The Declassified Board is a nonprofit organization dedicated to promoting transparency by advocating for the release of government documents and classified information. It works with researchers, journalists, and policymakers to ensure public access to historical records that enhance understanding of government actions. Discover how the Declassified Board's efforts impact your access to vital information by reading the rest of the article.

Table of Comparison

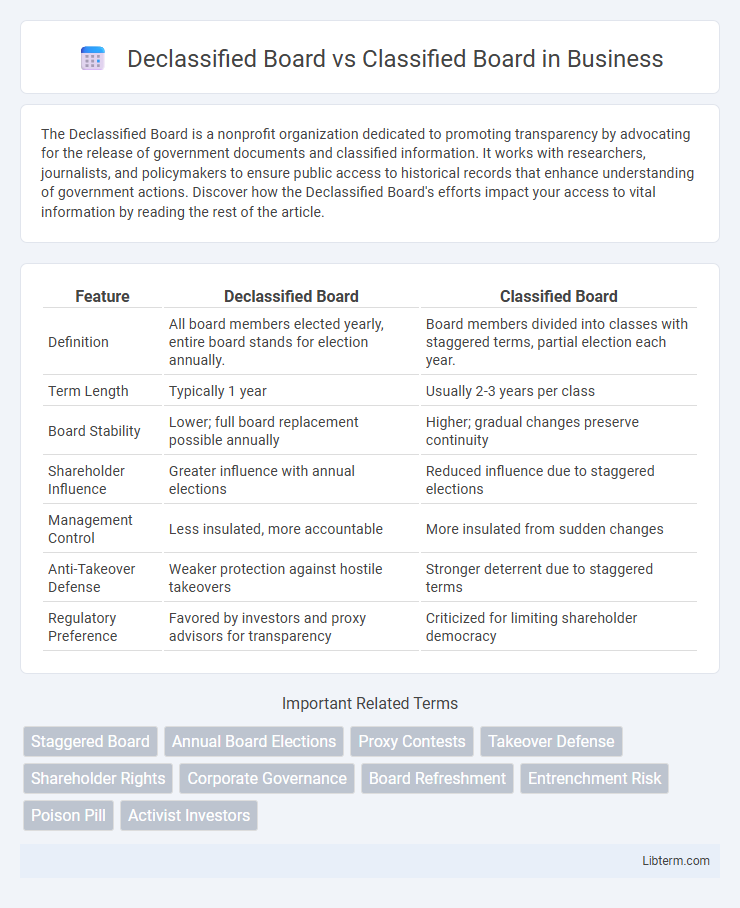

| Feature | Declassified Board | Classified Board |

|---|---|---|

| Definition | All board members elected yearly, entire board stands for election annually. | Board members divided into classes with staggered terms, partial election each year. |

| Term Length | Typically 1 year | Usually 2-3 years per class |

| Board Stability | Lower; full board replacement possible annually | Higher; gradual changes preserve continuity |

| Shareholder Influence | Greater influence with annual elections | Reduced influence due to staggered elections |

| Management Control | Less insulated, more accountable | More insulated from sudden changes |

| Anti-Takeover Defense | Weaker protection against hostile takeovers | Stronger deterrent due to staggered terms |

| Regulatory Preference | Favored by investors and proxy advisors for transparency | Criticized for limiting shareholder democracy |

Introduction to Board Classifications

Board classifications distinguish between declassified boards, which reveal member identities annually, and classified boards, where member information remains confidential for multiple years. Declassified boards promote transparency and allow shareholders to vote on members more frequently, increasing accountability. Classified boards stagger director terms to provide stability and continuity, often appealing to companies focused on long-term planning.

What is a Classified Board?

A Classified Board, also known as a staggered board, divides directors into separate classes serving overlapping multi-year terms, preventing the entire board from being replaced in a single election cycle. This structure enhances board stability and protects against hostile takeovers by limiting shareholders' ability to swiftly change control. Unlike Declassified Boards, where all directors face annual elections, Classified Boards offer continuity in governance and strategic planning.

What is a Declassified Board?

A Declassified Board refers to a corporate board structure where directors are elected annually rather than serving staggered multi-year terms, promoting increased accountability and shareholder influence. This structure contrasts with Classified Boards, which divide directors into classes with staggered terms to entrench management and reduce the likelihood of hostile takeovers. Annual elections in Declassified Boards enhance board responsiveness and align with good governance practices favored by institutional investors.

Key Differences Between Classified and Declassified Boards

Classified boards consist of directors divided into staggered terms, typically three classes, with only one class elected each year, providing continuity and reducing the risk of a hostile takeover. Declassified boards, also known as annual boards, elect all directors every year, enhancing shareholder influence and accountability in board composition. The key difference lies in the election frequency and director turnover, impacting corporate governance and control dynamics.

Advantages of a Classified Board Structure

A classified board structure provides enhanced stability by staggering director elections, reducing the risk of sudden changes in leadership and fostering long-term strategic planning. This stability supports sustained corporate governance, allowing directors to focus on company growth without the pressure of immediate shareholder demands. Classified boards also bolster board continuity, which enhances institutional memory and improves oversight effectiveness over complex business operations.

Pros of a Declassified Board Structure

A declassified board structure enhances accountability by requiring directors to stand for election annually, increasing responsiveness to shareholder interests. This structure promotes greater board independence and refreshes governance practices by enabling regular turnover of directors. Firms with declassified boards often experience improved transparency and stronger alignment with shareholder value creation.

Governance Implications: Shareholder Rights

Declassified boards, featuring annual director elections, enhance shareholder rights by allowing more frequent accountability and responsiveness to investor concerns compared to classified boards, which stagger terms and limit board turnover. This structure promotes stronger governance by increasing transparency and reducing entrenched management influence. Studies indicate firms with declassified boards often experience improved firm performance and shareholder value due to heightened board accountability.

Impact on Corporate Takeovers and Activism

Declassified boards, by requiring annual elections for all directors, increase accountability and empower shareholders to influence corporate strategy, which often accelerates corporate takeovers and activism. Classified boards stagger director terms over multiple years, providing stability that can deter hostile takeovers and limit activist shareholders' power to effect rapid change. Research shows firms with declassified boards experience more frequent board turnover and greater responsiveness to activist campaigns, enhancing shareholder value and corporate governance reforms.

Trends and Regulatory Perspectives

Declassified boards, increasingly favored in corporate governance reforms, separate director elections by staggering terms to enhance accountability and shareholder influence, contrasting with classified boards that group directors in classes with multi-year terms to optimize continuity. Regulatory frameworks, including SEC guidelines and state corporate laws, have trended towards encouraging declassification to improve transparency and responsiveness to investor concerns. Empirical studies indicate declassified boards correlate with higher shareholder value and robust oversight, prompting regulatory bodies to reassess policies favoring classified structures in favor of governance models prioritizing swift director turnover and enhanced disclosure.

Choosing the Right Board Structure for Your Company

Declassified boards, where all directors are elected annually, promote greater accountability and responsiveness to shareholders, making them ideal for companies seeking transparency and active governance. Classified boards stagger director elections over multiple years, enhancing stability and continuity, which benefits firms prioritizing long-term strategic planning and reduced takeover risks. Evaluating your company's goals for shareholder engagement, control, and governance will guide the choice between these two board structures to optimize corporate performance and investor confidence.

Declassified Board Infographic

libterm.com

libterm.com