Recognized revenue refers to the income a company records in its financial statements when it has fulfilled its performance obligations, regardless of when the cash is received. This accounting principle ensures financial transparency and aligns revenue reporting with actual business activity. Dive into the rest of the article to understand how recognized revenue impacts your business decisions and financial health.

Table of Comparison

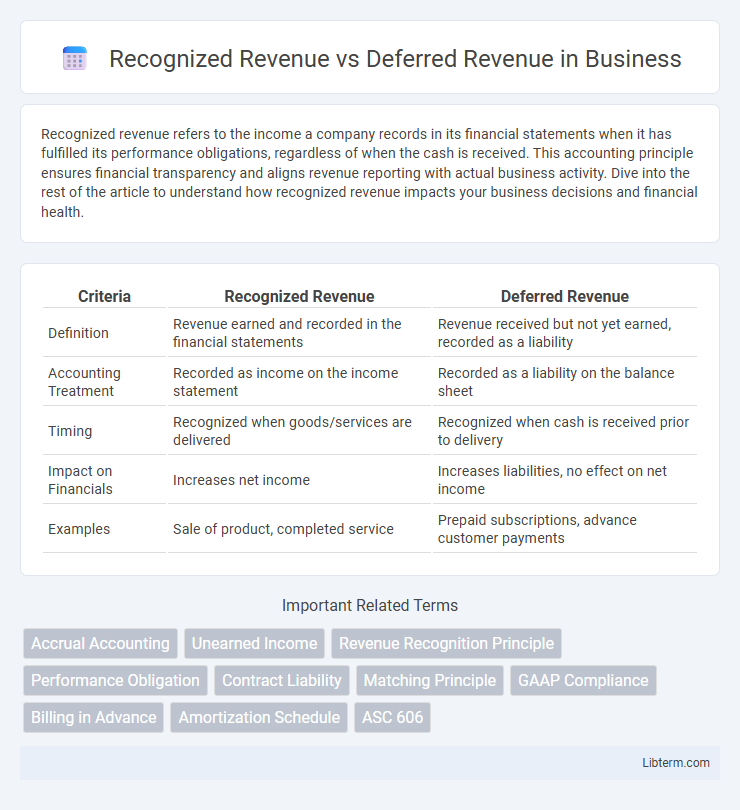

| Criteria | Recognized Revenue | Deferred Revenue |

|---|---|---|

| Definition | Revenue earned and recorded in the financial statements | Revenue received but not yet earned, recorded as a liability |

| Accounting Treatment | Recorded as income on the income statement | Recorded as a liability on the balance sheet |

| Timing | Recognized when goods/services are delivered | Recognized when cash is received prior to delivery |

| Impact on Financials | Increases net income | Increases liabilities, no effect on net income |

| Examples | Sale of product, completed service | Prepaid subscriptions, advance customer payments |

Introduction to Recognized Revenue and Deferred Revenue

Recognized revenue refers to the income a company records in its financial statements when goods or services have been delivered and the earnings process is complete, aligning with accrual accounting principles. Deferred revenue, also known as unearned revenue, represents payments received in advance for goods or services to be provided in the future, recorded as a liability until fulfillment occurs. Understanding the distinction between recognized and deferred revenue is essential for accurate financial reporting and compliance with revenue recognition standards such as ASC 606 and IFRS 15.

Key Differences Between Recognized Revenue and Deferred Revenue

Recognized revenue represents income that a company has earned and recorded in its financial statements, reflecting the delivery of goods or services to customers. Deferred revenue, also known as unearned revenue, is money received in advance for products or services not yet delivered, recorded as a liability until the obligation is fulfilled. The key difference lies in timing: recognized revenue impacts the income statement immediately, while deferred revenue remains on the balance sheet until earned, affecting cash flow without impacting current profitability.

Importance in Financial Reporting

Recognized revenue reflects the actual income earned during a specific period, providing an accurate measure of a company's financial performance for investors and stakeholders. Deferred revenue represents payments received for goods or services not yet delivered, ensuring liabilities are properly recorded and revenues are matched to the correct accounting periods. Accurate differentiation between recognized and deferred revenue is crucial for compliance with accounting standards such as GAAP and IFRS, enhancing transparency and enabling better financial decision-making.

Criteria for Revenue Recognition

Recognized revenue is recorded when goods or services are delivered and persuasive evidence of an arrangement exists, ensuring the revenue is earned and realizable according to GAAP or IFRS criteria. Deferred revenue occurs when payment is received before the delivery of goods or services, meaning the revenue is recorded as a liability until the performance obligations are satisfied. Key criteria for revenue recognition include identifying the contract, determining performance obligations, establishing transaction price, allocating price to obligations, and recognizing revenue upon fulfillment of each obligation.

How Deferred Revenue is Recorded

Deferred revenue is recorded as a liability on the balance sheet because it represents cash received for goods or services not yet delivered. This unearned revenue is initially recognized when payment occurs but the performance obligation remains outstanding. As the service is performed or the product delivered, deferred revenue is gradually recognized as earned revenue on the income statement.

Examples of Recognized Revenue

Recognized revenue includes sales from goods delivered or services rendered, such as a software company recording income after providing a license or subscription access to a customer. For example, an e-commerce retailer recognizes revenue once the product ships to the buyer, confirming the transfer of control. Additionally, a consulting firm recognizes revenue as milestones in a project are completed and invoiced, reflecting earned income per contract terms.

Examples of Deferred Revenue

Deferred revenue represents payments received for goods or services not yet delivered, such as annual software subscriptions paid upfront or airline tickets purchased before travel occurs. For example, a gym receiving membership fees in advance records this as deferred revenue until members use the facility. Similarly, magazine publishers recognize deferred revenue when subscribers pay for a yearly subscription before all issues are distributed.

Impact on Financial Statements

Recognized revenue directly increases net income and retained earnings on the income statement and balance sheet, reflecting earned income from delivered goods or services. Deferred revenue appears as a liability on the balance sheet, representing cash received but not yet earned, and does not affect net income until recognition. Proper differentiation affects financial ratios, investor perception, and compliance with revenue recognition standards like ASC 606 or IFRS 15.

Common Industries Using Deferred Revenue

Common industries utilizing deferred revenue include software-as-a-service (SaaS), subscription-based media, and telecommunications, where customers pay upfront for services delivered over time. These industries record payments as deferred revenue to comply with revenue recognition principles, ensuring income is matched with the delivery of goods or services. Accurate tracking of deferred and recognized revenue supports financial transparency and aligns with accounting standards like ASC 606 and IFRS 15.

Best Practices for Managing Revenue Recognition

Accurate management of recognized revenue and deferred revenue requires implementing clear policies aligned with the ASC 606 revenue recognition standard to ensure consistency and compliance. Tracking revenue through automated accounting systems enhances transparency and reduces errors by properly allocating revenue at the correct time based on performance obligations. Regular audits and real-time reporting support proactive adjustments, minimizing financial misstatements and optimizing cash flow forecasts.

Recognized Revenue Infographic

libterm.com

libterm.com