Share buybacks increase a company's earnings per share by reducing the number of outstanding shares, making each remaining share more valuable. They often signal management's confidence in the company's future and can provide shareholders with a tax-efficient way to receive returns. Explore the rest of the article to understand how share buybacks impact your investment strategy and compare them to dividends.

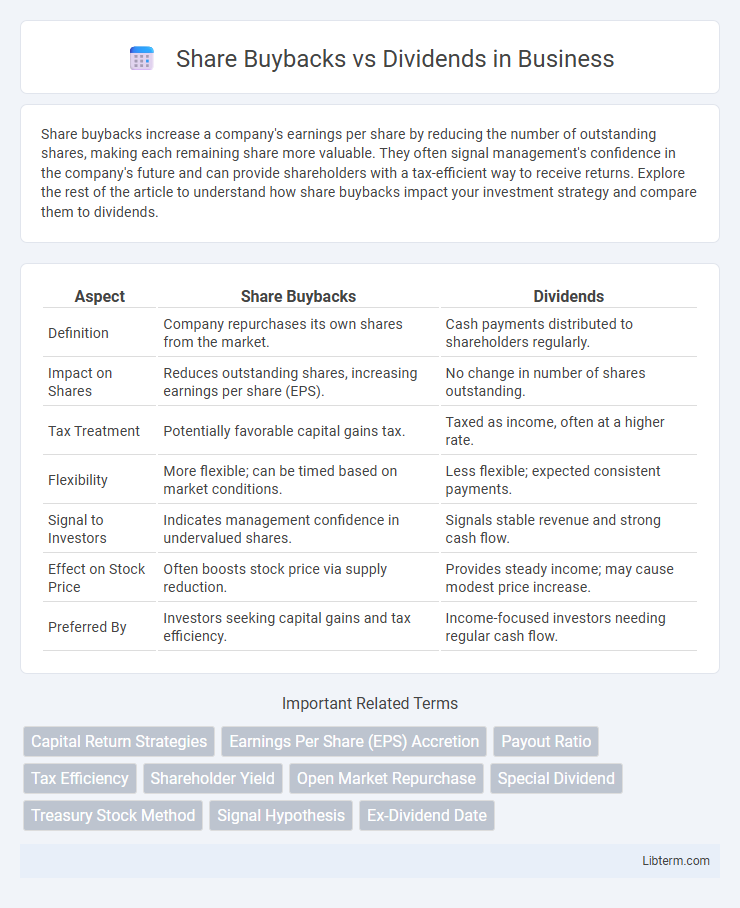

Table of Comparison

| Aspect | Share Buybacks | Dividends |

|---|---|---|

| Definition | Company repurchases its own shares from the market. | Cash payments distributed to shareholders regularly. |

| Impact on Shares | Reduces outstanding shares, increasing earnings per share (EPS). | No change in number of shares outstanding. |

| Tax Treatment | Potentially favorable capital gains tax. | Taxed as income, often at a higher rate. |

| Flexibility | More flexible; can be timed based on market conditions. | Less flexible; expected consistent payments. |

| Signal to Investors | Indicates management confidence in undervalued shares. | Signals stable revenue and strong cash flow. |

| Effect on Stock Price | Often boosts stock price via supply reduction. | Provides steady income; may cause modest price increase. |

| Preferred By | Investors seeking capital gains and tax efficiency. | Income-focused investors needing regular cash flow. |

Introduction to Share Buybacks and Dividends

Share buybacks involve a company repurchasing its own shares from the marketplace, effectively reducing the number of outstanding shares and often boosting earnings per share (EPS). Dividends are periodic cash payments distributed to shareholders as a portion of the company's profits. Both strategies serve as methods for returning value to shareholders but differ in their impact on stock price, tax treatment, and shareholder flexibility.

How Share Buybacks Work

Share buybacks occur when a company repurchases its own shares from the open market, reducing the total number of outstanding shares and increasing earnings per share (EPS). This process can signal management's confidence in the company's future prospects and can help boost the stock price by creating artificial demand. By decreasing share supply, buybacks can provide tax advantages compared to dividends, appealing to investors seeking capital gains over income.

Understanding Dividends

Dividends represent a portion of a company's earnings distributed directly to shareholders, offering a steady income stream and signaling financial stability. Companies that prioritize dividends often appeal to income-focused investors seeking reliable returns over capital gains. Understanding dividend payout ratios and yield provides insight into a company's profitability and commitment to shareholder value.

Key Differences Between Buybacks and Dividends

Share buybacks reduce the number of outstanding shares, increasing earnings per share and often boosting stock price, while dividends provide direct cash payments to shareholders as a form of income. Buybacks offer companies flexibility in capital allocation and potential tax advantages, whereas dividends create an ongoing obligation and signal consistent profitability. Investors may prefer buybacks for capital gains and dividends for steady income, reflecting different financial strategies and shareholder preferences.

Financial Impact on Shareholders

Share buybacks reduce the number of outstanding shares, increasing earnings per share (EPS) and often boosting the stock price, directly benefiting shareholders through capital gains. Dividends provide immediate cash returns to shareholders, offering a steady income stream but do not affect the share price directly. Both strategies impact shareholder value differently, influencing taxation and investment preferences based on individual financial goals and market conditions.

Effects on Earnings Per Share (EPS)

Share buybacks reduce the total number of outstanding shares, leading to an increase in Earnings Per Share (EPS) even if net income remains constant, enhancing perceived profitability. Dividends distribute earnings directly to shareholders without affecting the share count, leaving EPS unchanged but providing immediate cash returns. Companies often utilize share buybacks to boost EPS metrics for investor appeal, while dividends deliver steady income, impacting shareholder value differently.

Tax Implications: Buybacks vs. Dividends

Share buybacks typically result in capital gains tax, which may be taxed at a lower rate than ordinary income, making buybacks potentially more tax-efficient for shareholders compared to dividends. Dividends are usually taxed as ordinary income or qualified dividend income, often at higher rates depending on the investor's tax bracket. The choice between buybacks and dividends can significantly impact after-tax returns, influencing investor preference and corporate payout strategies.

Market Perceptions and Signaling

Share buybacks often signal management's confidence in the company's undervalued stock, boosting investor perception of future growth potential, while dividends convey stability and consistent cash flow, appealing to income-focused shareholders. Market perceptions interpret buybacks as a flexible capital allocation strategy that can enhance earnings per share, whereas dividends are viewed as a commitment to returning profits regularly. Both mechanisms serve distinct signaling roles: buybacks emphasize growth and financial strength, dividends highlight reliability and shareholder value maintenance.

Choosing Between Buybacks and Dividends

Choosing between share buybacks and dividends depends on a company's financial strategy and shareholder preferences. Share buybacks can increase earnings per share and stock price by reducing the number of outstanding shares, offering potential tax advantages for investors. Dividends provide regular income and appeal to income-focused investors, enhancing shareholder loyalty and signaling financial stability.

Conclusion: Which Strategy Benefits Investors More?

Share buybacks increase earnings per share and can boost stock prices by reducing the number of outstanding shares, making them a tax-efficient way for investors to gain value. Dividends provide consistent income and appeal to investors seeking steady cash flow, but they may trigger immediate tax liabilities. Investors benefit more from share buybacks in a low-tax environment prioritizing capital gains, while dividends suit those valuing regular income and dividend reinvestment opportunities.

Share Buybacks Infographic

libterm.com

libterm.com