A trade sale involves selling a business or its assets directly to another company, often a competitor or a firm within the same industry. This transaction can provide a quick exit strategy and maximize value by transferring ownership to a buyer with strategic interest. Discover how a trade sale could be the ideal solution to boost your business's growth and profitability by reading the rest of the article.

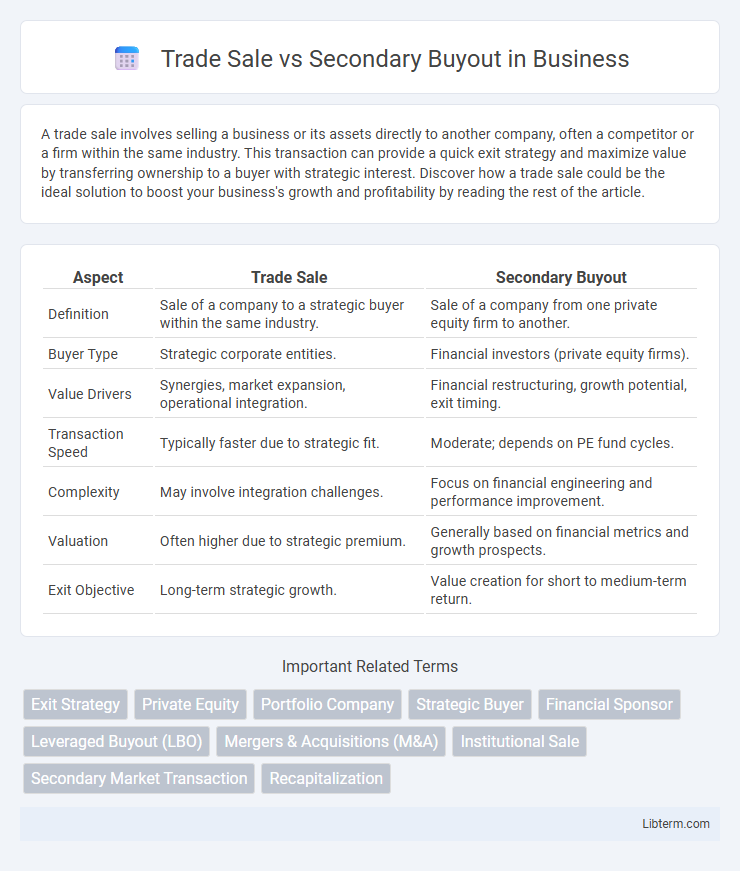

Table of Comparison

| Aspect | Trade Sale | Secondary Buyout |

|---|---|---|

| Definition | Sale of a company to a strategic buyer within the same industry. | Sale of a company from one private equity firm to another. |

| Buyer Type | Strategic corporate entities. | Financial investors (private equity firms). |

| Value Drivers | Synergies, market expansion, operational integration. | Financial restructuring, growth potential, exit timing. |

| Transaction Speed | Typically faster due to strategic fit. | Moderate; depends on PE fund cycles. |

| Complexity | May involve integration challenges. | Focus on financial engineering and performance improvement. |

| Valuation | Often higher due to strategic premium. | Generally based on financial metrics and growth prospects. |

| Exit Objective | Long-term strategic growth. | Value creation for short to medium-term return. |

Introduction to Trade Sale and Secondary Buyout

Trade sale involves selling a company to a strategic buyer, often a competitor or industry player, aiming for synergies and market expansion. Secondary buyout refers to the acquisition of a company by another private equity firm, focusing on value creation through operational improvements and financial restructuring. Both exit strategies provide liquidity events but differ in buyer profiles and post-transaction objectives.

Defining Trade Sale: Key Features

A Trade Sale involves the sale of a company or its assets to another business operating in the same industry, enabling strategic expansion or market consolidation. Key features include the transfer of operational control, potential synergies between buyer and seller, and often a premium price reflecting industry-specific value. This transaction type contrasts with Secondary Buyouts, where private equity firms sell portfolio companies to other financial investors.

Understanding Secondary Buyout: Core Concepts

Secondary buyout involves a private equity firm acquiring a company from another private equity firm, typically aiming to drive further growth or operational improvements. This transaction contrasts with a trade sale, where a strategic buyer purchases the target company, often seeking synergies or market expansion. Understanding secondary buyouts requires recognizing their role in providing liquidity to initial investors while allowing continued optimization under new ownership.

Major Differences Between Trade Sale and Secondary Buyout

Trade sale involves selling a company directly to a strategic buyer, often an industry competitor or related business, aiming for synergies and integration benefits. Secondary buyout occurs when one private equity firm sells a portfolio company to another private equity firm, focusing primarily on financial restructuring and value creation rather than strategic fit. Key differences include the buyer type, transaction motivations, and post-transaction operational involvement, with trade sales emphasizing strategic alignment and secondary buyouts targeting financial returns.

Advantages of a Trade Sale for Sellers

Trade sales offer sellers a higher likelihood of receiving a premium price due to strategic buyers valuing synergies and market expansion opportunities. The transaction process in a trade sale is often faster and more straightforward, reducing holding costs and market risks. Sellers also benefit from increased certainty of deal completion and improved access to post-sale resources for business continuity.

Benefits of Secondary Buyout Transactions

Secondary buyout transactions offer significant benefits, including enhanced flexibility for private equity firms seeking liquidity without going public. They provide opportunities to extend investment horizons and unlock additional value through operational improvements under new ownership. These deals often result in smoother transitions and faster execution compared to trade sales, preserving company culture and strategic direction.

Strategic Considerations for Private Equity Exits

Trade sales often provide private equity firms with strategic synergies and market expansion opportunities by selling to industry players, enhancing portfolio company value through operational integration. Secondary buyouts generally appeal to financial buyers seeking yield with less strategic disruption, allowing continuity in management and incremental growth. Evaluating exit timing, market conditions, and buyer alignment is crucial for maximizing returns in private equity exit strategies.

Market Trends Influencing Exit Choices

Market trends reveal increasing interest in secondary buyouts as private equity firms capitalize on established portfolio companies with strong performance metrics, offering quicker exit timelines compared to trade sales. Trade sales remain attractive due to strategic buyers valuing synergies and long-term integration potential, especially in technology and healthcare sectors experiencing rapid innovation. Shifts in regulatory environments and fluctuating market valuations further influence exit preferences, driving sellers toward options that maximize return on investment amid economic uncertainty.

Risks and Challenges in Trade Sales vs Secondary Buyouts

Trade sales pose risks such as integration difficulties, cultural clashes, and potential loss of key talent, which can disrupt business continuity and affect valuation. Secondary buyouts often carry challenges like increased debt leverage and valuation concerns, potentially leading to limited operational improvements and exit opportunities. Both exit routes require careful due diligence to mitigate risks related to market dynamics and stakeholder alignment.

Choosing the Right Exit Strategy: Key Takeaways

Trade sales offer strategic synergies and access to established distribution channels, making them ideal for companies seeking market expansion and operational support. Secondary buyouts provide liquidity to private equity investors while enabling the business to benefit from fresh capital and specialized industry expertise. Evaluating growth potential, buyer motivation, and timing is crucial when selecting between a trade sale and secondary buyout for optimal value realization.

Trade Sale Infographic

libterm.com

libterm.com