Purchasing Power Parity (PPP) is an economic theory that compares different countries' currencies through a "basket of goods" approach, ensuring that the same goods have equivalent prices when currency values are adjusted. It helps your understanding of exchange rates by highlighting discrepancies between market rates and the relative cost of living. Explore the rest of the article to discover how PPP influences global trade and economic policy decisions.

Table of Comparison

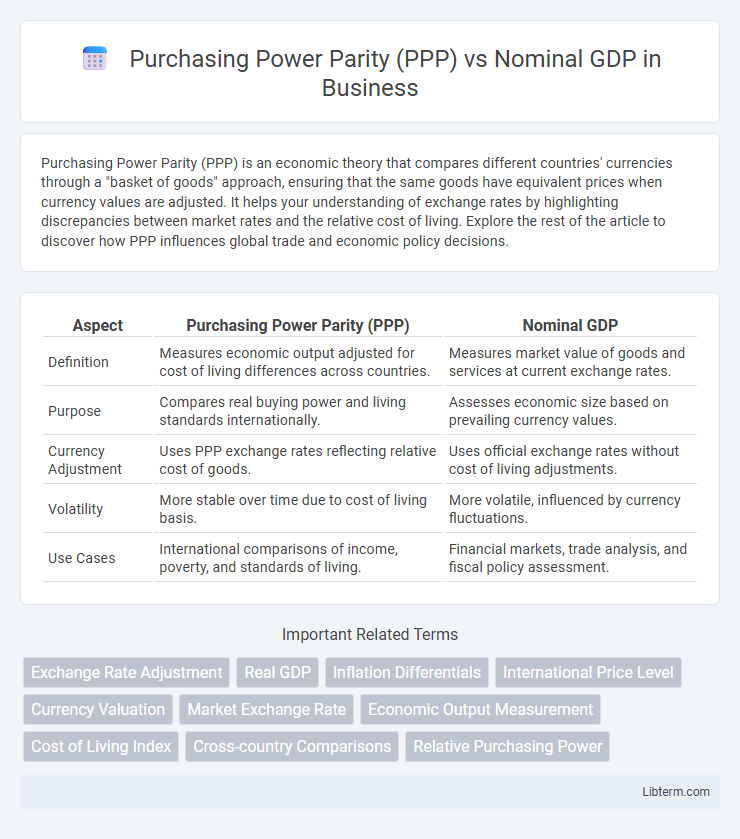

| Aspect | Purchasing Power Parity (PPP) | Nominal GDP |

|---|---|---|

| Definition | Measures economic output adjusted for cost of living differences across countries. | Measures market value of goods and services at current exchange rates. |

| Purpose | Compares real buying power and living standards internationally. | Assesses economic size based on prevailing currency values. |

| Currency Adjustment | Uses PPP exchange rates reflecting relative cost of goods. | Uses official exchange rates without cost of living adjustments. |

| Volatility | More stable over time due to cost of living basis. | More volatile, influenced by currency fluctuations. |

| Use Cases | International comparisons of income, poverty, and standards of living. | Financial markets, trade analysis, and fiscal policy assessment. |

Introduction to GDP Measurement

Nominal GDP measures a country's economic output using current market prices without adjusting for inflation or cost of living differences. Purchasing Power Parity (PPP) adjusts GDP by comparing the relative cost of a standard basket of goods across countries, providing a more accurate reflection of living standards and economic productivity. PPP is essential for cross-country comparisons, while nominal GDP highlights the size of an economy in current monetary terms.

Defining Nominal GDP

Nominal GDP measures the total market value of all final goods and services produced within a country using current prices, without adjusting for inflation or cost of living differences. It reflects the economic output based on existing exchange rates, making it useful for comparing the size of economies in current terms. Unlike Purchasing Power Parity (PPP), which adjusts for relative price levels across countries, Nominal GDP provides a straightforward snapshot of economic performance at face value.

Understanding Purchasing Power Parity (PPP)

Purchasing Power Parity (PPP) measures the relative value of currencies by comparing the cost of a standardized basket of goods and services across countries, providing a more accurate reflection of living standards than Nominal GDP. Unlike Nominal GDP, which is calculated using current market exchange rates, PPP accounts for price level differences and eliminates distortions caused by fluctuating currency values. This makes PPP a crucial metric for international economic comparisons, enabling better assessment of real income and economic productivity among nations.

Key Differences Between Nominal GDP and PPP

Nominal GDP measures a country's economic output using current market exchange rates, reflecting the value in U.S. dollars without adjusting for price level differences. Purchasing Power Parity (PPP) GDP accounts for relative cost of living and inflation rates, providing a more accurate comparison of living standards and real economic productivity across countries. While Nominal GDP highlights financial market strength and official exchange rate values, PPP emphasizes domestic consumption power and price parity differences.

Advantages of Using Nominal GDP

Nominal GDP provides a straightforward measurement of a country's economic output using current market prices, allowing direct comparison of the size of economies without adjustments. Its use reflects actual exchange rates, making it valuable for assessing economic power in global financial markets and investment decisions. Unlike Purchasing Power Parity (PPP), Nominal GDP captures the real impact of currency fluctuations and international trade dynamics on economic performance.

Advantages of Using PPP GDP

Purchasing Power Parity (PPP) GDP offers a more accurate comparison of living standards and economic productivity across countries by adjusting for differences in price levels and cost of living, unlike nominal GDP which can be distorted by exchange rate fluctuations. PPP GDP provides a better reflection of domestic market size and real income, enabling policymakers and economists to assess economic well-being and poverty levels more effectively. This method improves cross-country economic analyses by minimizing distortions from volatile currency movements and enabling fairer international benchmarking.

Limitations and Challenges of Each Metric

Purchasing Power Parity (PPP) faces limitations such as inaccurate price comparisons due to non-tradable goods and services, and challenges in reflecting real consumption patterns across countries. Nominal GDP does not account for cost of living differences or inflation, leading to misleading cross-country economic size comparisons. Both metrics struggle with data quality issues, currency fluctuations, and varying statistical methodologies, complicating accurate global economic assessments.

Real-World Applications: PPP vs Nominal GDP

Purchasing Power Parity (PPP) compares economic productivity and standards of living by accounting for price level differences across countries, providing a more accurate measure of real income and consumption. Nominal GDP reflects the market value of all final goods and services produced, using current exchange rates, which can be distorted by currency fluctuations and inflation. Policymakers and economists prefer PPP for cross-country comparisons and development assessments, while nominal GDP is often used for analyzing market size and international financial flows.

Impact on International Comparisons and Rankings

Purchasing Power Parity (PPP) adjusts GDP to reflect the relative cost of living and inflation rates, offering a more accurate measure for comparing economic productivity and standards of living across countries. Nominal GDP, calculated using current market exchange rates, often distorts international comparisons by failing to account for price level differences, leading to potentially misleading rankings. Consequently, PPP-based GDP rankings provide a more reliable basis for assessing economic strength and development, especially when comparing countries with significant currency valuation disparities.

Conclusion: Choosing the Right Economic Indicator

Purchasing Power Parity (PPP) offers a more accurate comparison of living standards and real economic productivity by adjusting for cost of living differences, while Nominal GDP reflects the market value of goods and services at current exchange rates, capturing economic size and international financial power. Selecting the appropriate economic indicator depends on the analysis goal: PPP is ideal for understanding domestic consumer purchasing capacity and welfare, whereas Nominal GDP is crucial for assessing global economic influence and fiscal capacity. Policymakers and analysts should consider these distinctions to draw meaningful insights from economic data.

Purchasing Power Parity (PPP) Infographic

libterm.com

libterm.com