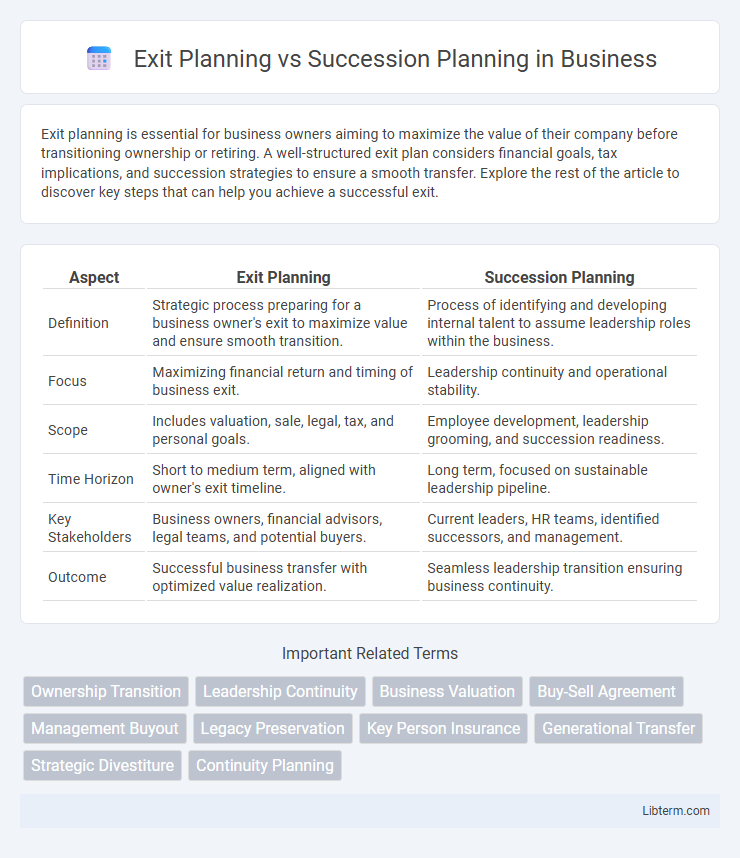

Exit planning is essential for business owners aiming to maximize the value of their company before transitioning ownership or retiring. A well-structured exit plan considers financial goals, tax implications, and succession strategies to ensure a smooth transfer. Explore the rest of the article to discover key steps that can help you achieve a successful exit.

Table of Comparison

| Aspect | Exit Planning | Succession Planning |

|---|---|---|

| Definition | Strategic process preparing for a business owner's exit to maximize value and ensure smooth transition. | Process of identifying and developing internal talent to assume leadership roles within the business. |

| Focus | Maximizing financial return and timing of business exit. | Leadership continuity and operational stability. |

| Scope | Includes valuation, sale, legal, tax, and personal goals. | Employee development, leadership grooming, and succession readiness. |

| Time Horizon | Short to medium term, aligned with owner's exit timeline. | Long term, focused on sustainable leadership pipeline. |

| Key Stakeholders | Business owners, financial advisors, legal teams, and potential buyers. | Current leaders, HR teams, identified successors, and management. |

| Outcome | Successful business transfer with optimized value realization. | Seamless leadership transition ensuring business continuity. |

Understanding Exit Planning: Definition and Purpose

Exit planning involves strategically preparing business owners to transition ownership through sale, transfer, or closure, maximizing value and ensuring continuity. It centers on aligning financial, legal, and operational elements to achieve personal and business goals at the end of ownership. Understanding exit planning is crucial for optimizing outcomes and securing legacy while minimizing risks during the transition process.

What Is Succession Planning? Key Concepts

Succession planning is the strategic process of identifying and developing future leaders to assume key roles within an organization, ensuring business continuity and leadership stability. It involves assessing potential candidates' skills, creating development programs, and aligning talent pipelines with long-term organizational goals. This proactive approach minimizes disruption during leadership transitions and supports sustainable growth by preparing successors well in advance.

Exit Planning vs Succession Planning: Core Differences

Exit planning focuses on the strategic process of preparing business owners to sell or transition out of their company, prioritizing maximizing financial value and smooth transfer. Succession planning centers on identifying and developing internal leadership to ensure business continuity and long-term stability. Core differences lie in exit planning's external market considerations and financial goals versus succession planning's internal talent management and operational succession.

Goals and Outcomes of Exit Planning

Exit planning centers on maximizing business value and ensuring a smooth transition for owners by aligning financial, personal, and operational goals. Key outcomes include liquidity optimization, risk mitigation, and preparing the company for sale or transfer within a targeted timeframe. Unlike succession planning, exit planning emphasizes achieving the owner's exit objectives, including wealth preservation and legacy considerations.

Objectives and Benefits of Succession Planning

Succession planning focuses on identifying and developing internal talent to ensure a smooth leadership transition and business continuity, minimizing operational disruptions. The primary objectives include maintaining organizational stability, preserving institutional knowledge, and preparing future leaders to drive long-term growth. Benefits of effective succession planning encompass enhanced employee retention, reduced recruitment costs, and strengthened stakeholder confidence in the company's future.

Key Steps in Effective Exit Planning

Effective exit planning involves a comprehensive assessment of business valuation, tax implications, and owner's personal goals to ensure a smooth transition. Establishing a clear timeline, developing a succession strategy, and preparing legal and financial documentation are critical steps in securing the business's future stability. Engaging professional advisors, such as financial planners, attorneys, and accountants, enhances decision-making and maximizes the value received during the exit process.

Essential Components of Succession Planning

Succession planning centers on identifying and developing internal talent to ensure leadership continuity and organizational stability, emphasizing key components such as talent assessment, leadership development programs, and knowledge transfer processes. Effective succession plans include clear timelines, defined roles for potential successors, and structured mentorship to prepare individuals for future responsibilities. Integrating performance metrics and regular review cycles guarantees alignment with strategic goals and facilitates seamless transitions.

Factors Influencing Exit Strategy Decisions

Factors influencing exit strategy decisions include the owner's financial goals, business valuation, market conditions, and tax implications. Exit planning emphasizes timing and maximizing monetary value, while succession planning prioritizes leadership continuity and organizational stability. Strategic alignment with personal objectives and stakeholder interests is critical for both approaches.

Challenges in Succession Planning for Businesses

Succession planning challenges for businesses often include identifying and developing qualified internal candidates to fill leadership roles while ensuring alignment with long-term strategic goals. Emotional complexities within family-owned businesses and resistance to change can hinder smooth transitions, impacting organizational stability. Moreover, inadequate communication and lack of a structured plan frequently result in leadership gaps and operational disruptions during ownership transfer.

Choosing the Right Approach: Exit or Succession Planning

Choosing the right approach between exit planning and succession planning hinges on the business owner's long-term goals and timeline for transition. Exit planning focuses on maximizing business value for a complete ownership transfer, often involving sale or liquidation. Succession planning centers on preparing internal leadership to sustainably manage and grow the company, ensuring continuity and legacy preservation.

Exit Planning Infographic

libterm.com

libterm.com