Replacement cost refers to the amount needed to replace an asset at current market prices, ensuring you can restore your property or belongings without financial loss. Understanding replacement cost helps you make informed decisions about insurance coverage and budgeting for repairs or upgrades. Explore the rest of the article to learn how accurate replacement cost estimation protects your investments.

Table of Comparison

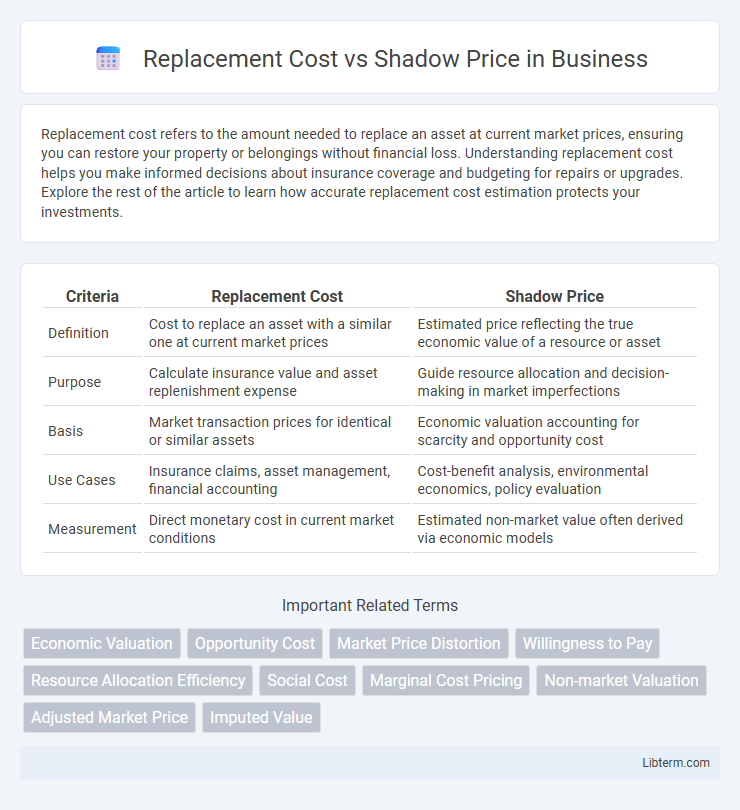

| Criteria | Replacement Cost | Shadow Price |

|---|---|---|

| Definition | Cost to replace an asset with a similar one at current market prices | Estimated price reflecting the true economic value of a resource or asset |

| Purpose | Calculate insurance value and asset replenishment expense | Guide resource allocation and decision-making in market imperfections |

| Basis | Market transaction prices for identical or similar assets | Economic valuation accounting for scarcity and opportunity cost |

| Use Cases | Insurance claims, asset management, financial accounting | Cost-benefit analysis, environmental economics, policy evaluation |

| Measurement | Direct monetary cost in current market conditions | Estimated non-market value often derived via economic models |

Introduction to Replacement Cost and Shadow Price

Replacement cost refers to the current expense required to replace an asset or resource with a similar one at prevailing market prices, reflecting the actual outlay needed for substitution. Shadow price represents the implicit value or opportunity cost of a resource in the absence of market prices, often used in economic evaluation to estimate the true cost or benefit of using a resource. Understanding the differences between replacement cost and shadow price is essential for accurate project appraisal and resource allocation in cost-benefit analysis.

Definition of Replacement Cost

Replacement cost refers to the amount of money required to replace an asset or resource with a similar one at current market prices, reflecting the actual expenditure needed to restore capacity or service levels. It is a tangible valuation method used in economic and engineering contexts to assess investment or repair costs based on real-world market conditions. Unlike shadow price, which estimates the implicit value of a resource or constraint in optimization problems, replacement cost directly measures market-based financial outlays.

Definition of Shadow Price

Shadow price represents the monetary value assigned to a constraint or resource that is not directly priced in the market, often used in economic and optimization models to reflect the opportunity cost of relaxing a constraint by one unit. It quantifies the marginal value of an additional unit of a scarce resource, guiding decision-making in resource allocation and cost-benefit analysis. Replacement cost, in contrast, refers to the current market cost to replace an asset or resource, without considering the implicit economic value or opportunity cost captured by the shadow price.

Key Differences Between Replacement Cost and Shadow Price

Replacement cost reflects the current market price required to replace an asset or resource, emphasizing tangible expenses in financial accounting and insurance contexts. Shadow price represents the implicit value of a resource or opportunity in optimization problems or cost-benefit analysis, often used in economics to measure the value of non-market goods or constrained resources. Key differences include replacement cost's focus on observable transaction values versus shadow price's role in theoretical valuation under scarcity or policy constraints.

Applications in Financial Decision-Making

Replacement cost reflects the current expense to replace an asset, guiding investment decisions by providing a realistic valuation for budgeting and cost control. Shadow price represents the implicit value of scarce resources or constraints in optimization models, informing resource allocation and opportunity cost assessment in financial planning. Firms use replacement cost for asset management while leveraging shadow price insights in cost-benefit analyses and project evaluation to maximize financial efficiency.

Advantages of Using Replacement Cost

Replacement cost provides a more accurate reflection of the true economic value of an asset by considering current market prices for replacing it, which enhances decision-making in resource allocation. This method allows businesses and policymakers to account for inflation and technological changes, ensuring asset valuation remains relevant over time. Using replacement cost supports better investment planning and risk management by aligning asset values with present-day economic conditions rather than historical costs or theoretical valuations like shadow prices.

Benefits of Shadow Price Analysis

Shadow price analysis offers a precise valuation of scarce resources by reflecting their true economic value beyond market prices. It enables better decision-making in cost-benefit analyses by capturing opportunity costs and externalities often overlooked in replacement cost methods. This approach improves resource allocation efficiency and supports sustainable project evaluations by integrating non-market impacts and future benefits.

Limitations of Both Valuation Methods

Replacement cost often overestimates asset value by ignoring factors such as depreciation, market demand, and technological obsolescence, leading to less accurate financial assessments. Shadow price relies heavily on assumptions and models that can be subjective or inconsistent, resulting in potential biases and difficulties in capturing true economic value. Both methods face challenges in reflecting real-world conditions, limiting their effectiveness in precise asset or project valuation decisions.

Real-World Examples and Case Studies

Replacement cost measures the actual expense required to replace an asset at current market prices, widely used in insurance valuations and infrastructure projects like highway reconstruction in the United States. Shadow price, often applied in environmental economics and cost-benefit analysis, represents the true social cost or benefit of a resource, such as estimating the environmental impact of deforestation in the Amazon rainforest. Case studies in utility regulation demonstrate replacement cost guiding tariff settings, while shadow pricing informs policies on carbon emissions trading in the European Union.

Choosing the Right Method for Your Needs

Replacement cost measures the actual expense to replace an asset with a similar one at current market prices, reflecting tangible financial outlays. Shadow price estimates the implicit value or opportunity cost of a resource not directly priced in the market, often used in cost-benefit analysis for decision-making. Selecting the right method depends on the context: use replacement cost for budgeting and insurance purposes, while shadow price is preferable for policy evaluation and resource optimization where market prices are absent or distorted.

Replacement Cost Infographic

libterm.com

libterm.com