Continuous settlement patterns shape the development of urban and rural areas by providing uninterrupted habitation that supports infrastructure growth and social cohesion. These settlements optimize land use and promote efficient resource distribution, enhancing community stability and economic vitality. Explore the rest of the article to understand how continuous settlement impacts your environment and urban planning strategies.

Table of Comparison

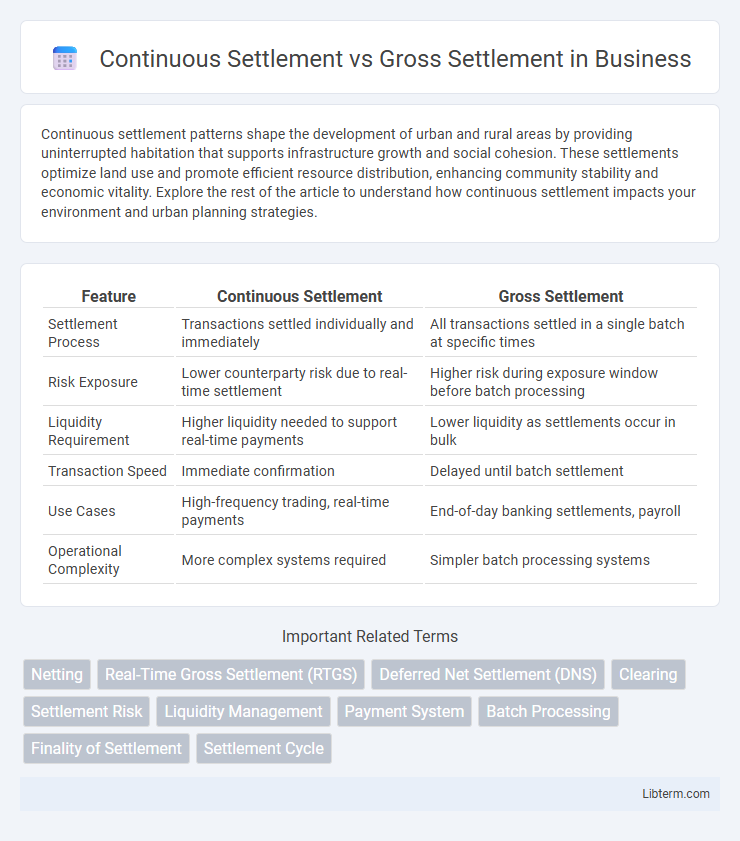

| Feature | Continuous Settlement | Gross Settlement |

|---|---|---|

| Settlement Process | Transactions settled individually and immediately | All transactions settled in a single batch at specific times |

| Risk Exposure | Lower counterparty risk due to real-time settlement | Higher risk during exposure window before batch processing |

| Liquidity Requirement | Higher liquidity needed to support real-time payments | Lower liquidity as settlements occur in bulk |

| Transaction Speed | Immediate confirmation | Delayed until batch settlement |

| Use Cases | High-frequency trading, real-time payments | End-of-day banking settlements, payroll |

| Operational Complexity | More complex systems required | Simpler batch processing systems |

Introduction to Settlement Systems

Settlement systems are critical components of financial markets, ensuring the accurate transfer of securities and funds between parties. Continuous settlement processes individual transactions immediately upon instruction, reducing counterparty risk and enhancing liquidity. In contrast, gross settlement involves settling each transaction independently in real-time without netting, often utilized in high-value payment systems like Real-Time Gross Settlement (RTGS).

What is Continuous Settlement?

Continuous Settlement is a payment processing method where financial transactions are settled individually and in real-time, ensuring immediate transfer of funds between parties. This system contrasts with Gross Settlement, which processes each transaction separately on a transaction-by-transaction basis without netting. Continuous Settlement enhances liquidity and reduces settlement risk by allowing faster clearance and finality of payments in financial markets.

What is Gross Settlement?

Gross settlement is a payment processing method where individual transactions are settled one by one, in real-time, ensuring immediate finality and irreversibility. This system reduces settlement risk by eliminating delays and batching, commonly used in high-value payment systems like Real-Time Gross Settlement (RTGS). Financial institutions rely on gross settlement to provide secure, instantaneous transfer of funds between banks, enhancing liquidity management and reducing counterparty exposure.

Key Differences Between Continuous and Gross Settlement

Continuous settlement processes transactions individually in real-time, ensuring immediate transfer of funds and ownership, whereas gross settlement processes transactions in batches, with each transaction settled separately at designated intervals. Continuous settlement reduces counterparty risk by finalizing payments instantly, while gross settlement may delay finality until the batch is completed, increasing settlement risk. Continuous systems require significant liquidity due to immediate obligations, contrasted with gross settlement which can optimize liquidity by netting transactions before settlement.

Advantages of Continuous Settlement

Continuous settlement, also known as real-time gross settlement (RTGS), offers the advantage of immediate transaction processing, reducing settlement risk and enhancing liquidity management. This system enables financial institutions to settle payments individually without batching, minimizing the risk of payment defaults and improving overall system efficiency. Continuous settlement supports higher transaction security and transparency, crucial for mitigating systemic risk in financial markets.

Benefits of Gross Settlement Systems

Gross settlement systems offer immediate finality for each transaction, significantly reducing settlement risk by eliminating delays between payment and settlement. This approach ensures high liquidity efficiency, as funds are transferred one-to-one, enabling faster and more accurate reflects of account balances. Financial institutions benefit from enhanced transparency and reduced credit risk compared to continuous settlement methods.

Disadvantages and Risks of Both Settlement Types

Continuous settlement systems may face increased operational risks due to processing numerous small transactions throughout the day, potentially leading to liquidity shortfalls and settlement failures. Gross settlement systems, while reducing intraday liquidity risk by settling transactions individually, require significantly higher liquidity resources and can cause delays if one large payment fails. Both settlement types expose financial institutions to counterparty risk, though gross settlement mitigates systemic risk more effectively by avoiding netting exposures.

Use Cases and Industry Applications

Continuous settlement enables real-time transaction processing ideal for high-frequency trading and retail payment systems, ensuring immediate fund availability and reducing counterparty risk. Gross settlement processes each transaction individually, making it suitable for large-value interbank transfers and securities settlement where finality and reduced systemic risk are crucial. Financial institutions leverage continuous settlement for everyday payments, while gross settlement underpins central bank payment systems and critical financial market infrastructures.

Regulatory and Compliance Considerations

Continuous Settlement systems facilitate real-time processing of transactions, ensuring compliance with stringent regulatory standards such as the Principles for Financial Market Infrastructures (PFMI) by reducing settlement risk and enhancing transparency. Gross Settlement systems, governed by frameworks like the Settlement Finality Directive (SFD), offer immediate and irrevocable transfer of assets, minimizing systemic risk but requiring robust liquidity management to meet regulatory capital requirements. Both settlement methods must adhere to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations to maintain market integrity and prevent financial crimes.

Choosing the Right Settlement System

Selecting the appropriate settlement system depends on transaction volume, risk tolerance, and liquidity requirements, with continuous settlement enabling real-time processing that minimizes credit risk through immediate finality. Gross settlement processes each transaction individually, offering simplicity and reduced systemic risk, but may require higher liquidity since funds must be available upfront. Understanding operational costs, timing needs, and transactional complexity guides financial institutions in choosing between continuous and gross settlement frameworks for optimal efficiency and security.

Continuous Settlement Infographic

libterm.com

libterm.com