Market price reflects the current value at which goods or assets are bought and sold in a competitive environment, directly influenced by supply and demand dynamics. Understanding market price is crucial for making informed financial decisions and optimizing investment strategies. Explore the full article to gain deeper insights into how market price impacts your economic choices.

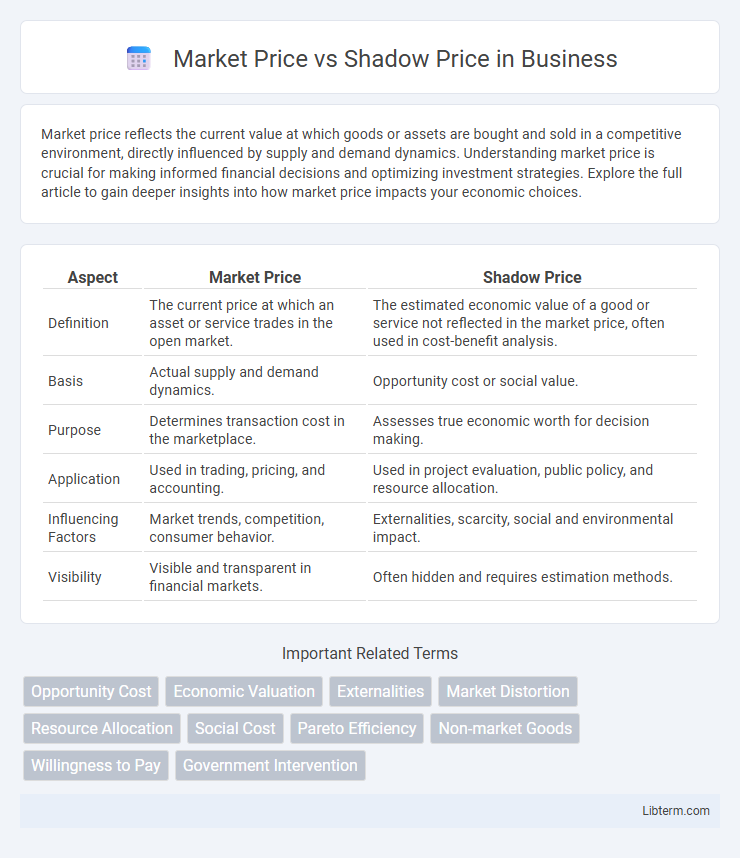

Table of Comparison

| Aspect | Market Price | Shadow Price |

|---|---|---|

| Definition | The current price at which an asset or service trades in the open market. | The estimated economic value of a good or service not reflected in the market price, often used in cost-benefit analysis. |

| Basis | Actual supply and demand dynamics. | Opportunity cost or social value. |

| Purpose | Determines transaction cost in the marketplace. | Assesses true economic worth for decision making. |

| Application | Used in trading, pricing, and accounting. | Used in project evaluation, public policy, and resource allocation. |

| Influencing Factors | Market trends, competition, consumer behavior. | Externalities, scarcity, social and environmental impact. |

| Visibility | Visible and transparent in financial markets. | Often hidden and requires estimation methods. |

Understanding Market Price: Definition and Components

Market price represents the current value at which goods or services are bought and sold in an open market, influenced by supply and demand dynamics. Key components of market price include the cost of production, competition levels, consumer preferences, and external factors such as taxes or subsidies. Understanding market price is essential for businesses to set competitive pricing strategies and for consumers to gauge fair value in transactions.

Defining Shadow Price: Concept and Context

Shadow price represents the implied value of a resource or constraint in economic or optimization models, often reflecting its true economic worth when market prices are absent or distorted. It quantifies the opportunity cost of utilizing one additional unit of a scarce resource, guiding decision-making in resource allocation and cost-benefit analyses. Unlike market price, which fluctuates based on supply and demand, shadow price is derived from the underlying constraints of a system, offering critical insights for policy evaluation, project appraisal, and internal pricing mechanisms.

Market Price vs Shadow Price: Core Differences

Market price reflects the current value of a good or service determined by supply and demand in competitive markets, while shadow price represents the estimated economic value of a resource or commodity not typically traded in markets or subject to externalities. Market price provides observable data for transactions, whereas shadow price is utilized in cost-benefit analysis to evaluate social opportunity costs and policy impacts. The core difference lies in market price capturing real-time exchange value, and shadow price representing theoretical or opportunity costs for non-market goods.

How Market Prices Are Determined

Market prices are determined by the forces of supply and demand in competitive markets, reflecting the equilibrium where quantity supplied equals quantity demanded. Factors such as production costs, consumer preferences, and external conditions influence these prices, making them dynamic and responsive to market changes. Shadow prices, in contrast, represent the implicit value of constrained resources, often used in optimization models to assess opportunity costs beyond visible market indicators.

The Calculation of Shadow Prices: Methods and Models

Shadow prices are calculated using methods such as linear programming, dual value analysis, and input-output models to estimate the true economic value of goods or resources not reflected in market prices. These models analyze constraints and opportunity costs within optimization problems to determine the cost or value of an additional unit of a resource. Techniques like cost-benefit analysis and constrained optimization are essential for deriving shadow prices, enabling better decision-making in resource allocation and project evaluation.

Applications of Market Price in Real-World Scenarios

Market price reflects the current value at which goods or assets are exchanged in competitive markets, serving as a critical benchmark for business pricing strategies and consumer purchasing decisions. It influences stock market valuations, commodity trading, and real estate transactions by providing transparent and real-time signals of supply and demand conditions. Companies use market prices to optimize inventory management, set competitive prices, and evaluate investment opportunities, ensuring alignment with prevailing economic trends and consumer behavior.

The Role of Shadow Price in Economic Analysis

Shadow price represents the true economic value of a resource when market prices do not reflect scarcity or externalities, enabling more accurate cost-benefit analysis in resource allocation. It helps identify the opportunity cost of constraints in optimization problems, guiding policymakers to efficient decision-making beyond conventional market signals. By capturing intangible or non-market factors, shadow price facilitates sustainable development and equitable resource distribution in economic planning.

Advantages and Limitations of Using Market Prices

Market prices provide real-time valuation based on supply and demand, making them highly transparent and easy to obtain for most commodities and financial assets. However, they can be volatile and may not reflect externalities or social costs, limiting their utility in policy analysis or resource allocation decisions. Relying solely on market prices may overlook long-term environmental impacts or public goods that are not traded in conventional markets.

Benefits and Challenges of Shadow Pricing

Shadow pricing offers a critical advantage by assigning monetary values to non-market goods like environmental benefits or social impacts, enabling more comprehensive cost-benefit analyses and informed decision-making. This approach helps policymakers evaluate projects where market prices fail to capture true social costs or benefits, promoting sustainable and equitable outcomes. Challenges of shadow pricing include difficulties in accurately estimating these implicit values, potential subjectivity, and the complexity of integrating diverse stakeholder perspectives.

Choosing Between Market Price and Shadow Price: Key Considerations

Choosing between market price and shadow price involves evaluating availability of reliable market data and the presence of externalities or market distortions. Market price reflects actual transaction costs in competitive markets, whereas shadow price is used to estimate the true economic value of goods or resources when market prices are absent or misleading. Key considerations include the project's objective, data accuracy, and whether societal costs or benefits need to be incorporated beyond conventional market signals.

Market Price Infographic

libterm.com

libterm.com