-risk-based backstop, improving the overall resilience of the banking sector. Innovations in Basel III also include enhanced capital buffers and stricter liquidity standards to strengthen financial stability beyond the Basel II framework.

Liquidity Standards: Basel II vs Basel III

Basel II primarily focused on credit risk, market risk, and operational risk, lacking explicit liquidity standards, which led to vulnerabilities during financial crises. Basel III introduced comprehensive liquidity frameworks, including the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR), to ensure banks maintain adequate short-term and long-term liquidity buffers. These standards significantly enhance banks' resilience against liquidity shocks, addressing gaps left by Basel II.

Impact on Banks and Financial Institutions

Basel II introduced a risk-sensitive framework that significantly impacted banks by requiring more accurate capital allocation based on credit, market, and operational risks, enhancing risk management practices. Basel III further strengthened capital adequacy by increasing minimum capital requirements, introducing leverage and liquidity ratios, and improving stress testing, which heightened banks' resilience to financial shocks. Both frameworks collectively pushed financial institutions toward greater transparency, risk sensitivity, and overall stability in the global banking system.

Implementation Challenges

Basel II implementation challenges mainly arise from its complex regulatory requirements, such as the need for advanced risk measurement systems and extensive data collection for credit, market, and operational risk. Financial institutions often struggle with the significant investment in technology upgrades and staff training to comply with the Internal Ratings-Based (IRB) approaches and the Supervisory Review Process (Pillar 2). Regulatory inconsistencies across jurisdictions further complicate Basel II adoption, leading to varied interpretation and enforcement of capital adequacy standards.

Future Outlook of Global Banking Regulations

Basel III builds on Basel II by introducing stricter capital requirements and enhanced risk management standards to strengthen the resilience of global banks. Future global banking regulations will likely emphasize digital asset risks, climate-related financial disclosures, and more comprehensive stress testing frameworks. Regulatory bodies worldwide are also moving towards harmonizing standards to ensure greater stability and transparency in the international financial system.

Basel II Infographic

libterm.com

libterm.com