An investment center is a unit or department within an organization responsible for generating revenue and controlling both costs and investments. It provides managers with accountability for profit and the efficient use of assets, making it essential for evaluating performance and strategic decision-making. Discover how understanding your investment center can enhance financial management by exploring the full article.

Table of Comparison

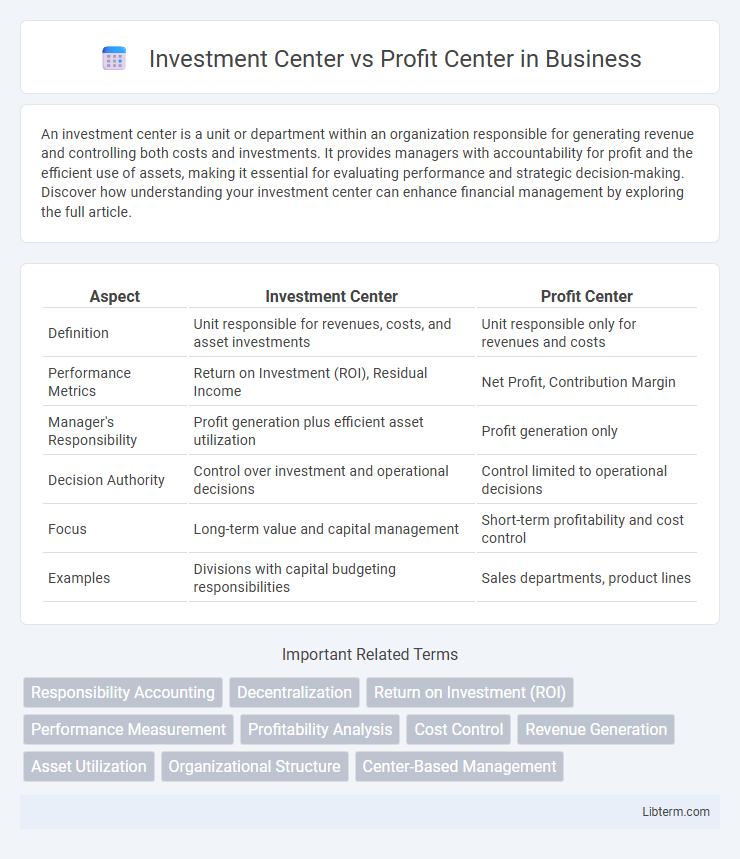

| Aspect | Investment Center | Profit Center |

|---|---|---|

| Definition | Unit responsible for revenues, costs, and asset investments | Unit responsible only for revenues and costs |

| Performance Metrics | Return on Investment (ROI), Residual Income | Net Profit, Contribution Margin |

| Manager's Responsibility | Profit generation plus efficient asset utilization | Profit generation only |

| Decision Authority | Control over investment and operational decisions | Control limited to operational decisions |

| Focus | Long-term value and capital management | Short-term profitability and cost control |

| Examples | Divisions with capital budgeting responsibilities | Sales departments, product lines |

Introduction: Defining Investment Centers and Profit Centers

Investment centers are organizational units responsible for generating revenues, controlling costs, and efficiently managing assets to maximize return on investment (ROI). Profit centers focus primarily on generating profits by managing revenues and expenses without direct control over asset investments. Both centers play key roles in decentralized management, with investment centers having broader financial accountability compared to profit centers.

Key Differences Between Investment Centers and Profit Centers

Investment centers differ from profit centers primarily in scope and responsibility, as investment centers manage both profits and assets, while profit centers focus solely on generating revenue and controlling costs. Performance evaluation in investment centers includes return on investment (ROI) and residual income, whereas profit centers are assessed based on net profit or contribution margin. Investment centers require managers to make decisions about capital investments, asset utilization, and cost control, highlighting a broader accountability compared to the narrower financial goals of profit centers.

Structure and Responsibilities of an Investment Center

An Investment Center is structured to manage revenues, costs, and the assets used to generate those profits, giving managers full responsibility for investment decisions and performance evaluation. Unlike Profit Centers, which are primarily accountable for profitability, Investment Centers emphasize efficient asset utilization, capital budgeting, and return on investment (ROI) metrics. This comprehensive responsibility enhances strategic decision-making and aligns operational activities with long-term financial goals.

Structure and Responsibilities of a Profit Center

A Profit Center is a business segment or unit responsible for generating revenue and controlling expenses to achieve profitability, focusing solely on profit as a performance metric. Its structure includes dedicated management with the authority over both operational activities and cost management, enabling clear accountability for financial results. Unlike an Investment Center, a Profit Center does not manage assets or capital investments but concentrates on maximizing income while minimizing operational costs within its scope.

Performance Measurement in Investment Centers

Investment centers are evaluated based on ROI (Return on Investment) and residual income, emphasizing efficient asset utilization alongside profitability to measure overall performance. Performance measurement in investment centers involves analyzing operating income relative to invested capital, promoting decisions that optimize both profit generation and capital deployment. Unlike profit centers which focus solely on net income, investment centers integrate asset management metrics to assess managerial effectiveness comprehensively.

Performance Measurement in Profit Centers

Profit centers are evaluated primarily on their ability to generate net income by effectively controlling revenues and expenses within their operational scope, making profitability the key performance metric. Unlike investment centers, which also consider asset utilization and return on investment (ROI), profit centers focus strictly on profit margins and cost efficiency to measure success. Performance measurement in profit centers typically involves variance analysis, net profit comparisons, and contribution margins to assess managerial effectiveness and operational transparency.

Advantages and Disadvantages of Investment Centers

Investment centers provide managers with control over revenues, expenses, and assets, enabling better alignment of decisions with organizational goals and encouraging long-term strategic planning. However, they require more complex performance measurement systems and may face challenges in accurately attributing responsibility for asset utilization and capital investment efficiency. Unlike profit centers, investment centers emphasize asset management, which can enhance accountability but also increase the risk of suboptimal investment decisions if managers prioritize asset growth over profitability.

Advantages and Disadvantages of Profit Centers

Profit centers enable organizations to evaluate managerial performance based on revenue generation and cost control, promoting accountability and operational efficiency. They provide clear insights into the profitability of specific business units, facilitating focused decision-making and resource allocation. However, profit centers may overlook investment decisions and capital efficiency, potentially leading to suboptimal long-term growth compared to investment centers that assess both profits and asset utilization.

Choosing the Right Center for Your Organization

Choosing the right center for your organization depends on control scope and performance evaluation criteria; an Investment Center manages revenues, costs, and asset investments to maximize return on investment, while a Profit Center focuses solely on generating profits by controlling revenues and expenses. Organizations seeking to enhance strategic decision-making and long-term asset utilization often benefit from an Investment Center framework, enabling comprehensive accountability. In contrast, entities prioritizing short-term profitability and operational efficiency may find Profit Centers more effective for targeted performance measurement.

Conclusion: Strategic Impact of Investment and Profit Centers

Investment centers drive strategic growth by managing assets to maximize return on invested capital, aligning with long-term value creation goals. Profit centers prioritize operational efficiency and cost control to enhance profitability within their scope, directly impacting short-term financial performance. Balancing both centers fosters comprehensive organizational success by integrating asset utilization with profit generation strategies.

Investment Center Infographic

libterm.com

libterm.com