Sophisticated investors possess extensive market knowledge and significant financial resources, enabling them to access exclusive investment opportunities often unavailable to the general public. Their expertise allows them to navigate complex financial instruments and make informed decisions that aim to maximize returns while managing risks. Discover how sophisticated investing strategies can elevate Your portfolio by reading the rest of the article.

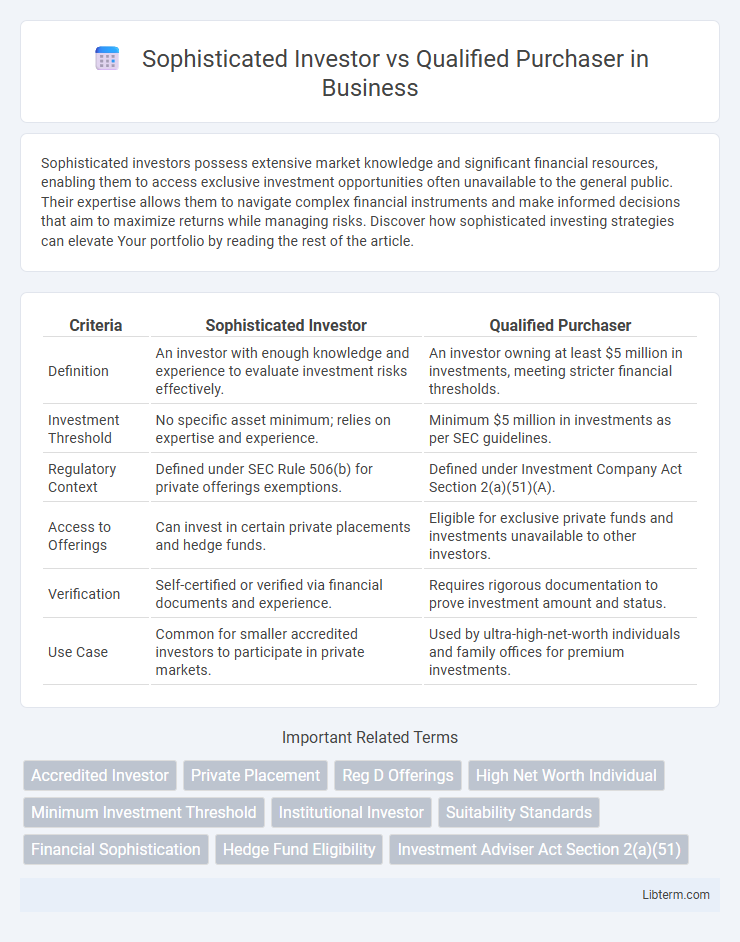

Table of Comparison

| Criteria | Sophisticated Investor | Qualified Purchaser |

|---|---|---|

| Definition | An investor with enough knowledge and experience to evaluate investment risks effectively. | An investor owning at least $5 million in investments, meeting stricter financial thresholds. |

| Investment Threshold | No specific asset minimum; relies on expertise and experience. | Minimum $5 million in investments as per SEC guidelines. |

| Regulatory Context | Defined under SEC Rule 506(b) for private offerings exemptions. | Defined under Investment Company Act Section 2(a)(51)(A). |

| Access to Offerings | Can invest in certain private placements and hedge funds. | Eligible for exclusive private funds and investments unavailable to other investors. |

| Verification | Self-certified or verified via financial documents and experience. | Requires rigorous documentation to prove investment amount and status. |

| Use Case | Common for smaller accredited investors to participate in private markets. | Used by ultra-high-net-worth individuals and family offices for premium investments. |

Defining Sophisticated Investor

A Sophisticated Investor is defined by the Securities Act as an individual or entity possessing sufficient knowledge and experience in financial and business matters to evaluate the merits and risks of a prospective investment. Unlike Qualified Purchasers, who must meet higher thresholds such as owning $5 million or more in investments, Sophisticated Investors qualify based on their expertise rather than asset size alone. This classification allows access to certain private placements and exempt securities offerings under Regulation D Rule 506(b).

Who Qualifies as a Qualified Purchaser

Qualified purchasers are individuals or entities possessing at least $5 million in investments, including trusts, family-owned companies, and certain institutional investors. Sophisticated investors meet a lower threshold, generally demonstrating sufficient financial knowledge or experience without a strict asset requirement. The higher asset standard for qualified purchasers grants access to exclusive private investment funds under the Investment Company Act of 1940 exemptions.

Key Regulatory Differences

Sophisticated investors must demonstrate sufficient knowledge or experience in financial matters to assess investment risks, whereas qualified purchasers meet specific wealth thresholds, such as owning $5 million or more in investments. Securities regulations under the Investment Company Act of 1940 impose stricter eligibility criteria and disclosure requirements on offerings to sophisticated investors compared to the more exclusive and less regulated environment for qualified purchasers. The distinction impacts access to private investment funds, with qualified purchasers eligible for a broader range of private placements due to their higher financial sophistication and presumed risk tolerance.

Eligibility Criteria Explained

A Sophisticated Investor qualifies based on experience and knowledge in financial and business matters, often demonstrating the ability to evaluate investment risks without needing full regulatory protection. A Qualified Purchaser must meet stricter financial thresholds, such as owning at least $5 million in investments individually or $25 million for family-owned entities, enabling access to exclusive private funds. The eligibility criteria ensure that Qualified Purchasers have a higher net worth and investment acumen compared to Sophisticated Investors, reflecting their capacity to engage in more complex and less regulated investment opportunities.

Investment Opportunities Available

Sophisticated investors have access to a broader range of investment opportunities compared to retail investors, including private placements and hedge funds that require a certain net worth or income threshold. Qualified purchasers, as defined by the Investment Company Act of 1940, meet even higher financial thresholds, typically owning at least $5 million in investments, granting them eligibility to invest in exclusive funds such as private equity and complex pooled investment vehicles. These distinctions enable qualified purchasers to participate in investment opportunities with fewer regulatory restrictions and potentially higher returns.

Rights and Protections Compared

Sophisticated investors possess extensive knowledge and experience, granting access to complex securities with fewer regulatory protections compared to qualified purchasers, who meet higher asset thresholds and receive enhanced legal safeguards under the Investment Company Act of 1940. Qualified purchasers, typically individuals or entities with at least $5 million in investments, benefit from exemptions allowing them to participate in a broader range of private funds while enjoying stronger fiduciary protections. Rights for qualified purchasers include greater disclosure and voting privileges, whereas sophisticated investors often face more limited rights but increased flexibility in investment opportunities.

Reporting and Disclosure Requirements

Sophisticated investors face fewer reporting and disclosure requirements compared to qualified purchasers due to their broader access to private investment opportunities under Regulation D exemptions. Qualified purchasers, typically holding $5 million or more in investments, are often subject to more stringent disclosure norms under the Investment Company Act of 1940 to maintain investor protection standards. This distinction impacts the level of transparency and frequency of financial reporting investors receive in private fund structures.

Risks Involved for Each Category

Sophisticated investors face risks primarily related to their limited financial sophistication or understanding of complex investment products, potentially leading to higher exposure to market volatility and illiquid assets. Qualified purchasers, often with significantly greater wealth and investment experience, encounter risks from concentrated holdings and access to private placements, where due diligence challenges and limited regulatory protections can increase vulnerability. Both categories must carefully assess the potential for loss, lack of transparency, and the impact of economic downturns on specialized investment vehicles.

Impact on Fundraising and Offerings

Sophisticated investors, defined by their financial expertise and investment experience, typically enable funds to meet regulatory exemptions for private offerings, expanding fundraising opportunities under Regulation D. Qualified purchasers, holding at least $5 million in investments, allow funds to access broader exemptions under the Investment Company Act of 1940, facilitating larger capital raises and fewer offering restrictions. The distinction impacts fundraising strategies by determining eligibility constraints and disclosure requirements, with qualified purchasers offering greater flexibility and efficiency for high-capital investment funds.

Choosing the Right Investor Status

Choosing the right investor status between Sophisticated Investor and Qualified Purchaser depends on financial thresholds and regulatory benefits. Sophisticated Investors typically have sufficient knowledge and a minimum income or net worth, often $200,000 annual income or $1 million net worth, allowing access to certain private offerings under Regulation D. Qualified Purchasers must meet a higher net worth threshold, generally $5 million in investments, providing broader investment opportunities with fewer restrictions under the Investment Company Act of 1940.

Sophisticated Investor Infographic

libterm.com

libterm.com