Futures contracts are standardized agreements to buy or sell an asset at a predetermined price on a specific future date, widely used for hedging risk and speculative trading. These instruments help you manage price volatility in commodities, currencies, or financial indices by locking in prices ahead of time. Explore the rest of the article to understand how futures contracts can impact your investment strategy and risk management.

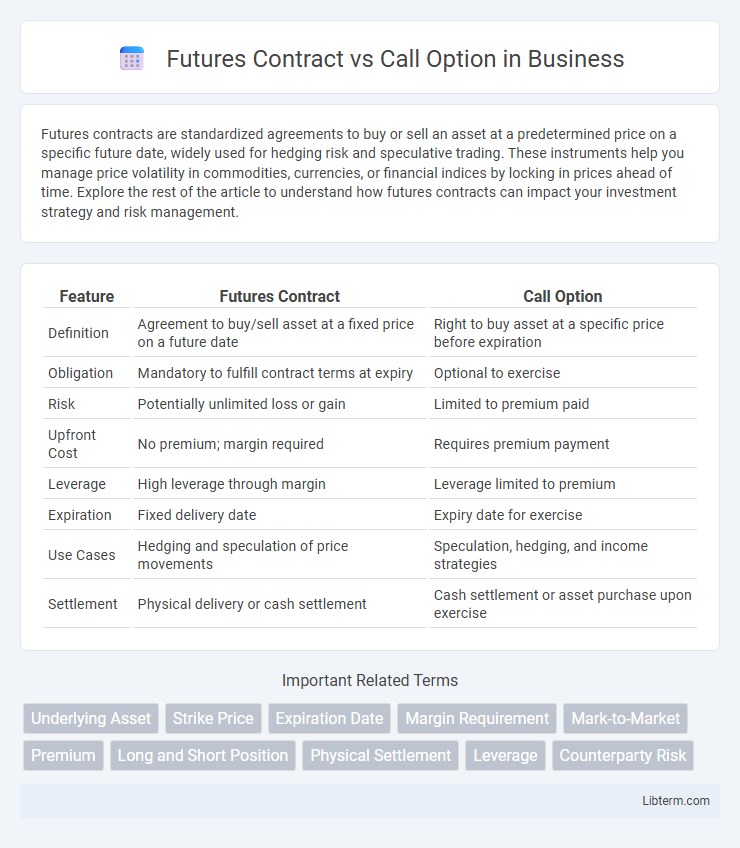

Table of Comparison

| Feature | Futures Contract | Call Option |

|---|---|---|

| Definition | Agreement to buy/sell asset at a fixed price on a future date | Right to buy asset at a specific price before expiration |

| Obligation | Mandatory to fulfill contract terms at expiry | Optional to exercise |

| Risk | Potentially unlimited loss or gain | Limited to premium paid |

| Upfront Cost | No premium; margin required | Requires premium payment |

| Leverage | High leverage through margin | Leverage limited to premium |

| Expiration | Fixed delivery date | Expiry date for exercise |

| Use Cases | Hedging and speculation of price movements | Speculation, hedging, and income strategies |

| Settlement | Physical delivery or cash settlement | Cash settlement or asset purchase upon exercise |

Introduction to Futures Contracts and Call Options

Futures contracts are standardized agreements obligating the buyer to purchase, and the seller to sell, an asset at a predetermined price on a specific future date, enabling hedging and speculation in commodities, currencies, and financial instruments. Call options grant the holder the right, but not the obligation, to buy an underlying asset at a set strike price before or on the expiration date, offering leveraged exposure with limited risk. Both instruments facilitate risk management and investment strategies but differ in obligation, risk profile, and cost structure.

Key Definitions and Basic Concepts

A futures contract is a standardized legal agreement to buy or sell an asset at a predetermined price on a specified future date, obligating both parties to execute the transaction. A call option grants the buyer the right, but not the obligation, to purchase an underlying asset at a specified strike price before or at expiration. Futures contracts involve mandatory settlement, while call options provide asymmetric risk exposure with limited loss potential for the buyer.

Structure of Futures Contracts

Futures contracts represent standardized agreements to buy or sell an asset at a predetermined price on a specific future date, obligating both parties to fulfill the contract terms upon expiration. These contracts are traded on regulated exchanges with daily settlement through margin accounts, ensuring transparency and minimizing credit risk. Unlike call options, futures contracts do not grant the right but impose a binding commitment, which affects leverage, risk exposure, and margin requirements.

Mechanics of Call Options

Call options grant the buyer the right, but not the obligation, to purchase an underlying asset at a predetermined strike price before or at expiration, requiring payment of a premium upfront. Unlike futures contracts, which mandate the purchase or sale of the asset on a specific date with leverage and marked-to-market daily, call options limit risk to the premium paid while providing potential for unlimited upside gain. The need to manage factors such as time decay (theta), volatility (vega), and the option's intrinsic and extrinsic value distinguishes the mechanics of call options in derivatives trading.

Margin Requirements and Premiums

Futures contracts require traders to post an initial margin, typically a percentage of the contract's value, which is adjusted daily based on market fluctuations to maintain the margin level. Call options involve paying a premium upfront, representing the maximum potential loss, with no additional margin required unless the option is sold or exercised. Margin requirements for futures create continuous financial exposure, while call option premiums provide limited risk by defining the cost to enter the position.

Profit and Loss Scenarios

Futures contracts entail symmetrical profit and loss potential since both buyers and sellers are obligated to transact the underlying asset at the contract price upon expiration, leading to unlimited gains or losses based on price movements. Call options offer asymmetric risk, where buyers have limited loss equal to the premium paid and potentially unlimited profit if the underlying asset's price exceeds the strike price by expiration. Sellers of call options face limited profit confined to the premium received but carry the risk of substantial losses if the underlying asset price rises significantly.

Risk Exposure and Management

Futures contracts expose both buyers and sellers to potentially unlimited risk due to the obligation to buy or sell the underlying asset at a predetermined price, necessitating margin requirements and daily mark-to-market adjustments to manage these risks. Call options limit the buyer's risk to the premium paid, offering the right but not the obligation to purchase the asset, which provides a more controlled risk exposure while sellers face potentially unlimited risk if the asset's price rises significantly. Effective risk management in futures involves maintaining adequate margin and monitoring market fluctuations, whereas call option buyers manage risk by the upfront premium, and sellers often use hedging strategies to mitigate potential losses.

Use Cases: Hedging vs Speculation

A futures contract is commonly used by producers and consumers of commodities to hedge against price fluctuations by locking in prices, ensuring cost predictability and risk management. Call options offer investors the opportunity to speculate on asset appreciation with limited downside risk, as the buyer's maximum loss is confined to the premium paid. In hedging, futures provide obligation enforcement, while call options provide asymmetric payoff structures suited for speculative strategies.

Liquidity and Market Accessibility

Futures contracts typically offer higher liquidity due to standardized contract sizes and centralized exchanges, making it easier for traders to enter and exit positions quickly. Call options provide greater market accessibility with lower capital requirements and flexible strike prices, appealing to a broader range of investors including those with limited risk tolerance. Both instruments benefit from active secondary markets, but futures often exhibit tighter bid-ask spreads reflecting more efficient price discovery.

Choosing Between Futures and Call Options

Choosing between futures contracts and call options depends on risk tolerance, upfront costs, and flexibility preferences. Futures require a margin deposit and carry unlimited risk with obligatory execution, making them suitable for traders seeking direct exposure and commitment to buy or sell the underlying asset. Call options offer the right, but not the obligation, to purchase assets, providing limited risk to the premium paid and allowing strategic leverage with customizable strike prices and expiration dates.

Futures Contract Infographic

libterm.com

libterm.com