Green Bonds and Sustainability Bonds are financial instruments designed to fund projects with positive environmental and social impacts, respectively. Green Bonds typically focus on initiatives like renewable energy, pollution reduction, and conservation, while Sustainability Bonds combine environmental and social objectives to promote broader sustainable development. Discover how these bonds can align with your investment strategy and contribute to a more sustainable future in the rest of the article.

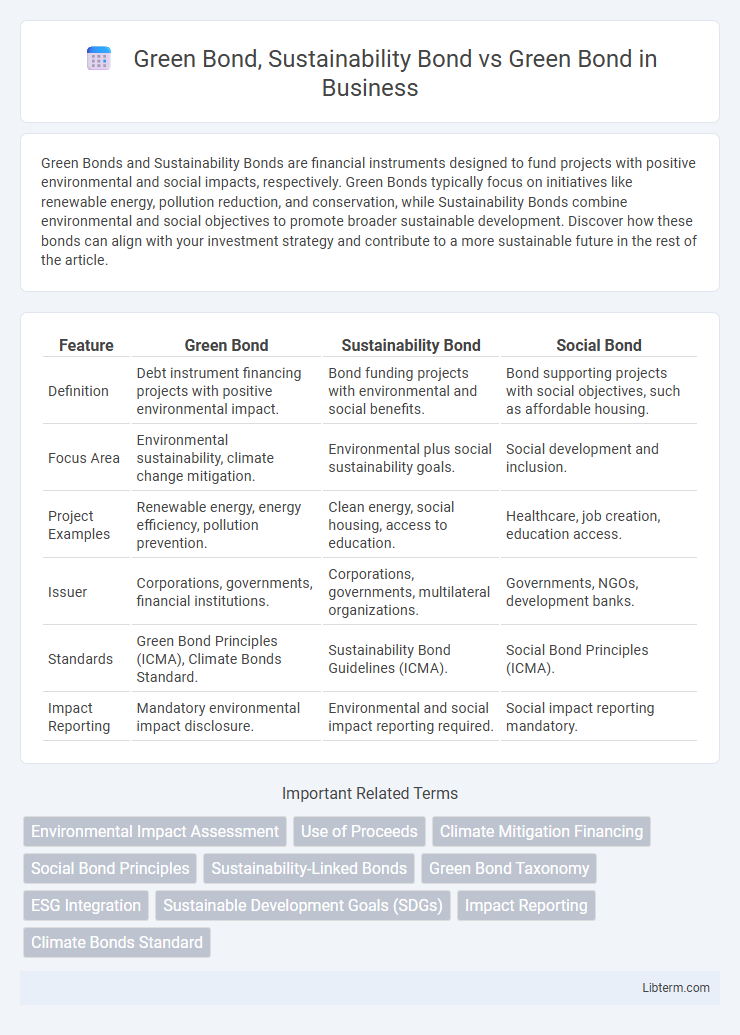

Table of Comparison

| Feature | Green Bond | Sustainability Bond | Social Bond |

|---|---|---|---|

| Definition | Debt instrument financing projects with positive environmental impact. | Bond funding projects with environmental and social benefits. | Bond supporting projects with social objectives, such as affordable housing. |

| Focus Area | Environmental sustainability, climate change mitigation. | Environmental plus social sustainability goals. | Social development and inclusion. |

| Project Examples | Renewable energy, energy efficiency, pollution prevention. | Clean energy, social housing, access to education. | Healthcare, job creation, education access. |

| Issuer | Corporations, governments, financial institutions. | Corporations, governments, multilateral organizations. | Governments, NGOs, development banks. |

| Standards | Green Bond Principles (ICMA), Climate Bonds Standard. | Sustainability Bond Guidelines (ICMA). | Social Bond Principles (ICMA). |

| Impact Reporting | Mandatory environmental impact disclosure. | Environmental and social impact reporting required. | Social impact reporting mandatory. |

Introduction to Green Bonds and Sustainability Bonds

Green Bonds are debt instruments specifically designated to finance projects with environmental benefits, such as renewable energy or pollution reduction. Sustainability Bonds combine the objectives of Green Bonds with social impact goals, funding projects that address environmental sustainability alongside social issues like affordable housing or education. Both instruments support sustainable development but differ in their scope, with Green Bonds focusing solely on environmental outcomes and Sustainability Bonds targeting a broader range of sustainability impacts.

Defining Green Bonds

Green bonds represent fixed-income financial instruments dedicated exclusively to funding projects with clear environmental benefits, such as renewable energy, clean transportation, and sustainable water management. Sustainability bonds encompass a broader spectrum, financing initiatives that address both environmental goals and social objectives, including affordable housing and community development. Defining green bonds involves rigorous criteria centered on transparency, third-party verification, and alignment with recognized standards like the Climate Bonds Initiative, ensuring proceeds directly contribute to measurable ecological improvements.

Understanding Sustainability Bonds

Sustainability Bonds combine the environmental benefits of Green Bonds with social impact projects, financing initiatives that address both ecological preservation and social equity. Unlike Green Bonds, which exclusively fund projects with positive environmental outcomes such as renewable energy or clean water, Sustainability Bonds expand their scope to include social objectives like affordable housing and community development. Understanding Sustainability Bonds is essential for investors seeking comprehensive impact investing strategies that integrate environmental and social governance (ESG) criteria.

Key Features of Green Bonds

Green Bonds are fixed-income financial instruments specifically earmarked to fund projects with positive environmental benefits, featuring transparent reporting and independent verification to ensure accountability. Sustainability Bonds broaden this scope by financing both environmental and social projects, combining criteria from Green Bonds and Social Bonds. Key features of Green Bonds include dedicated use of proceeds for climate-related initiatives, rigorous impact reporting standards, and alignment with frameworks such as the Climate Bond Initiative or ICMA Green Bond Principles.

Key Features of Sustainability Bonds

Sustainability bonds integrate green and social projects, targeting environmental benefits and social outcomes, unlike green bonds that focus solely on environmental initiatives. Key features of sustainability bonds include the allocation of proceeds to a mix of green and social projects, clear impact reporting on both environmental and social metrics, and adherence to sustainability bond guidelines like those from the ICMA. These bonds offer investors diversified impact exposure, reflecting a broader commitment to sustainable development goals beyond just environmental concerns.

Green Bonds vs Sustainability Bonds: Core Differences

Green Bonds fund projects exclusively aimed at environmental benefits such as renewable energy, pollution reduction, and climate change mitigation, while Sustainability Bonds finance a broader range of initiatives including social and environmental objectives like affordable housing and clean water access. The core difference lies in their scope: Green Bonds are strictly environmental, whereas Sustainability Bonds incorporate both environmental and social impact criteria. Investors prioritize Green Bonds for targeted eco-friendly projects, whereas Sustainability Bonds attract those seeking combined environmental and social returns.

Benefits of Issuing and Investing in Green Bonds

Green bonds specifically fund environmentally beneficial projects, offering issuers access to a growing market of eco-conscious investors and potentially lower borrowing costs due to their green credentials. Sustainability bonds cover a broader range of social and environmental projects, allowing issuers to address multiple sustainability goals while attracting diverse investor interest. Investing in green bonds supports renewable energy, pollution reduction, and climate resilience initiatives, providing financial returns alongside positive environmental impact and enhanced corporate reputation.

Advantages of Sustainability Bonds for Sustainable Development

Sustainability bonds extend beyond the green bond framework by financing a broader range of projects that include social and environmental objectives, enhancing their impact on sustainable development. These bonds support inclusive initiatives such as affordable housing, clean energy, and healthcare, driving comprehensive progress toward the United Nations Sustainable Development Goals (SDGs). Capital raised through sustainability bonds fosters resilience and equitable growth by integrating environmental preservation with social well-being, making them a versatile tool for long-term sustainability financing.

Market Trends and Growth in Green and Sustainability Bonds

Green bonds and sustainability bonds have seen significant market growth, with green bonds primarily funding environmentally beneficial projects such as renewable energy and clean transportation. The sustainability bond market expands this scope by integrating social and governance criteria alongside environmental objectives, appealing to a broader range of impact investors. Recent trends show a surge in issuance, with green bonds reaching over $500 billion globally in 2023 and sustainability bonds growing rapidly as companies prioritize ESG commitments and regulatory frameworks evolve.

Future Outlook: Green Bonds and Sustainability Bonds

Green Bonds specifically finance projects with clear environmental benefits such as renewable energy and clean transportation, while Sustainability Bonds cover broader social and environmental objectives. The future outlook indicates a growing demand driven by increasing regulatory support, investor awareness, and ambitious global climate targets. Market projections expect Green Bonds and Sustainability Bonds to expand significantly, facilitating the transition to a low-carbon and socially inclusive economy.

Green Bond, Sustainability Bond Infographic

libterm.com

libterm.com