Information asymmetry occurs when one party in a transaction holds more or better information than the other, leading to imbalanced decision-making and potential market inefficiencies. This imbalance can result in adverse selection or moral hazard, significantly impacting pricing, trust, and overall economic outcomes. Explore the rest of the article to understand how information asymmetry influences markets and what strategies you can use to mitigate its effects.

Table of Comparison

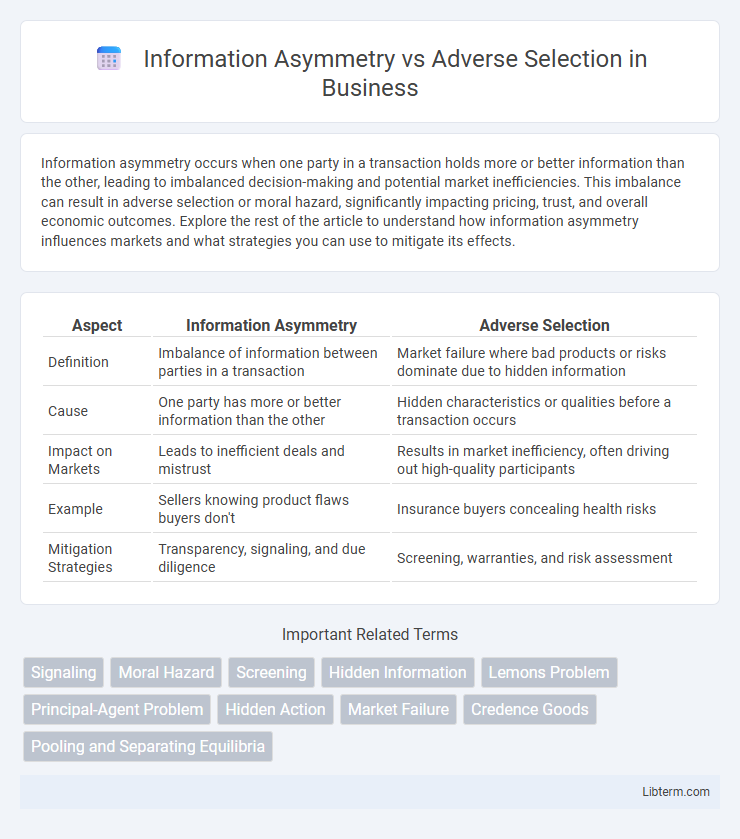

| Aspect | Information Asymmetry | Adverse Selection |

|---|---|---|

| Definition | Imbalance of information between parties in a transaction | Market failure where bad products or risks dominate due to hidden information |

| Cause | One party has more or better information than the other | Hidden characteristics or qualities before a transaction occurs |

| Impact on Markets | Leads to inefficient deals and mistrust | Results in market inefficiency, often driving out high-quality participants |

| Example | Sellers knowing product flaws buyers don't | Insurance buyers concealing health risks |

| Mitigation Strategies | Transparency, signaling, and due diligence | Screening, warranties, and risk assessment |

Understanding Information Asymmetry

Information asymmetry occurs when one party in a transaction possesses more or better information than the other, creating an imbalance that can distort decision-making and market outcomes. This imbalance often leads to adverse selection, where the side with less information makes suboptimal decisions, such as buying lower-quality goods or services. Understanding information asymmetry is crucial for designing mechanisms like screening and signaling to mitigate its negative effects and improve market efficiency.

Defining Adverse Selection

Adverse selection is a market phenomenon occurring when one party possesses more information than the other during a transaction, often resulting in high-risk individuals or products dominating the market. This situation emerges due to information asymmetry, where sellers or buyers conceal critical details, leading to inefficient market outcomes. In insurance markets, adverse selection causes premiums to rise as insurers cannot accurately distinguish between low-risk and high-risk policyholders.

Key Differences Between Information Asymmetry and Adverse Selection

Information asymmetry occurs when one party in a transaction possesses more or better information than the other, creating an imbalance in decision-making; adverse selection is a specific consequence of this imbalance where high-risk individuals are more likely to engage in transactions, especially in insurance and financial markets. The key difference lies in scope: information asymmetry is the broader condition of uneven information distribution, while adverse selection specifically refers to the resulting problem of quality distortion due to hidden information before a contract is signed. Understanding this distinction is crucial for designing mechanisms like signaling and screening to mitigate inefficiencies in markets characterized by hidden information.

Causes of Information Asymmetry in Markets

Information asymmetry in markets arises primarily from unequal access to relevant information between buyers and sellers, often due to hidden characteristics or actions not observable by one party. Causes include imperfections in information disclosure, high costs of verifying information, and deliberate withholding or misrepresentation of data by one side to gain advantage. This imbalance leads to adverse selection, where the party with less information makes suboptimal decisions, frequently resulting in market inefficiencies.

How Adverse Selection Occurs

Adverse selection occurs when buyers or sellers possess private information that the other party cannot access, leading to transactions where high-risk or low-quality products dominate the market. This phenomenon arises in markets like insurance or used cars, where individuals with hidden disadvantages are more likely to participate, skewing the market equilibrium. The resulting imbalance intensifies information asymmetry, causing inefficiencies and market failures.

Real-World Examples of Information Asymmetry

Information asymmetry occurs when one party in a transaction possesses more or better information than the other, often leading to adverse selection, where poor-quality goods or high-risk individuals are more likely to be selected. In the used car market, sellers typically have more knowledge about vehicle conditions than buyers, resulting in buyers overpaying or acquiring defective cars, a classic example known as the "market for lemons." Similarly, in health insurance, applicants often know more about their health risks than insurers, causing higher-risk individuals to seek coverage disproportionately and raising costs for all policyholders.

Case Studies: Adverse Selection in Practice

Adverse selection occurs when buyers or sellers possess private information, leading to market inefficiencies as seen in the used car market where sellers know more about vehicle defects than buyers, causing the "lemons problem." In insurance markets, adverse selection arises when individuals with higher health risks are more likely to purchase comprehensive coverage, raising costs for insurers, as documented in the Affordable Care Act's early enrollment data. Case studies from the labor market reveal that employers often face adverse selection when hiring, as applicants may hide skill deficiencies, resulting in suboptimal hiring outcomes and increased turnover.

Consequences for Consumers and Businesses

Information asymmetry occurs when one party in a transaction has more or better information than the other, leading to adverse selection where high-risk consumers or low-quality products dominate the market. Consumers face higher prices, reduced choices, and potential exploitation as businesses leverage their informational advantage, eroding trust and market efficiency. Businesses experience increased costs from screening and monitoring, decreased profitability, and potential market failures due to the inability to accurately assess risk or product quality.

Strategies to Mitigate Information Asymmetry and Adverse Selection

Strategies to mitigate information asymmetry and adverse selection include enhancing transparency through accurate disclosure of information and implementing rigorous screening processes. Utilizing third-party verification services and adopting signaling mechanisms, such as warranties or certifications, reduces the risk of hidden information discrepancies. Developing robust contractual agreements and leveraging technology like blockchain for secure data sharing further align incentives and minimize adverse selection effects.

Implications for Policy and Regulation

Information asymmetry, where one party possesses more or better information than another, leads to adverse selection, causing markets to malfunction and inefficient outcomes. Policymakers must implement regulations such as mandatory disclosure requirements, transparency standards, and screening mechanisms to mitigate risks associated with hidden information. Effective remedies reduce market failures in sectors like insurance, finance, and healthcare by improving trust and enabling better decision-making.

Information Asymmetry Infographic

libterm.com

libterm.com