A merger combines two companies to create a stronger, more competitive organization with enhanced resources and market reach. It often leads to increased efficiency, cost savings, and expanded capabilities to better serve customers. Explore the rest of the article to understand how a merger can impact your business strategy and future growth.

Table of Comparison

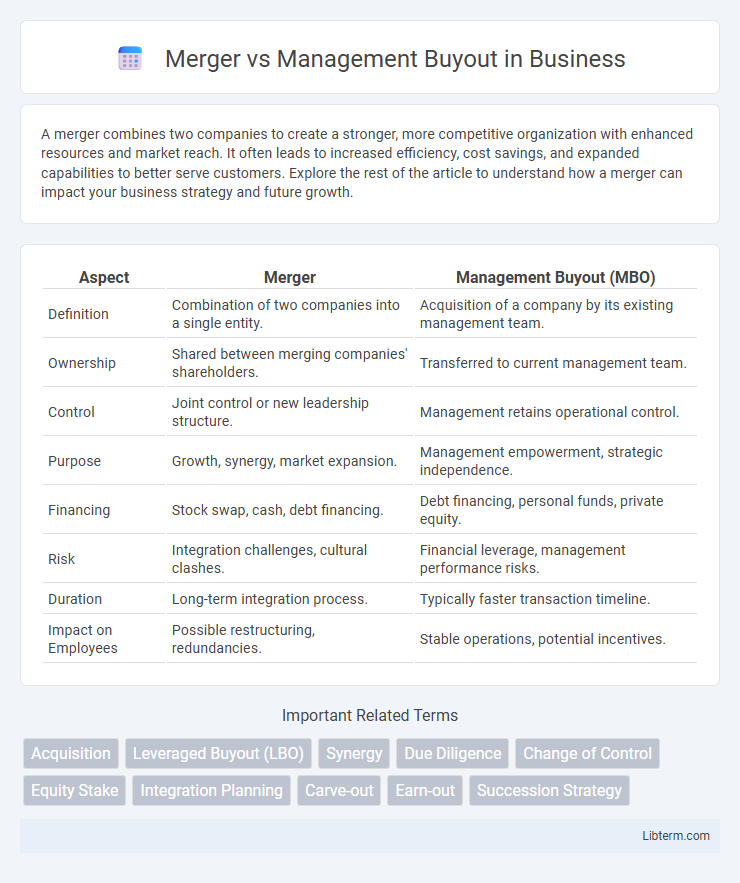

| Aspect | Merger | Management Buyout (MBO) |

|---|---|---|

| Definition | Combination of two companies into a single entity. | Acquisition of a company by its existing management team. |

| Ownership | Shared between merging companies' shareholders. | Transferred to current management team. |

| Control | Joint control or new leadership structure. | Management retains operational control. |

| Purpose | Growth, synergy, market expansion. | Management empowerment, strategic independence. |

| Financing | Stock swap, cash, debt financing. | Debt financing, personal funds, private equity. |

| Risk | Integration challenges, cultural clashes. | Financial leverage, management performance risks. |

| Duration | Long-term integration process. | Typically faster transaction timeline. |

| Impact on Employees | Possible restructuring, redundancies. | Stable operations, potential incentives. |

Understanding Mergers: Definition and Types

Mergers involve the combination of two or more companies into a single entity to achieve strategic growth, enhanced market share, or operational synergies. Common types of mergers include horizontal mergers, where companies in the same industry unite; vertical mergers, which integrate different stages of production; and conglomerate mergers that combine firms in unrelated businesses. Understanding these types helps clarify the strategic intent and potential benefits behind each merger deal.

What is a Management Buyout (MBO)?

A Management Buyout (MBO) occurs when a company's existing management team purchases the business they operate, often using a combination of personal funds and external financing such as private equity or loans. This strategic move allows management to gain full operational control and equity ownership, aligning their interests closely with the company's success. MBOs are frequently pursued in businesses seeking leadership continuity during ownership transitions or in situations where owners want to divest without disrupting company operations.

Key Differences Between Mergers and Management Buyouts

Mergers involve the combination of two or more companies to form a single entity, often aiming for market expansion and synergy creation, whereas management buyouts (MBOs) occur when a company's existing management team acquires a significant portion or all of the business, focusing on ownership control and operational continuity. Mergers typically involve external parties and shareholders, impacting company structure on a broader scale, while MBOs are internally driven transactions emphasizing management's vested interest in company performance. Financial structuring also differs, with mergers often financed through stock swaps or cash, and MBOs frequently relying on leveraged buyout financing, including debt secured against future company earnings.

Strategic Advantages of Mergers

Mergers offer strategic advantages such as enhanced market share, operational synergies, and increased competitive positioning by combining complementary strengths of both companies. They enable access to new markets, diversified product lines, and pooled resources, which drive innovation and cost efficiencies. Mergers also facilitate accelerated growth and stronger brand presence, providing a scalable platform for long-term success.

Benefits of Management Buyouts for Existing Teams

Management buyouts (MBOs) empower existing teams by providing ownership stakes, aligning employee interests with company success and fostering long-term commitment. This ownership structure often leads to increased motivation, higher productivity, and improved decision-making due to deep organizational knowledge. MBOs also minimize disruption, preserving company culture and stability while enabling more agile and responsive management compared to traditional mergers.

Risks and Challenges in Mergers vs. MBOs

Mergers present risks including cultural clashes, integration difficulties, and regulatory hurdles that can disrupt business operations and reduce synergies. Management Buyouts (MBOs) face challenges such as financing constraints, valuation disputes, and potential conflicts of interest between management and shareholders. Both approaches require careful risk assessment, with mergers often encountering broader market uncertainties, while MBOs heavily depend on internal leadership capability and financial structuring.

Financial Considerations: Mergers vs. MBOs

Mergers involve combining two companies, often requiring substantial capital for acquisition, integration costs, and potential liabilities, impacting cash flow and balance sheets significantly. Management buyouts (MBOs) usually rely on leveraged financing, where management teams secure debt against the target company's assets, affecting debt-to-equity ratios and financial risk profiles. Evaluating return on investment, funding sources, and post-transaction financial stability is crucial in determining the viability of mergers versus MBOs.

Legal and Regulatory Factors

Legal and regulatory factors in mergers involve comprehensive antitrust reviews to prevent monopolistic practices, compliance with securities laws, and disclosure requirements mandated by agencies such as the SEC. Management buyouts (MBOs) require scrutiny over conflict of interest issues, fiduciary duties of managers, and adherence to shareholder approval protocols to ensure fairness and transparency. Both transactions must navigate complex regulatory frameworks including the Hart-Scott-Rodino Act, which mandates pre-merger notifications to federal authorities for significant deals.

Deciding Between Merger and Management Buyout

Choosing between a merger and a management buyout hinges on factors such as control retention, financial resources, and strategic goals. Mergers offer opportunities for market expansion and operational synergies by combining two companies, while management buyouts enable existing leadership to maintain ownership and drive tailored company growth. Evaluating the impact on corporate culture, cash flow availability, and long-term vision is essential for informed decision-making.

Case Studies: Successful Mergers and MBOs

Successful mergers, such as the Disney-Pixar merger, highlight the power of combining complementary strengths and cultures to drive innovation and market expansion. Management buyouts (MBOs) like the Dell privatization showcase how insider ownership aligns management incentives with business performance, leading to focused strategic direction and operational efficiency. Case studies reveal that while mergers often create value through scale and synergies, MBOs deliver success by leveraging detailed internal knowledge and agility.

Merger Infographic

libterm.com

libterm.com