A margin represents the difference between the cost and the selling price of a product or service, indicating profit potential. Understanding how to calculate and optimize your margin is crucial for improving business profitability and making strategic decisions. Explore the rest of the article to learn practical tips for maximizing your margin effectively.

Table of Comparison

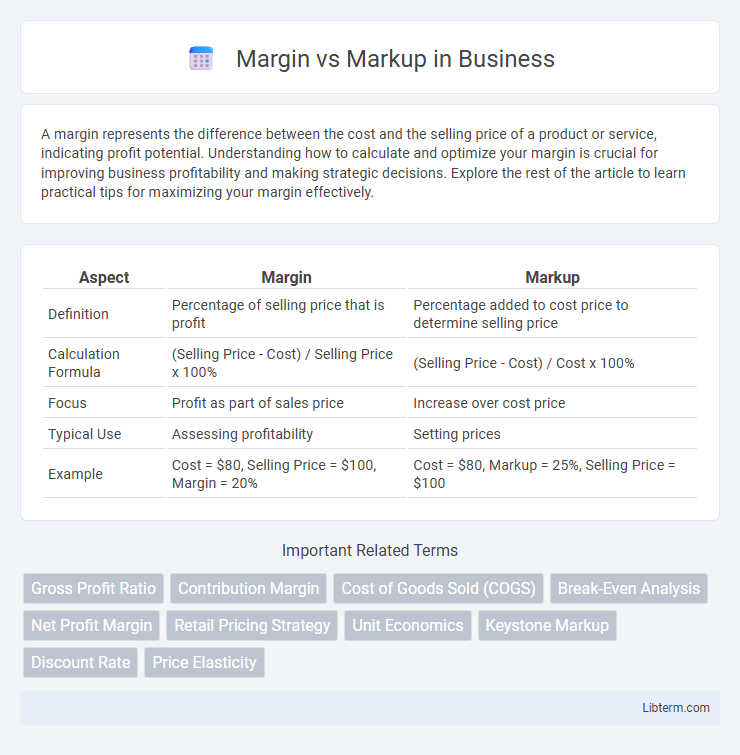

| Aspect | Margin | Markup |

|---|---|---|

| Definition | Percentage of selling price that is profit | Percentage added to cost price to determine selling price |

| Calculation Formula | (Selling Price - Cost) / Selling Price x 100% | (Selling Price - Cost) / Cost x 100% |

| Focus | Profit as part of sales price | Increase over cost price |

| Typical Use | Assessing profitability | Setting prices |

| Example | Cost = $80, Selling Price = $100, Margin = 20% | Cost = $80, Markup = 25%, Selling Price = $100 |

Understanding the Basics: What Are Margin and Markup?

Margin represents the percentage of sales revenue that exceeds the cost of goods sold, indicating profitability per sale, while markup refers to the amount added to the cost price to determine the selling price. Both margin and markup are crucial in pricing strategy, with margin calculated as (Sales Price - Cost) / Sales Price and markup calculated as (Sales Price - Cost) / Cost. Understanding the difference between margin and markup helps businesses set prices that maximize profit and remain competitive in the market.

Key Differences Between Margin and Markup

Margin represents the percentage of sales revenue that is profit, calculated by dividing profit by sales price, whereas markup is the percentage added to the cost price to determine the selling price, calculated by dividing profit by cost. Margin focuses on how much of the selling price is profit, making it critical for understanding profitability, while markup centers on the price increase over cost, guiding pricing strategy. Understanding the distinction helps businesses set prices accurately to achieve desired profit levels and maintain competitive positioning.

Why Margin and Markup Matter in Business

Margin and markup are crucial financial metrics that directly impact business profitability and pricing strategies. Understanding margin helps businesses determine the percentage of sales revenue that exceeds the cost of goods sold, ensuring sustainable profit levels. Markup indicates how much more the selling price is compared to the cost price, guiding pricing decisions to cover expenses and achieve target profits.

Calculating Margin: Step-by-Step Guide

Calculating margin involves determining the difference between selling price and cost price, expressed as a percentage of the selling price. To find the margin, subtract the cost from the selling price, then divide the result by the selling price and multiply by 100. For example, if the selling price is $150 and the cost price is $100, the margin is (($150 - $100) / $150) x 100 = 33.33%.

Calculating Markup: Step-by-Step Guide

Calculating markup involves determining the percentage added to the cost price to set the selling price. To compute markup, subtract the cost price from the selling price, then divide the result by the cost price and multiply by 100. This formula--Markup % = [(Selling Price - Cost Price) / Cost Price] x 100--ensures accurate pricing strategies for profit maximization.

Common Mistakes When Using Margin and Markup

Confusing margin and markup often leads to pricing errors, as margin represents profit as a percentage of sales, while markup is based on cost. A frequent mistake is applying markup percentage directly to the selling price instead of the cost, resulting in overpricing or underpricing products. Misinterpreting these concepts can distort profit calculations and negatively impact business financial strategies.

Practical Examples: Margin vs Markup in Action

Margin represents the percentage of sales price that is profit, calculated as (Selling Price - Cost) / Selling Price, while markup is the percentage increase on the cost, calculated as (Selling Price - Cost) / Cost. For example, if a product costs $50 and sells for $75, the margin is 33.33% and the markup is 50%. Understanding this distinction helps businesses price products effectively to achieve desired profit levels and avoid pricing errors.

Choosing the Right Pricing Strategy for Your Business

Margin represents the percentage of sales revenue that exceeds the cost of goods sold, while markup refers to the percentage added to the cost price to determine the selling price. Selecting the right pricing strategy requires understanding your industry standards, customer demand, and profit goals to balance competitive pricing with sustainable margins. Analyzing the relationship between margin and markup helps businesses optimize profitability and make informed decisions on product pricing.

Tools and Software for Tracking Margins and Markups

Tools and software such as QuickBooks, FreshBooks, and Zoho Inventory provide robust features for tracking both margin and markup by automating cost calculations and sales price monitoring. Advanced analytics platforms like Tableau and Microsoft Power BI enable businesses to visualize margin and markup trends, facilitating informed pricing strategies and profitability analysis. Inventory management solutions, including TradeGecko and Fishbowl, integrate margin and markup tracking to optimize stock levels and improve financial performance.

Frequently Asked Questions About Margin and Markup

Margin represents the percentage of sales revenue remaining after deducting the cost of goods sold, calculated as (Sales - Cost) / Sales, while markup refers to the percentage added to the cost price to determine the selling price, calculated as (Sales - Cost) / Cost. Frequently asked questions about margin and markup often address how to convert between the two, their impact on pricing strategies, and the importance of distinguishing margin as profit percentage versus markup as cost-based pricing adjustment. Understanding these differences helps businesses set prices to achieve desired profitability and manage financial performance effectively.

Margin Infographic

libterm.com

libterm.com