Effective cost control is essential for maintaining profitability and optimizing your business operations. By implementing strategic budgeting, monitoring expenses, and analyzing financial data, companies can reduce waste and improve resource allocation. Discover practical cost control techniques and tips to enhance your financial management in the rest of this article.

Table of Comparison

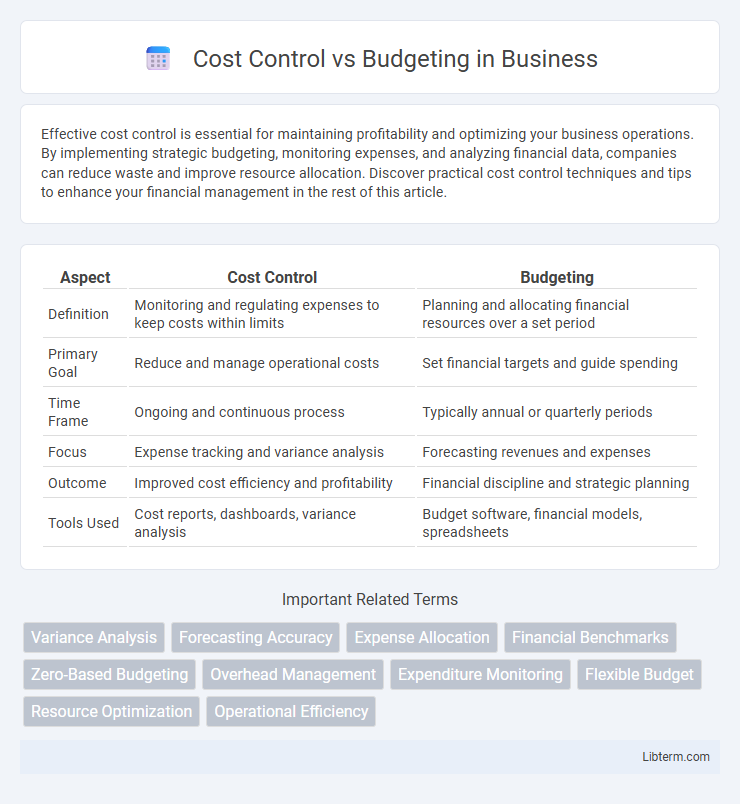

| Aspect | Cost Control | Budgeting |

|---|---|---|

| Definition | Monitoring and regulating expenses to keep costs within limits | Planning and allocating financial resources over a set period |

| Primary Goal | Reduce and manage operational costs | Set financial targets and guide spending |

| Time Frame | Ongoing and continuous process | Typically annual or quarterly periods |

| Focus | Expense tracking and variance analysis | Forecasting revenues and expenses |

| Outcome | Improved cost efficiency and profitability | Financial discipline and strategic planning |

| Tools Used | Cost reports, dashboards, variance analysis | Budget software, financial models, spreadsheets |

Understanding Cost Control and Budgeting

Cost control involves monitoring and managing expenses to ensure they do not exceed allocated limits, emphasizing real-time tracking and corrective actions. Budgeting is the strategic process of planning financial resources by estimating income and expenditures over a specific period to guide spending and investment decisions. Both practices are essential for effective financial management, with budgeting setting the financial framework and cost control enforcing discipline within that framework.

Key Differences Between Cost Control and Budgeting

Cost control involves monitoring and managing actual expenses to ensure they stay within predefined limits, while budgeting focuses on planning and allocating financial resources before expenses occur. Cost control emphasizes real-time tracking and corrective actions to minimize overspending, whereas budgeting is a strategic forecasting tool that sets financial goals and expenditure limits. The key difference lies in budgeting being a forward-looking plan, whereas cost control is a reactive process that adjusts spending to align with the budget.

Objectives of Cost Control

Cost control aims to monitor and regulate expenses to ensure that project or operational costs stay within predefined limits, minimizing waste and optimizing resource allocation. It focuses on identifying cost variances early, enabling timely corrective actions to prevent budget overruns. Effective cost control enhances financial efficiency, supports decision-making, and improves overall project profitability.

Objectives of Budgeting

Budgeting aims to establish a detailed financial plan that allocates resources efficiently while setting spending limits to guide organizational activities. It provides a framework for forecasting revenues and expenses, enabling managers to monitor financial performance and enforce fiscal discipline. Effective budgeting supports strategic decision-making by aligning financial goals with operational priorities and ensuring accountability.

Processes Involved in Cost Control

Cost control involves continuous monitoring, analyzing, and managing expenses to keep projects within budget, utilizing techniques such as variance analysis and cost tracking. Key processes include setting cost standards, measuring actual costs, comparing actual costs against budgeted amounts, and implementing corrective actions when deviations occur. Effective cost control ensures optimal resource allocation and financial efficiency throughout the project lifecycle.

Steps in the Budgeting Process

The budgeting process involves defining organizational goals, estimating revenues, and allocating resources to departments. Key steps include preparing a budget schedule, gathering input from various stakeholders, and reviewing financial assumptions to ensure accuracy. Finalizing and communicating the approved budget helps guide cost control measures and monitor financial performance.

Benefits of Effective Cost Control

Effective cost control ensures projects stay within financial limits by continuously monitoring expenses and identifying cost-saving opportunities, which enhances profitability and reduces waste. By implementing cost control measures, businesses can improve cash flow management, allocate resources efficiently, and respond proactively to cost overruns. These benefits contribute to achieving long-term financial stability and supporting strategic growth initiatives.

Advantages of Strategic Budgeting

Strategic budgeting enables organizations to allocate resources effectively by aligning financial plans with long-term business goals, improving overall decision-making accuracy. It promotes proactive cost management and risk mitigation by anticipating future financial needs and market fluctuations. Enhanced financial discipline and transparency result in better performance tracking and increased stakeholder confidence.

Challenges in Cost Control and Budgeting

Challenges in cost control include accurately forecasting expenses and managing unexpected overheads, which often lead to cost overruns. Budgeting difficulties arise from creating realistic financial plans that account for market volatility, fluctuating resource prices, and shifting business priorities. Both processes require continuous monitoring and adjustment to ensure alignment with organizational goals and financial constraints.

Integrating Cost Control with Budgeting for Business Success

Integrating cost control with budgeting streamlines financial management, ensuring businesses maintain spending discipline while adapting to real-time financial data. Effective integration enhances accuracy in forecasting, resource allocation, and variance analysis, driving informed decision-making and maximizing profitability. Utilizing advanced software tools for continuous monitoring aligns budgets with actual expenses, fostering proactive adjustments and long-term financial stability.

Cost Control Infographic

libterm.com

libterm.com