Enterprise Value (EV) represents the total value of a company, encompassing market capitalization, debt, and cash reserves to provide a comprehensive measure beyond stock price alone. It is a crucial metric for investors and analysts to assess a company's true worth and compare firms with varying capital structures. Discover how understanding Enterprise Value can enhance your investment decisions by exploring the rest of this article.

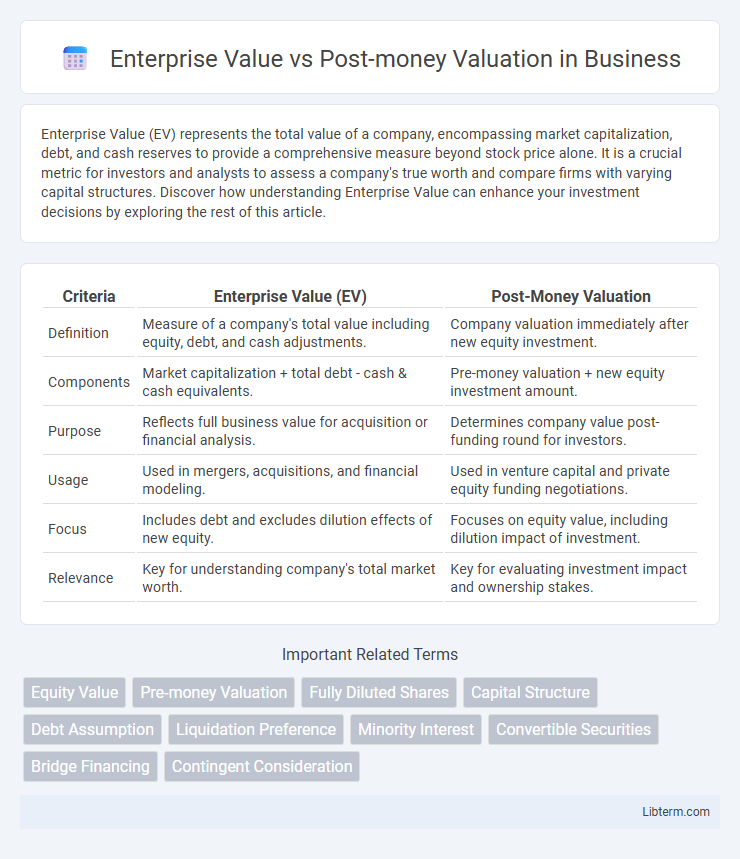

Table of Comparison

| Criteria | Enterprise Value (EV) | Post-Money Valuation |

|---|---|---|

| Definition | Measure of a company's total value including equity, debt, and cash adjustments. | Company valuation immediately after new equity investment. |

| Components | Market capitalization + total debt - cash & cash equivalents. | Pre-money valuation + new equity investment amount. |

| Purpose | Reflects full business value for acquisition or financial analysis. | Determines company value post-funding round for investors. |

| Usage | Used in mergers, acquisitions, and financial modeling. | Used in venture capital and private equity funding negotiations. |

| Focus | Includes debt and excludes dilution effects of new equity. | Focuses on equity value, including dilution impact of investment. |

| Relevance | Key for understanding company's total market worth. | Key for evaluating investment impact and ownership stakes. |

Introduction: Understanding Valuation Metrics

Enterprise Value represents the total value of a company, including equity, debt, and cash, offering a comprehensive assessment of its market worth. Post-money Valuation refers to a company's value immediately after receiving external financing or investments, reflecting the new equity stake. Differentiating these metrics is crucial for investors and stakeholders to accurately gauge investment impact and company performance.

What is Enterprise Value?

Enterprise Value (EV) represents the total value of a company, including its market capitalization, debt, and minus cash and cash equivalents, providing a comprehensive measure for assessing a firm's worth. EV is crucial for investors and analysts to compare companies regardless of capital structure differences, reflecting the true cost to acquire the business. It differs from post-money valuation, which primarily accounts for equity value after a funding round, excluding debt and cash considerations.

Defining Post-money Valuation

Post-money valuation represents the total value of a company immediately after a financing round, calculated by adding the new investment amount to the pre-money valuation. It reflects the ownership percentage of new and existing shareholders based on the latest capital infusion. Enterprise value differs as it encompasses total company value, including debt and excluding cash, providing a comprehensive valuation metric beyond just equity stakes.

Key Differences Between Enterprise Value and Post-money Valuation

Enterprise Value (EV) measures a company's total value, including equity, debt, and cash, reflecting the true acquisition cost. Post-money Valuation refers to the company's value immediately after new equity investment, calculated by adding the investment amount to the pre-money valuation. The key difference lies in EV encompassing debt and cash adjustments, whereas post-money valuation focuses solely on equity value after funding rounds.

How Enterprise Value is Calculated

Enterprise Value (EV) is calculated by adding market capitalization, total debt, and preferred equity, then subtracting cash and cash equivalents, providing a comprehensive measure of a company's total value. This metric captures both equity and debt holders' claims, reflecting the firm's operational value regardless of its capital structure. Unlike post-money valuation, which reflects an investor's stake after funding, EV offers a more precise understanding of the company's overall financial worth in mergers and acquisitions.

Calculating Post-money Valuation

Post-money valuation is calculated by adding the amount of new equity investment to the pre-money valuation, reflecting the company's total value immediately after the funding round. This figure represents the ownership stake of all shareholders and is essential for determining equity dilution and ownership percentages. Understanding the distinction from enterprise value, which includes debt and excludes cash, is crucial for accurate financial analysis and investment decisions.

Use Cases: When to Use Each Metric

Enterprise Value (EV) provides a comprehensive measure of a company's total value, including debt and excluding cash, making it ideal for mergers, acquisitions, and comparing firms with varied capital structures. Post-money valuation, reflecting the company's equity value immediately after an investment round, is crucial for startups and investors to assess ownership dilution and gauge fundraising success. Use Enterprise Value for operational and financial analysis in mature companies, while post-money valuation is essential during venture capital funding and startup equity evaluations.

Impact on Investors and Founders

Enterprise Value reflects a company's total valuation including debt and equity, influencing investor perception of overall risk and potential return. Post-money Valuation, calculated after investment, directly affects founders' ownership percentage and investor equity stake, impacting control and future dilution. Investors assess Enterprise Value for comprehensive financial health, while founders focus on Post-money Valuation to gauge dilution and capital raised.

Common Mistakes in Valuation Analysis

Confusing Enterprise Value with Post-money Valuation often leads to overestimating a company's worth by ignoring debt and cash differences included in Enterprise Value calculations. Analysts frequently misinterpret Post-money Valuation as the total company value without adjusting for new equity issuance diluting existing shares. Mistakes in valuation analysis can cause flawed investment decisions by overlooking the impact of liabilities, equity structure, and the timing of capital raises.

Conclusion: Choosing the Right Metric

Choosing between Enterprise Value and Post-money Valuation depends on the specific financial analysis or investment decision context. Enterprise Value provides a holistic view of a company's total value, including debt and cash, making it ideal for acquisition comparisons and capital structure assessments. Post-money Valuation is crucial for startup financing rounds, reflecting investor ownership stakes immediately after funding, guiding equity dilution and future funding strategies.

Enterprise Value Infographic

libterm.com

libterm.com