Volatility measures the degree of variation in asset prices over time, reflecting market uncertainty and risk. High volatility often signals potential for significant price swings, impacting investment strategies and portfolio management. Discover how understanding volatility can enhance your financial decisions by exploring the rest of this article.

Table of Comparison

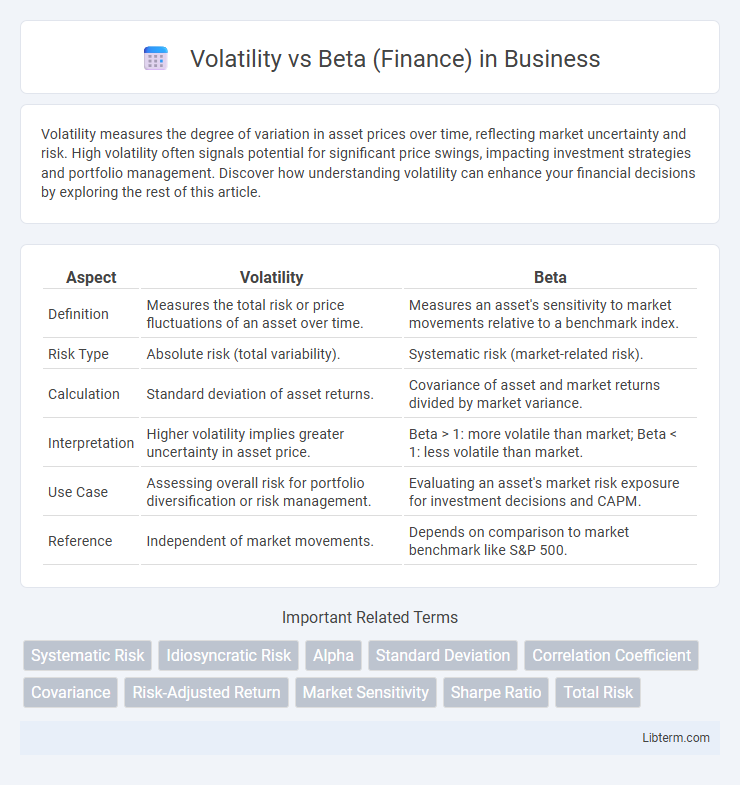

| Aspect | Volatility | Beta |

|---|---|---|

| Definition | Measures the total risk or price fluctuations of an asset over time. | Measures an asset's sensitivity to market movements relative to a benchmark index. |

| Risk Type | Absolute risk (total variability). | Systematic risk (market-related risk). |

| Calculation | Standard deviation of asset returns. | Covariance of asset and market returns divided by market variance. |

| Interpretation | Higher volatility implies greater uncertainty in asset price. | Beta > 1: more volatile than market; Beta < 1: less volatile than market. |

| Use Case | Assessing overall risk for portfolio diversification or risk management. | Evaluating an asset's market risk exposure for investment decisions and CAPM. |

| Reference | Independent of market movements. | Depends on comparison to market benchmark like S&P 500. |

Understanding Volatility in Finance

Volatility measures the degree of variation in the price of a financial asset over time, indicating its risk level and potential for price fluctuations. It is often quantified using standard deviation or variance of returns, reflecting how much an asset's price deviates from its average. Unlike beta, which compares an asset's movement relative to the overall market, volatility focuses solely on the magnitude of price changes within the asset itself.

Defining Beta: A Measure of Market Risk

Beta quantifies a stock's sensitivity to overall market movements, indicating its systematic risk relative to the market index, typically the S&P 500. A beta greater than 1 implies higher volatility than the market, while a beta less than 1 indicates lower volatility. Investors use beta to gauge portfolio risk and expected returns based on market fluctuations.

Key Differences Between Volatility and Beta

Volatility measures the total risk or price fluctuations of a security over a specific period, capturing the magnitude of both upward and downward movements. Beta quantifies a security's sensitivity to market movements, indicating how much its price changes relative to changes in a benchmark index like the S&P 500. While volatility reflects absolute risk, beta provides a relative risk assessment by comparing the security's performance to overall market trends.

How Volatility is Calculated

Volatility in finance is calculated by measuring the standard deviation of an asset's returns over a specific period, reflecting the degree of variation or dispersion from its average return. This metric quantifies the risk associated with the asset by capturing the magnitude of price fluctuations in the market. Unlike beta, which compares an asset's returns to a benchmark, volatility purely assesses the asset's own historical return variability.

Calculating Beta: The Basics

Beta measures a stock's sensitivity to market movements by calculating the covariance between the stock's returns and the market's returns, divided by the variance of the market returns. This calculation helps quantify systematic risk, distinguishing it from volatility, which refers to the total variation in a security's returns. Investors use beta to assess how much a stock's price might change relative to overall market fluctuations, aiding in portfolio risk management and asset pricing models like CAPM.

The Role of Volatility in Investment Decisions

Volatility measures the degree of variation in asset prices over time, reflecting the risk and uncertainty inherent in investment returns. It helps investors quantify potential price fluctuations to better assess portfolio risk tolerance and adjust asset allocation strategies. Understanding volatility enables more informed decisions by balancing potential returns against the likelihood of price swings, complementing beta, which tracks an asset's sensitivity to overall market movements.

Beta’s Significance in Portfolio Management

Beta measures a security's sensitivity to overall market movements, crucial for assessing systematic risk in portfolio management. Portfolio managers rely on beta to balance risk and return, tailoring asset allocations to align with investment objectives and market expectations. Understanding beta's significance enables more effective diversification and risk-adjusted performance optimization in financial portfolios.

Limitations of Using Volatility and Beta

Volatility measures the total variability of asset returns but fails to distinguish between upside and downside risk, limiting its effectiveness for risk-averse investors. Beta quantifies a stock's sensitivity to market movements but assumes a linear relationship and relies heavily on historical data, which may not predict future performance accurately. Both metrics overlook factors such as liquidity risk, company-specific events, and macroeconomic changes, reducing their reliability in comprehensive risk assessment.

Practical Examples: Volatility vs Beta in Action

Volatility measures the total risk of a stock by calculating the standard deviation of its returns, while beta quantifies the stock's sensitivity to market movements, indicating systematic risk. For example, a technology stock with high volatility may experience sharp price swings, but if its beta is low, it moves independently of the market index. Conversely, a utility stock with low volatility often has a beta close to 1, reflecting steady returns closely aligned with overall market performance.

Choosing the Right Metric for Financial Analysis

Volatility measures the total risk of an asset by assessing the standard deviation of its returns, capturing both systematic and unsystematic risk, while Beta quantifies an asset's sensitivity to market movements, reflecting only systematic risk relative to a benchmark index. Selecting the right metric depends on the analysis goal: use Volatility for understanding an asset's overall risk profile and Beta for evaluating its market-related risk exposure and portfolio diversification impact. Financial analysts targeting market risk management prioritize Beta, whereas those assessing total risk prefer Volatility to make informed investment decisions.

Volatility Infographic

libterm.com

libterm.com