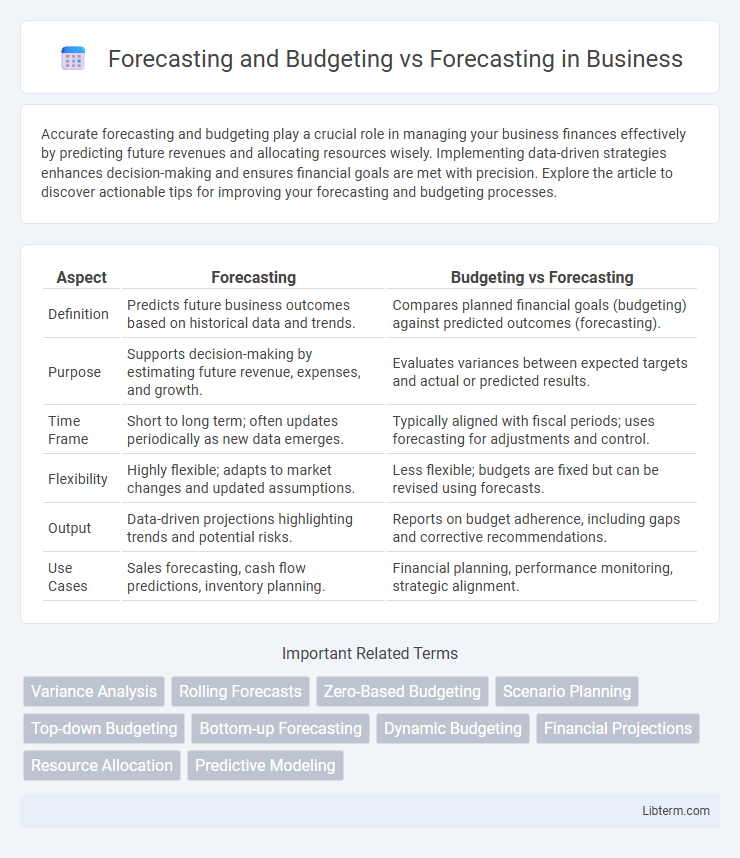

Accurate forecasting and budgeting play a crucial role in managing your business finances effectively by predicting future revenues and allocating resources wisely. Implementing data-driven strategies enhances decision-making and ensures financial goals are met with precision. Explore the article to discover actionable tips for improving your forecasting and budgeting processes.

Table of Comparison

| Aspect | Forecasting | Budgeting vs Forecasting |

|---|---|---|

| Definition | Predicts future business outcomes based on historical data and trends. | Compares planned financial goals (budgeting) against predicted outcomes (forecasting). |

| Purpose | Supports decision-making by estimating future revenue, expenses, and growth. | Evaluates variances between expected targets and actual or predicted results. |

| Time Frame | Short to long term; often updates periodically as new data emerges. | Typically aligned with fiscal periods; uses forecasting for adjustments and control. |

| Flexibility | Highly flexible; adapts to market changes and updated assumptions. | Less flexible; budgets are fixed but can be revised using forecasts. |

| Output | Data-driven projections highlighting trends and potential risks. | Reports on budget adherence, including gaps and corrective recommendations. |

| Use Cases | Sales forecasting, cash flow predictions, inventory planning. | Financial planning, performance monitoring, strategic alignment. |

Definition of Forecasting and Budgeting

Forecasting involves predicting future financial outcomes based on historical data, trends, and market analysis to guide decision-making and strategic planning. Budgeting is the process of creating a detailed financial plan that allocates resources and sets spending limits to achieve specific organizational goals. While forecasting estimates what is likely to happen, budgeting sets the financial framework and constraints within which operations must be managed.

Key Differences Between Forecasting and Budgeting

Forecasting involves predicting future financial outcomes based on historical data and market trends to inform strategic decisions, while budgeting sets specific financial goals and allocates resources to achieve those goals over a defined period. Key differences include forecasting's flexible, continuous nature aimed at estimating potential results, whereas budgeting is a fixed plan used for controlling expenditures and guiding operational activities. Forecasting adapts to changing conditions and updates projections regularly, whereas budgeting provides a stable financial framework that supports performance measurement and accountability.

The Role of Forecasting in Business Planning

Forecasting plays a crucial role in business planning by providing data-driven projections that guide strategic decision-making and resource allocation. Unlike budgeting, which sets specific financial targets and limits, forecasting offers flexible, scenario-based insights that help businesses anticipate market trends and adjust plans proactively. Accurate forecasting improves risk management and operational efficiency by aligning business objectives with expected economic and industry developments.

The Purpose of Budgeting in Financial Management

Budgeting in financial management serves as a detailed plan that allocates resources and sets spending limits to achieve organizational goals efficiently, while forecasting predicts future financial performance based on historical data and market trends. The primary purpose of budgeting is to provide a financial roadmap that guides decision-making, controls costs, and ensures alignment with strategic objectives. Effective budgeting supports risk management by anticipating financial constraints and enabling proactive adjustments to maintain fiscal discipline.

Forecasting Methods and Techniques

Forecasting and budgeting both rely on data-driven forecasting methods to enhance financial planning accuracy, but forecasting emphasizes predictive analytics and trend analysis techniques such as time series analysis, econometric models, and machine learning algorithms. Budgeting integrates these forecasting results with strategic planning frameworks, using techniques like zero-based budgeting and rolling forecasts to allocate resources effectively. Advanced forecasting methods, including scenario planning and Monte Carlo simulations, improve decision-making by quantifying uncertainty in both processes.

Integrating Forecasting with Budgeting Processes

Integrating forecasting with budgeting processes enhances financial accuracy by aligning predictive insights with resource allocation and spending plans. This integration allows organizations to create dynamic budgets that adjust based on real-time forecast updates, improving agility and strategic decision-making. Leveraging technologies like integrated planning software facilitates seamless data flow, ensuring forecasts directly inform budgeting cycles for better performance tracking and risk management.

Benefits of Combining Forecasting and Budgeting

Combining forecasting and budgeting enhances financial accuracy by aligning predictive analysis with allocated resources, enabling organizations to adapt quickly to market changes. This integration improves strategic decision-making through continuous performance monitoring and variance analysis, ensuring budget adjustments reflect real-time forecasts. Leveraging both processes together maximizes resource efficiency, minimizes financial risks, and supports proactive business planning.

Common Challenges in Forecasting vs Budgeting

Forecasting often faces challenges such as data volatility and unpredictable market conditions, making accuracy difficult to maintain, while budgeting struggles with rigidity and static assumptions that limit adaptability. Both processes require balancing precision with flexibility, but forecasting demands continuous adjustments based on real-time data, whereas budgeting relies on predefined financial targets. Misalignment between forecasting and budgeting processes can lead to resource misallocation and strategic inconsistencies that impact organizational performance.

Forecasting-Only Approaches: Pros and Cons

Forecasting-only approaches emphasize predicting future outcomes based on historical data and trends without integrating budget constraints, allowing for flexibility and adaptability in rapidly changing markets. This method enhances strategic planning by focusing solely on potential scenarios, but it may lack the financial discipline necessary for cost control and resource allocation. Limitations include potential misalignment with organizational budgets and difficulty in enforcing fiscal accountability, which budgeting processes typically address.

Best Practices for Effective Forecasting and Budgeting

Effective forecasting and budgeting require accurate data analysis, realistic assumptions, and regular updates to reflect changing market conditions. Leveraging technology such as AI-driven forecasting tools enhances predictive accuracy and streamlines budgeting processes. Collaboration between finance teams and department heads ensures alignment with organizational goals and improves decision-making efficiency.

Forecasting and Budgeting Infographic

libterm.com

libterm.com