A forward contract is a customized financial agreement between two parties to buy or sell an asset at a specified price on a future date, helping to manage risk and lock in prices. This contract is commonly used in currencies, commodities, and securities trading to hedge against market volatility. Discover how forward contracts can protect Your investments and enhance your financial strategies by reading the full article.

Table of Comparison

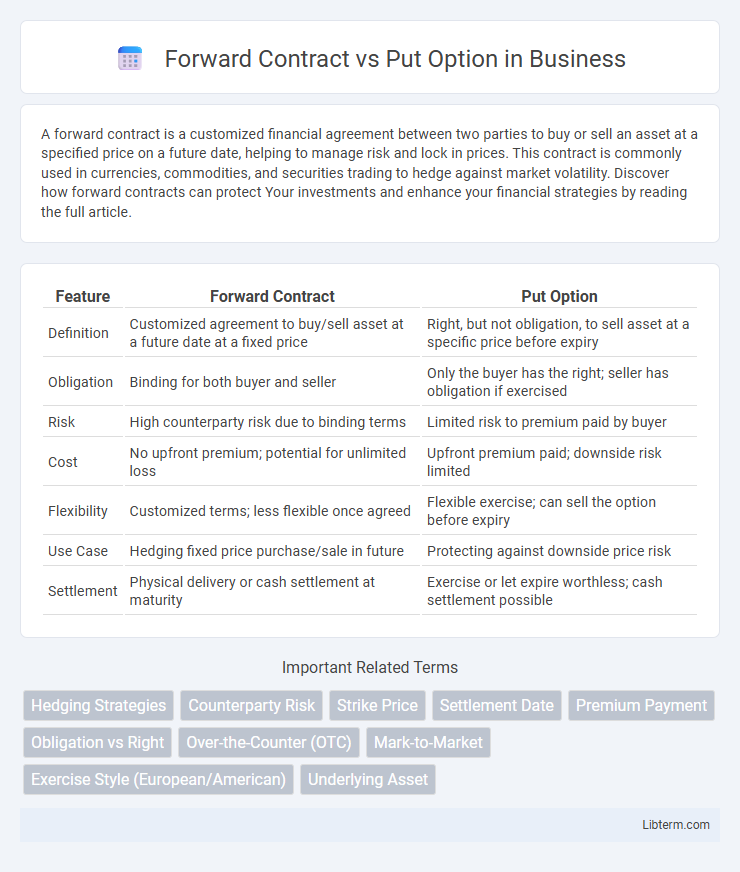

| Feature | Forward Contract | Put Option |

|---|---|---|

| Definition | Customized agreement to buy/sell asset at a future date at a fixed price | Right, but not obligation, to sell asset at a specific price before expiry |

| Obligation | Binding for both buyer and seller | Only the buyer has the right; seller has obligation if exercised |

| Risk | High counterparty risk due to binding terms | Limited risk to premium paid by buyer |

| Cost | No upfront premium; potential for unlimited loss | Upfront premium paid; downside risk limited |

| Flexibility | Customized terms; less flexible once agreed | Flexible exercise; can sell the option before expiry |

| Use Case | Hedging fixed price purchase/sale in future | Protecting against downside price risk |

| Settlement | Physical delivery or cash settlement at maturity | Exercise or let expire worthless; cash settlement possible |

Introduction to Forward Contracts and Put Options

Forward contracts are customized agreements between two parties to buy or sell an asset at a specified future date for a predetermined price, commonly used for hedging currency or commodity risks. Put options grant the buyer the right, but not the obligation, to sell an underlying asset at a strike price before or at expiration, offering flexibility and downside protection. Both instruments serve as financial derivatives employed to manage price risk, but forward contracts entail obligation while put options provide optionality.

Key Features of Forward Contracts

Forward contracts are customized agreements between two parties to buy or sell an asset at a predetermined price on a future date, offering protection against price fluctuations. Unlike put options, forward contracts obligate both parties to complete the transaction, eliminating optionality but providing certainty for cash flow planning. They are typically used in currency and commodity markets for hedging purposes, with no upfront premium and exposure to counterparty credit risk.

Key Features of Put Options

Put options grant the buyer the right, but not the obligation, to sell an asset at a predetermined strike price within a specified time frame, providing downside protection against falling prices. Unlike forward contracts, which involve binding obligations to transact at a set price and date, put options offer flexibility and limit potential losses to the premium paid. Key features include the strike price, expiration date, and option premium, making put options a valuable tool for hedging and speculative strategies in volatile markets.

How Forward Contracts Work in Practice

Forward contracts bind two parties to exchange an asset at a predetermined price on a specified future date, eliminating price uncertainty for both buyer and seller. These agreements are customized to fit the exact terms required by the parties, including asset type, quantity, and delivery date, making them suitable for hedging commodity price risk or managing foreign exchange exposure. Settlement typically occurs at contract maturity through physical delivery or cash settlement, depending on the contract specifications and market conditions.

How Put Options Function in Financial Markets

Put options function in financial markets by granting the holder the right, but not the obligation, to sell an underlying asset at a predetermined strike price before or on the expiration date, providing a strategic tool for hedging against price declines. Unlike forward contracts, which obligate parties to transact at a future date, put options offer flexibility and limited downside risk, making them essential for portfolio protection and speculative strategies. The premium paid for the put option reflects its market value and intrinsic potential, influenced by factors such as volatility, time to maturity, and underlying asset price movements.

Risk and Reward Comparison: Forwards vs Put Options

Forward contracts offer a fixed obligation to buy or sell an asset at a predetermined price, exposing the holder to unlimited risk if the market moves unfavorably, but guaranteeing full participation in favorable price movements. Put options provide the right, but not the obligation, to sell an asset at a set strike price, limiting potential losses to the premium paid while offering downside protection and the ability to benefit from price declines. The trade-off involves forwards having higher risk due to obligation without upfront cost, whereas put options limit risk through premium payment but may forfeit total gains if the market moves favorably.

Use Cases: When to Choose a Forward Contract

Forward contracts are ideal for businesses seeking to lock in a fixed exchange rate or commodity price to hedge against future price fluctuations in a predictable transaction. These contracts suit companies with specific, known amounts and delivery dates, such as exporters and importers aiming to eliminate uncertainty in cash flow forecasts. Forward contracts provide certainty in budgeting and financial planning for transactions where the timing and quantity are fixed, unlike put options which offer flexibility but come at a premium.

Use Cases: When to Choose a Put Option

A put option is ideal for hedgers seeking downside protection without obligating themselves to sell, providing flexibility in volatile markets or uncertain future prices. Investors use put options when expecting potential price declines but wanting to retain upside gains, such as in equity portfolios or commodity holdings. Unlike forward contracts, put options allow limited risk exposure while maintaining the option to benefit from favorable price movements.

Key Differences Between Forward Contracts and Put Options

Forward contracts obligate both parties to buy or sell an asset at a predetermined price on a specified future date, providing a binding agreement without upfront cost, while put options grant the buyer the right, but not the obligation, to sell an asset at a set strike price before or at expiration, requiring a premium payment. Forward contracts entail unlimited risk and potential gain, whereas put options offer limited downside risk to the premium paid and unlimited upside protection. The forward contract's payoff is linear and symmetrical, while put options exhibit asymmetric payoff profiles, favoring downside protection with the possibility of forgoing the transaction.

Conclusion: Selecting the Right Hedging Instrument

A forward contract offers a fixed price agreement ideal for companies seeking certainty in future transactions without upfront costs but carries exposure to counterparty risk. Put options provide flexibility and limited downside risk by granting the right to sell at a predetermined price, suitable for hedgers valuing optionality despite premium costs. Selecting the right hedging instrument depends on risk tolerance, cost considerations, and the need for flexibility versus certainty in managing price fluctuations.

Forward Contract Infographic

libterm.com

libterm.com