Loss profoundly impacts emotional well-being, often triggering grief and a need for healing. Understanding the stages of loss can help you navigate this difficult experience with resilience. Explore the rest of this article to discover effective coping strategies and support resources.

Table of Comparison

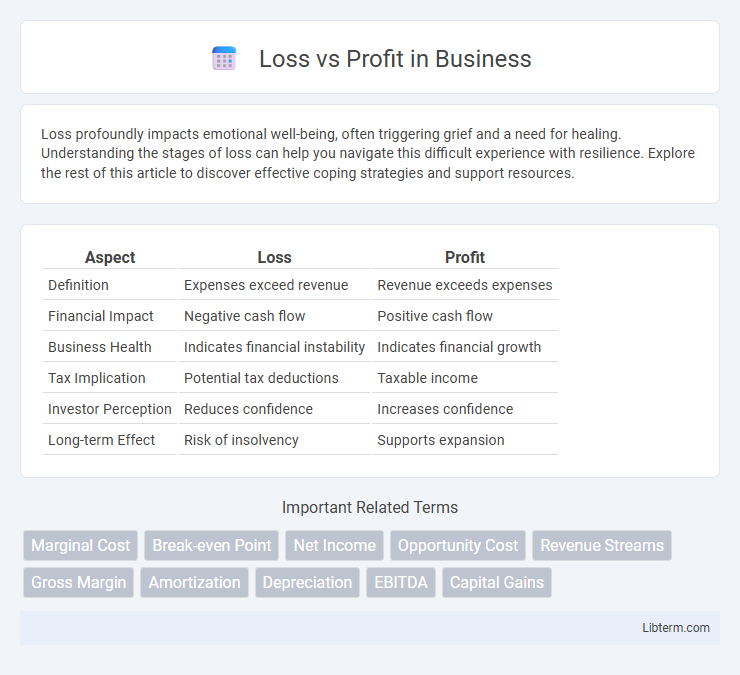

| Aspect | Loss | Profit |

|---|---|---|

| Definition | Expenses exceed revenue | Revenue exceeds expenses |

| Financial Impact | Negative cash flow | Positive cash flow |

| Business Health | Indicates financial instability | Indicates financial growth |

| Tax Implication | Potential tax deductions | Taxable income |

| Investor Perception | Reduces confidence | Increases confidence |

| Long-term Effect | Risk of insolvency | Supports expansion |

Understanding Loss and Profit

Loss occurs when expenses exceed revenues, resulting in negative financial outcomes for a business or individual. Profit represents the surplus remaining after all costs are deducted from total income, serving as a key indicator of financial health and business success. Accurately understanding loss and profit enables effective decision-making, strategic planning, and sustainable growth.

Key Differences Between Loss and Profit

Loss occurs when total expenses exceed total revenue, resulting in a negative financial outcome, whereas profit is achieved when total revenue surpasses total expenses, indicating a positive financial gain. Loss reduces a company's retained earnings and can impact cash flow and operational sustainability, while profit increases retained earnings and enhances financial stability and growth potential. Understanding the distinction between loss and profit is crucial for effective financial management, strategic decision-making, and business performance evaluation.

Factors Influencing Loss and Profit

Loss and profit are primarily influenced by factors such as revenue generation, operational costs, market demand, and competitive pricing strategies. External elements like economic conditions, taxation policies, and regulatory changes also significantly impact financial outcomes. Effective management of inventory, production efficiency, and marketing efforts are crucial in optimizing profit margins and minimizing losses.

Importance of Accurate Financial Reporting

Accurate financial reporting is crucial for distinguishing between loss and profit, enabling businesses to make informed decisions based on precise data. Reliable financial statements provide stakeholders with clear insights into company performance, ensuring transparency and fostering investor confidence. Misreporting or errors can lead to incorrect assessments, affecting strategic planning, tax liabilities, and regulatory compliance.

Common Causes of Business Losses

Poor cash flow management, declining sales, and high operational costs are common causes of business losses. Ineffective marketing strategies and failure to adapt to market changes often lead to decreased revenue. Moreover, excessive debt and inadequate financial planning contribute significantly to sustained financial losses.

Strategies to Maximize Profit

Maximizing profit requires implementing targeted strategies such as cost reduction, pricing optimization, and revenue diversification. Analyzing financial statements and key performance indicators enables businesses to identify loss centers and improve operational efficiency. Leveraging data-driven decision-making and investing in marketing and customer retention further enhance profitability.

Analyzing Profit Margins

Analyzing profit margins involves examining the ratio between net profit and revenue to assess a company's financial health. High profit margins indicate efficient cost management and robust pricing strategies, while low or negative margins often signal operational inefficiencies or declining sales. Monitoring gross, operating, and net profit margins provides critical insights for strategic decision-making and long-term business sustainability.

Impact of Loss and Profit on Business Growth

Profit drives business growth by enabling reinvestment in innovation, expansion, and talent acquisition, fueling competitive advantage and market share increase. Loss hinders growth by depleting financial resources, reducing operational capability, and eroding stakeholder confidence, which can lead to downsizing or closure. Sustained profitability strengthens brand value and attracts investors, while persistent losses may trigger risk management challenges and strategic pivots to recover financial stability.

Tools for Monitoring Financial Performance

Tools for monitoring financial performance, such as accounting software, financial dashboards, and budgeting apps, enable businesses to accurately track losses and profits in real time. Advanced analytics platforms provide detailed insights into revenue streams, expense management, and cash flow trends, helping identify areas of financial concern or growth opportunities. Implementing these tools ensures timely decision-making and enhances the ability to optimize profitability while minimizing losses.

Future Trends in Profit and Loss Management

Future trends in profit and loss management emphasize advanced data analytics and AI-driven forecasting to enhance decision-making accuracy. Increasing adoption of real-time financial monitoring systems allows businesses to quickly identify loss patterns and optimize profitability. Embracing blockchain technology is expected to improve transparency and reduce errors in profit and loss reporting processes.

Loss Infographic

libterm.com

libterm.com