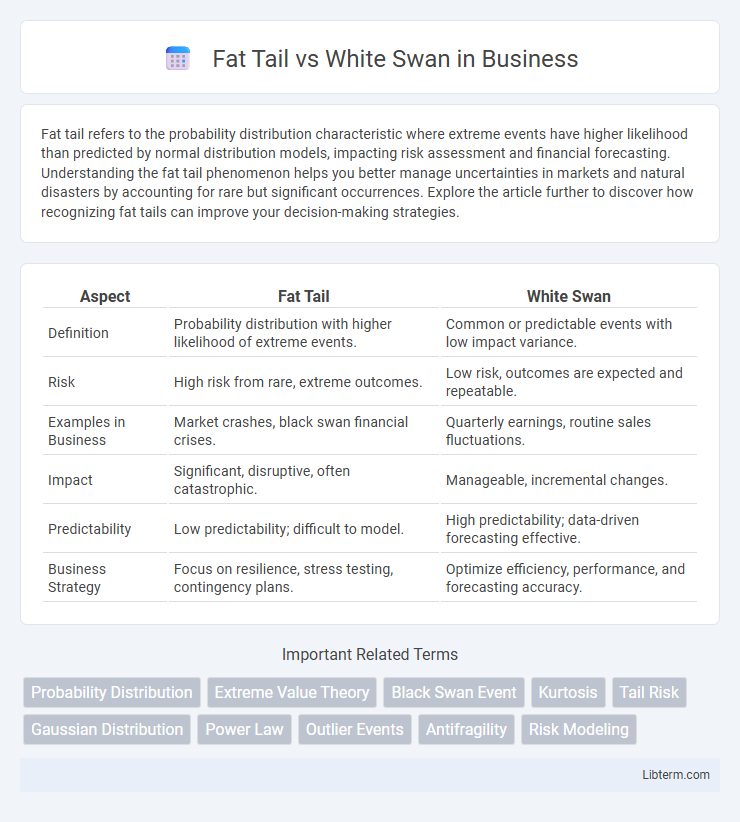

Fat tail refers to the probability distribution characteristic where extreme events have higher likelihood than predicted by normal distribution models, impacting risk assessment and financial forecasting. Understanding the fat tail phenomenon helps you better manage uncertainties in markets and natural disasters by accounting for rare but significant occurrences. Explore the article further to discover how recognizing fat tails can improve your decision-making strategies.

Table of Comparison

| Aspect | Fat Tail | White Swan |

|---|---|---|

| Definition | Probability distribution with higher likelihood of extreme events. | Common or predictable events with low impact variance. |

| Risk | High risk from rare, extreme outcomes. | Low risk, outcomes are expected and repeatable. |

| Examples in Business | Market crashes, black swan financial crises. | Quarterly earnings, routine sales fluctuations. |

| Impact | Significant, disruptive, often catastrophic. | Manageable, incremental changes. |

| Predictability | Low predictability; difficult to model. | High predictability; data-driven forecasting effective. |

| Business Strategy | Focus on resilience, stress testing, contingency plans. | Optimize efficiency, performance, and forecasting accuracy. |

Understanding Fat Tail Events

Fat tail events refer to occurrences in probability distributions where extreme outcomes have a higher likelihood than predicted by normal distributions, highlighting risks often underestimated by traditional models. These events contrast with white swan events, which are rare but statistically foreseeable occurrences within expected parameters. Understanding fat tail events enables more accurate risk assessment in finance, insurance, and natural disasters by emphasizing the potential impact of extreme, unexpected occurrences.

Defining the White Swan Phenomenon

The White Swan phenomenon describes predictable events with high probability and measurable impact, contrasting sharply with the Fat Tail concept, which represents rare, extreme events in probability distributions. Unlike Fat Tail risks, which are difficult to anticipate due to their low occurrence but severe consequences, White Swan events are expected outcomes supported by sufficient historical data and observable trends. Understanding White Swan events involves analyzing regular patterns and statistical distributions to identify consistent, likely occurrences within complex systems.

Key Differences Between Fat Tail and White Swan

Fat Tail events represent extreme, rare occurrences with significant impact and higher probability than normal distributions predict, often linked to financial risks and market crashes. White Swan events are predictable and expected occurrences with moderate impact, allowing for preparation and risk management based on known probabilities. The key difference lies in fat tails' unpredictability and outsized consequences versus white swans' foreseeability and manageable effects.

Origins and Theoretical Background

Fat Tail events, rooted in extreme value theory and heavy-tailed distributions, describe occurrences with a higher probability of extreme outcomes than predicted by normal distribution models. The concept originates from statistical research on financial markets and natural phenomena where rare events like market crashes or natural disasters occur more frequently than expected. White Swan theory, less formalized, challenges the rarity assumption by emphasizing events perceived as improbable but explainable in hindsight, reflecting cognitive biases in risk assessment and decision-making.

Impact on Risk Management Strategies

Fat tail events, characterized by extreme deviations in probability distributions, significantly impact risk management strategies by requiring models to account for rare but severe losses beyond normal expectations. Unlike white swan events, which are unexpected and unpredictable, fat tail risks can be statistically anticipated, prompting firms to implement robust stress testing and capital reserves to mitigate potential catastrophic impacts. Effective risk management incorporates fat tail risk modeling to enhance portfolio resilience and avoid underestimating the likelihood of extreme market movements.

Predictability and Frequency of Occurrence

Fat Tail events exhibit low predictability due to their rare but extreme impact, occurring more frequently than Gaussian models suggest, which challenges traditional risk assessment paradigms. White Swan events, while predictable and anticipated with sufficient data and understanding, happen regularly and are integrated into normal risk models, allowing for standard preparedness measures. The difference in frequency and predictability between Fat Tail and White Swan events necessitates distinct analytical approaches in risk management and forecasting.

Case Studies: Fat Tail Events in History

Fat tail events, characterized by rare but extreme impacts, have shaped significant historical moments such as the 2008 financial crisis and the 1918 Spanish Flu pandemic. These case studies reveal how fat tail risks challenge conventional probability models and emphasize the need for robust risk management strategies. Understanding fat tail dynamics aids in anticipating potential catastrophic outcomes in finance, public health, and natural disasters.

Real-World Examples of White Swan Events

White Swan events are foreseeable and have clear warning signs, such as the 2008 Global Financial Crisis triggered by the collapse of mortgage-backed securities and the subprime mortgage market. The COVID-19 pandemic also exemplifies a White Swan event, as epidemiologists had long anticipated a global outbreak due to zoonotic viruses like coronaviruses. These real-world examples highlight how White Swan events, unlike Fat Tail rare catastrophes, can be predicted and mitigated through proactive risk management and policy measures.

Implications for Investors and Policymakers

Fat Tail events, characterized by extreme, low-probability outcomes with significant impacts, pose substantial risks for investors by undermining traditional risk models and necessitating robust hedging strategies. White Swan events, while rare, are more predictable and allow policymakers to implement preemptive measures and stress tests to mitigate systemic threats. Understanding the distinctions between these event types enhances risk management frameworks, guiding investment decisions and regulatory policies toward greater resilience in volatile markets.

Preparing for Uncertainty: Best Practices

Preparing for uncertainty involves recognizing the impact of fat tail events, which have rare but severe consequences, and white swan events that are unexpected yet plausible. Implementing robust risk management strategies, such as stress testing and scenario analysis, helps organizations anticipate extreme variations in market behavior. Diversification of assets, maintaining liquidity, and developing adaptive contingency plans enhance resilience against the unpredictability of these statistical phenomena.

Fat Tail Infographic

libterm.com

libterm.com