Trade credit is a crucial financing method where suppliers allow buyers to purchase goods or services on account, deferring payment to a later date. This arrangement helps businesses manage cash flow and maintain operational flexibility without immediate cash outflow. To learn more about how trade credit can benefit Your business and the best practices for managing it, keep reading the article.

Table of Comparison

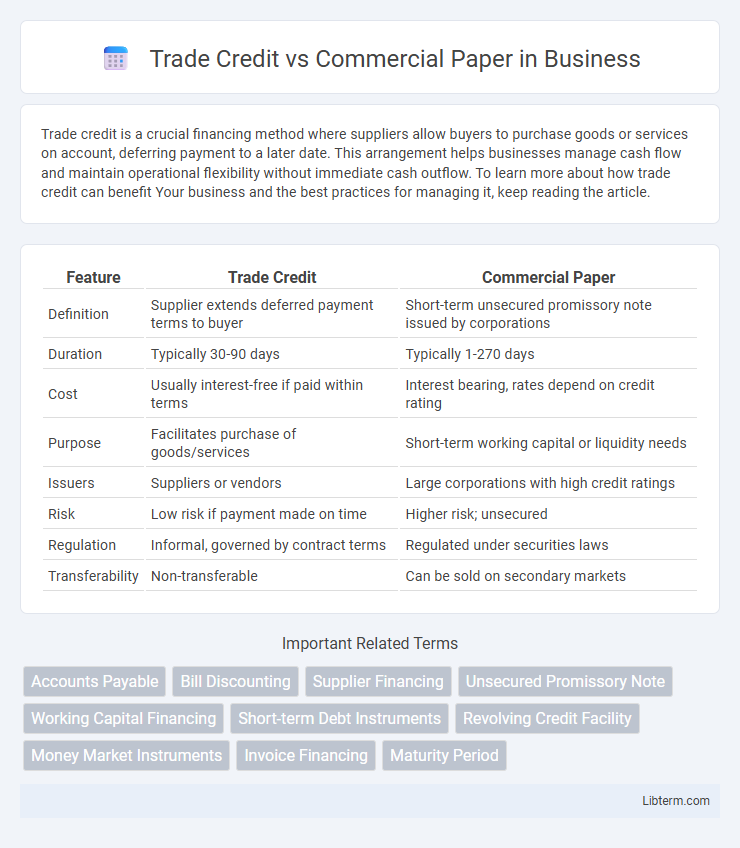

| Feature | Trade Credit | Commercial Paper |

|---|---|---|

| Definition | Supplier extends deferred payment terms to buyer | Short-term unsecured promissory note issued by corporations |

| Duration | Typically 30-90 days | Typically 1-270 days |

| Cost | Usually interest-free if paid within terms | Interest bearing, rates depend on credit rating |

| Purpose | Facilitates purchase of goods/services | Short-term working capital or liquidity needs |

| Issuers | Suppliers or vendors | Large corporations with high credit ratings |

| Risk | Low risk if payment made on time | Higher risk; unsecured |

| Regulation | Informal, governed by contract terms | Regulated under securities laws |

| Transferability | Non-transferable | Can be sold on secondary markets |

Introduction to Trade Credit and Commercial Paper

Trade credit is a short-term financing arrangement where suppliers allow buyers to purchase goods or services on account, deferring payment typically for 30 to 90 days. Commercial paper is an unsecured, short-term debt instrument issued by corporations to raise funds, usually with maturities ranging from a few days up to 270 days. Both serve as crucial tools for managing working capital but differ in form, availability, and cost structure.

Key Definitions and Concepts

Trade credit is a short-term financing arrangement where suppliers allow buyers to purchase goods or services on account, deferring payment to a later date without interest. Commercial paper is an unsecured, short-term debt instrument issued by corporations to raise funds, typically with maturities ranging from a few days up to 270 days. While trade credit is a direct invoice-based credit extended by suppliers, commercial paper involves selling promissory notes to investors in the money market.

How Trade Credit Works

Trade credit allows businesses to purchase goods or services from suppliers with deferred payment terms, typically ranging from 30 to 90 days, improving cash flow management without immediate cash outlay. Suppliers extend credit by assessing the buyer's creditworthiness, often documented through invoices outlining payment deadlines and any applicable early payment discounts such as 2/10 net 30. This informal financing method reduces the need for external borrowing and strengthens supplier-buyer relationships by facilitating operational liquidity.

How Commercial Paper Operates

Commercial paper operates as an unsecured, short-term debt instrument issued by corporations to finance immediate working capital needs, typically maturing within 270 days. It is sold at a discount to face value and redeemed at par upon maturity, providing investors with a return equivalent to the interest cost for the borrowing company. Unlike trade credit, which arises from vendor agreements, commercial paper is actively traded in money markets and requires a strong credit rating for issuance.

Differences in Usage and Applicability

Trade credit is primarily used by businesses to purchase goods and services on account, allowing short-term financing directly between suppliers and buyers without formal documentation. Commercial paper serves as a short-term, unsecured promissory note issued by corporations to raise funds from institutional investors for working capital or refinancing needs. Trade credit typically applies to routine business transactions, while commercial paper targets larger, more sophisticated financing requirements with regulatory oversight and credit rating considerations.

Risk Factors Involved

Trade credit exposes businesses to counterparty risk, as delayed payments or defaults by buyers can disrupt cash flow and working capital management. Commercial paper carries credit risk tied to the issuer's short-term solvency, with higher default risk during economic downturns impacting investor confidence. Both instruments face liquidity risk, but trade credit relies heavily on buyer relationship stability, whereas commercial paper depends on market conditions and credit ratings.

Cost Implications and Interest Rates

Trade credit typically involves no explicit interest charges but may carry implicit costs through early payment discounts lost or penalties for late payment. Commercial paper, a short-term unsecured promissory note issued by corporations, usually offers lower interest rates than bank loans but requires firms to manage issuance costs and creditworthiness. Firms often choose trade credit for flexibility and zero nominal interest, while commercial paper is favored for larger financing needs with predictable interest expenses.

Advantages and Disadvantages Comparison

Trade credit offers businesses the advantage of easy access to short-term financing without interest costs, promoting strong supplier relationships and flexible payment terms; however, it can strain cash flow if payments are delayed. Commercial paper provides a low-cost alternative to bank loans for large, creditworthy companies, enabling quick liquidity for working capital needs, yet it carries risks of market volatility and is generally accessible only to firms with high credit ratings. The choice between trade credit and commercial paper depends on the company's creditworthiness, financing scale, and cash flow management requirements.

Suitability for Different Business Types

Trade credit suits small to medium-sized enterprises (SMEs) seeking short-term financing with flexible repayment terms directly from suppliers, enhancing cash flow without formal borrowing. Commercial paper is ideal for large, creditworthy corporations requiring substantial, cost-effective short-term funds in the money market with quick issuance but demands high credit ratings. SMEs often find trade credit more accessible, while commercial paper benefits established firms with robust financial standing and access to capital markets.

Conclusion: Choosing the Right Short-term Financing Tool

Trade credit offers ease of access and flexibility for businesses needing short-term financing without formal agreements, while commercial paper provides a cost-effective solution for large, creditworthy companies seeking unsecured, short-term debt. Companies must assess factors such as creditworthiness, financing amount, cost of funds, and repayment terms to determine the most suitable option. Selecting the right tool optimizes working capital management and supports operational liquidity efficiently.

Trade Credit Infographic

libterm.com

libterm.com