A wealth management firm offers expert financial planning, investment management, and personalized strategies to grow and protect your assets effectively. These firms tailor solutions to meet your unique financial goals while addressing risk tolerance and estate planning needs. Explore the full article to discover how partnering with a trusted wealth management firm can enhance Your financial future.

Table of Comparison

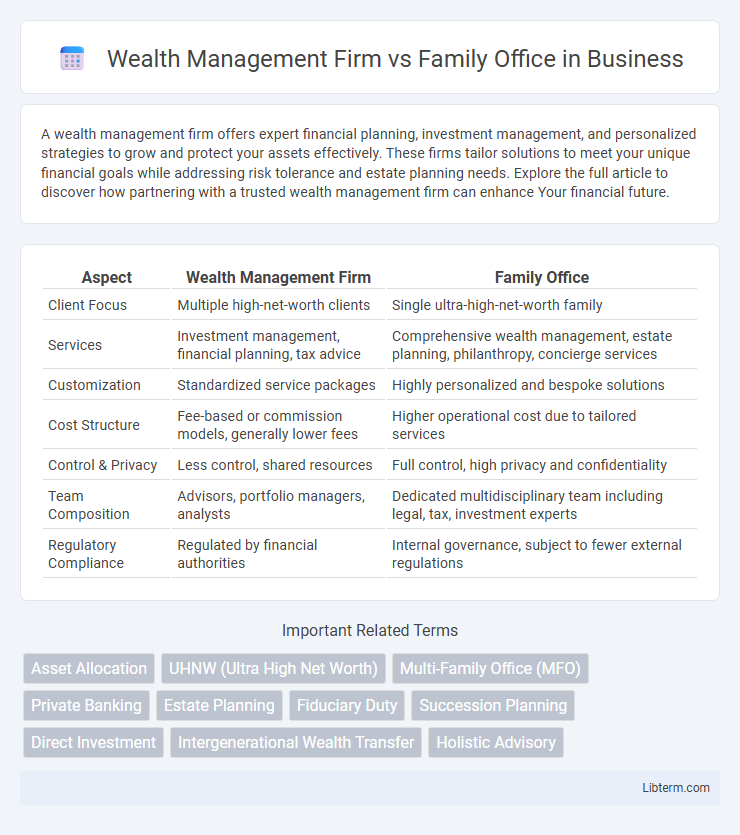

| Aspect | Wealth Management Firm | Family Office |

|---|---|---|

| Client Focus | Multiple high-net-worth clients | Single ultra-high-net-worth family |

| Services | Investment management, financial planning, tax advice | Comprehensive wealth management, estate planning, philanthropy, concierge services |

| Customization | Standardized service packages | Highly personalized and bespoke solutions |

| Cost Structure | Fee-based or commission models, generally lower fees | Higher operational cost due to tailored services |

| Control & Privacy | Less control, shared resources | Full control, high privacy and confidentiality |

| Team Composition | Advisors, portfolio managers, analysts | Dedicated multidisciplinary team including legal, tax, investment experts |

| Regulatory Compliance | Regulated by financial authorities | Internal governance, subject to fewer external regulations |

Introduction to Wealth Management Firms and Family Offices

Wealth management firms typically offer comprehensive financial services including investment management, tax planning, and retirement strategies to high-net-worth individuals and families. Family offices serve ultra-high-net-worth families by providing personalized wealth management, estate planning, philanthropy coordination, and often lifestyle management under one dedicated entity. Both structures aim to grow, protect, and transfer wealth effectively but differ in scale, customization, and scope of services.

Key Differences Between Wealth Management Firms and Family Offices

Wealth management firms provide comprehensive financial services to a broad client base, including investment management, tax planning, and retirement strategies, typically serving high-net-worth individuals and families. Family offices offer highly personalized, holistic wealth management exclusively for ultra-high-net-worth families, encompassing not only financial planning but also estate management, philanthropic advising, and family governance. The key differences lie in the scope of services, client exclusivity, and the degree of customization tailored to multi-generational wealth preservation and legacy planning.

Services Offered by Wealth Management Firms

Wealth management firms offer comprehensive financial services including investment management, retirement planning, tax optimization, and risk assessment tailored to high-net-worth individuals. These firms provide personalized strategies combining asset allocation, estate planning, and portfolio diversification to maximize growth and preserve wealth. Unlike family offices, wealth management firms typically serve multiple clients, leveraging broad market expertise and advanced financial technology to deliver scalable solutions.

Services Provided by Family Offices

Family offices offer comprehensive wealth management services that extend beyond traditional investment advice to include estate planning, tax optimization, philanthropic guidance, and concierge services tailored to ultra-high-net-worth families. They provide personalized financial oversight, incorporating risk management, succession planning, and lifestyle management to preserve and grow generational wealth. This holistic approach differentiates family offices from standard wealth management firms by addressing the complex needs of affluent families through customized, integrated solutions.

Client Profiles: Who Should Choose Each Option?

Wealth management firms typically serve high-net-worth individuals seeking professional investment strategies, retirement planning, and tax optimization with a standardized service model. Family offices cater to ultra-high-net-worth families requiring comprehensive, personalized wealth solutions including estate planning, philanthropic management, and intergenerational wealth transfer. Clients with complex financial needs and substantial assets often benefit from family office services, while those with sizable portfolios but less extensive requirements may prefer wealth management firms.

Fee Structures and Cost Comparison

Wealth management firms typically charge a percentage-based fee on assets under management, averaging around 1% annually, which may include advisory, transaction, and administrative costs. Family offices, serving ultra-high-net-worth clients, often employ a fixed or retainer fee model, with costs ranging from $300,000 to over $1 million annually, reflecting the bespoke, comprehensive services provided. Comparing costs, family offices are generally more expensive but offer tailored wealth planning and concierge services, whereas wealth management firms offer scalable solutions with more standardized fees.

Customization and Personalization of Financial Solutions

Wealth management firms offer tailored financial solutions designed to meet the specific goals of high-net-worth clients, leveraging a broad range of investment products and advisory services. Family offices provide an even higher level of customization, managing not only investments but also estate planning, tax optimization, philanthropy, and intergenerational wealth transfer for ultra-high-net-worth families. The depth of personalization in family offices ensures comprehensive, integrated financial strategies aligned with the family's unique values and long-term objectives.

Levels of Privacy and Confidentiality

Wealth management firms offer professional financial services with standard privacy protocols regulated by industry norms and compliance requirements. Family offices provide a higher level of privacy and confidentiality, as they serve a single family exclusively and manage wealth in-house, minimizing exposure to external parties. This exclusivity ensures sensitive financial information remains closely guarded, surpassing typical confidentiality standards found in wealth management firms.

Choosing the Right Wealth Management Solution for Your Needs

Wealth management firms typically offer a broad range of financial services to multiple clients, including investment management, retirement planning, and tax strategies, making them ideal for individuals seeking comprehensive, yet standardized solutions. Family offices provide highly personalized wealth management services tailored exclusively to the needs of ultra-high-net-worth families, offering estate planning, philanthropy coordination, and concierge services that address complex financial and legacy goals. Choosing the right wealth management solution depends on factors such as asset size, service customization requirements, and the desire for dedicated advisory teams managing multi-generational wealth.

Future Trends in Wealth Management and Family Offices

Future trends in wealth management and family offices emphasize the integration of advanced technologies such as artificial intelligence and blockchain to enhance personalized investment strategies and streamline asset management processes. Increasingly, family offices are adopting sustainable and impact investing to align portfolios with environmental, social, and governance (ESG) criteria, reflecting growing client demand for ethical wealth growth. The rise of multi-family offices as hybrid models combines bespoke services with scalability, catering to evolving needs for intergenerational wealth transfer and comprehensive financial planning.

Wealth Management Firm Infographic

libterm.com

libterm.com