A merger combines two companies into one entity to enhance competitive advantage, increase market share, and achieve economies of scale. Successful mergers require thorough due diligence, cultural integration, and strategic alignment to maximize value creation. Explore the full article to understand how a well-executed merger can transform your business landscape.

Table of Comparison

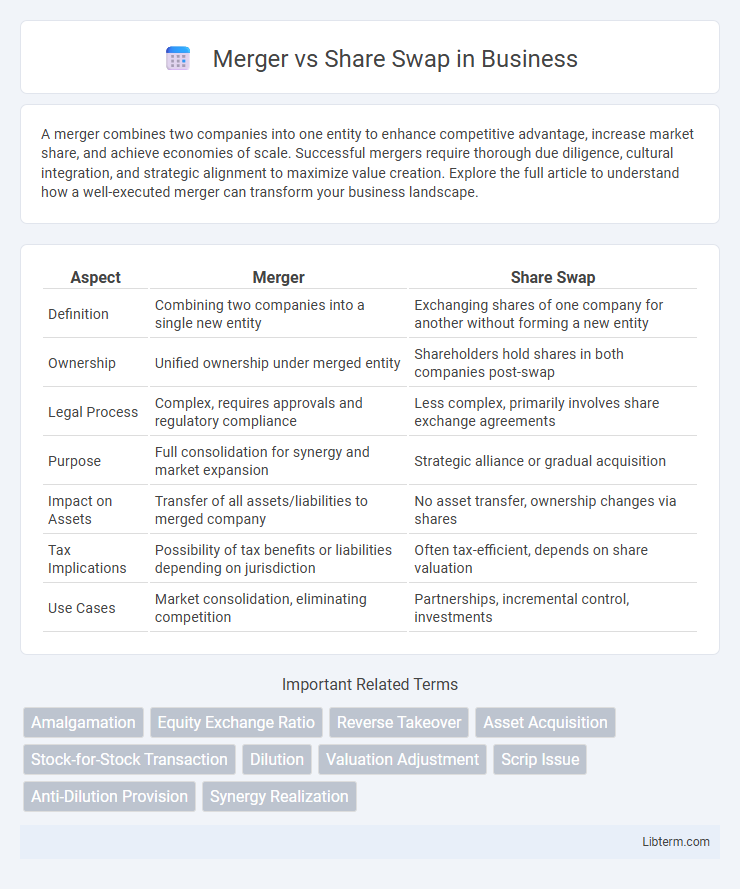

| Aspect | Merger | Share Swap |

|---|---|---|

| Definition | Combining two companies into a single new entity | Exchanging shares of one company for another without forming a new entity |

| Ownership | Unified ownership under merged entity | Shareholders hold shares in both companies post-swap |

| Legal Process | Complex, requires approvals and regulatory compliance | Less complex, primarily involves share exchange agreements |

| Purpose | Full consolidation for synergy and market expansion | Strategic alliance or gradual acquisition |

| Impact on Assets | Transfer of all assets/liabilities to merged company | No asset transfer, ownership changes via shares |

| Tax Implications | Possibility of tax benefits or liabilities depending on jurisdiction | Often tax-efficient, depends on share valuation |

| Use Cases | Market consolidation, eliminating competition | Partnerships, incremental control, investments |

Introduction to Mergers and Share Swaps

Mergers involve the combination of two or more companies into a single entity, optimizing resources and expanding market reach, while share swaps refer to the exchange of shares between companies as a method of acquisition or consolidation without immediate cash flow. Both strategies are fundamental in corporate restructuring, enabling firms to achieve synergies, diversify offerings, and improve competitive positioning. Understanding the key differences between mergers and share swaps is crucial for evaluating the impact on shareholder value and corporate control.

Defining Corporate Mergers

Corporate mergers involve the consolidation of two or more companies into a single legal entity to achieve synergies, expand market reach, or enhance operational efficiency. Share swaps are a common mechanism in mergers where shareholders exchange their shares in the target company for shares in the acquiring company, facilitating ownership transfer without cash transactions. This method aligns interests and allows for smoother integration of merged entities under a unified corporate structure.

What is a Share Swap?

A share swap is a transaction in which shareholders exchange their existing shares for shares in a new or acquiring company, often used in mergers and acquisitions to facilitate ownership transfer without immediate cash payment. This method allows companies to restructure equity, maintain control, and align shareholder interests by converting stakes proportionally. Share swaps are advantageous in preserving liquidity while enabling strategic consolidation and growth through synergistic partnerships.

Key Differences Between Mergers and Share Swaps

Mergers involve the complete consolidation of two companies into a single legal entity, often resulting in the dissolution of the acquired company, whereas share swaps entail exchanging shares between companies without losing their separate identities. In a merger, assets and liabilities are combined under one entity, while share swaps allow shareholders to maintain proportional ownership in both companies. Valuation complexities differ significantly; mergers require comprehensive asset and financial evaluation, whereas share swaps focus primarily on equitable share exchange ratios based on market values.

Strategic Reasons for Choosing Mergers

Mergers are often chosen for strategic reasons such as achieving rapid market expansion, enhancing competitive advantage, and realizing synergies through combining complementary resources and capabilities. Companies pursuing mergers aim to increase operational efficiency, broaden their product or service portfolio, and strengthen market positioning while avoiding the complexity of share valuation inherent in share swaps. The strategic focus on integration and unified management in mergers facilitates smoother decision-making and long-term value creation.

Strategic Advantages of Share Swaps

Share swaps offer strategic advantages by enabling companies to combine resources and expertise without immediate cash outflows, preserving liquidity for future investments. They facilitate alignment of shareholder interests through equity participation, fostering long-term collaboration and commitment to shared business goals. This method also allows for flexible valuation and can reduce transaction costs compared to outright mergers, making share swaps an efficient tool for corporate restructuring and expansion.

Impact on Shareholders: Merger vs Share Swap

A merger typically results in shareholders receiving shares of the acquiring company, which may dilute their ownership percentage but often provides access to a larger market and enhanced resources. In a share swap, shareholders exchange their existing shares for shares in the new or acquiring entity based on a predetermined ratio, maintaining proportional ownership but potentially facing valuation and liquidity considerations. Both methods impact shareholder value and control differently, depending on deal structure and market reaction.

Legal and Regulatory Considerations

Merger and share swap transactions each involve distinct legal and regulatory frameworks impacting compliance requirements, shareholder approvals, and disclosure obligations under securities laws. Mergers typically require extensive due diligence to address antitrust laws, contract novations, and statutory filings with regulatory bodies like the SEC or Competition Commissions. Share swaps must comply with jurisdiction-specific stock exchange regulations and tax implications on share valuations, necessitating precise adherence to corporate governance standards and shareholder rights protections.

Tax Implications in Mergers and Share Swaps

Tax implications in mergers often include capital gains tax on asset transfers and potential deferred tax liabilities, whereas share swaps may trigger capital gains tax only upon the sale of exchanged shares. In share swaps, tax deferral benefits can arise if the transaction qualifies as a tax-free reorganization under relevant tax codes. Careful structuring is necessary to maximize tax efficiency and comply with jurisdiction-specific tax regulations.

Case Studies: Merger vs Share Swap in Practice

Case studies of mergers versus share swaps reveal clear distinctions in corporate strategy and stakeholder impact. In the 2018 Vodafone-Idea merger, a direct merger streamlined operations but faced integration hurdles, while the Tata Motors-Jaguar Land Rover transaction utilized a share swap to align shareholder interests without full consolidation. Analysis highlights that mergers often aim for synergy and market expansion, whereas share swaps prioritize equity restructuring and gradual control shifts.

Merger Infographic

libterm.com

libterm.com