Net Revenue Interest represents the percentage of production revenue an owner receives from oil or gas wells after deducting royalties and other interests. Understanding your Net Revenue Interest is crucial for accurately calculating your earnings and making informed investment decisions. Explore the full article to learn how this key metric impacts your revenue streams.

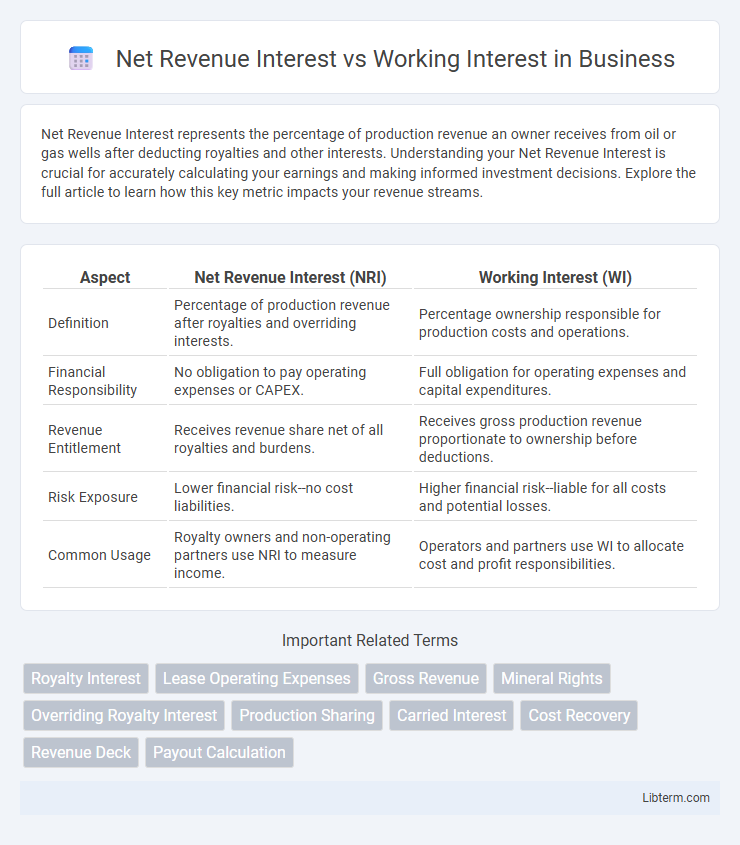

Table of Comparison

| Aspect | Net Revenue Interest (NRI) | Working Interest (WI) |

|---|---|---|

| Definition | Percentage of production revenue after royalties and overriding interests. | Percentage ownership responsible for production costs and operations. |

| Financial Responsibility | No obligation to pay operating expenses or CAPEX. | Full obligation for operating expenses and capital expenditures. |

| Revenue Entitlement | Receives revenue share net of all royalties and burdens. | Receives gross production revenue proportionate to ownership before deductions. |

| Risk Exposure | Lower financial risk--no cost liabilities. | Higher financial risk--liable for all costs and potential losses. |

| Common Usage | Royalty owners and non-operating partners use NRI to measure income. | Operators and partners use WI to allocate cost and profit responsibilities. |

Understanding Net Revenue Interest (NRI)

Net Revenue Interest (NRI) represents the percentage of production revenue an owner receives after deducting royalty interests, reflecting their true share of profits from oil and gas wells. Unlike Working Interest, which indicates the share of operational costs and expenses an entity is responsible for, NRI shows the net income portion after all royalties are paid to mineral rights owners. Understanding NRI is crucial for investors and operators to evaluate the actual financial benefit from production activities, distinct from the total ownership and expense obligations conveyed by Working Interest.

Defining Working Interest (WI)

Working Interest (WI) represents the ownership percentage in an oil and gas lease that entitles the holder to both a share of production revenues and responsibility for drilling and operating costs. Net Revenue Interest (NRI) differs by reflecting the actual percentage of production revenue an owner receives after royalties and other burdens are deducted. Understanding WI is crucial for assessing financial exposure and operational obligations in hydrocarbon exploration projects.

Key Differences Between NRI and WI

Net Revenue Interest (NRI) represents the actual percentage of revenue an owner receives from oil and gas production after deducting royalty interests, whereas Working Interest (WI) refers to the ownership share responsible for operational costs and liabilities in a lease. NRI is always less than or equal to WI because royalty owners do not bear production expenses, while WI holders fund drilling, completion, and production activities. Understanding the distinction between NRI and WI is crucial for accurately assessing cash flow, risk exposure, and profitability in oil and gas investments.

Calculating Net Revenue Interest

Calculating Net Revenue Interest (NRI) requires multiplying the Working Interest (WI) by the royalty interest percentage, representing the actual share of production revenue retained after royalties. For example, if a working interest is 80% and the royalty interest is 20%, the NRI equals 0.8 x (1 - 0.2), resulting in 64%. Understanding NRI calculation is essential for accurately estimating revenue streams in oil and gas joint ventures or lease agreements.

Calculating Working Interest

Working Interest represents the percentage of ownership a party holds in an oil or gas lease, entitling them to a proportional share of production and obliging them to pay corresponding development and operating costs. Calculating Working Interest involves dividing the individual ownership share by the total lease ownership, adjusting for any overriding royalty interests that reduce the net revenue. Mastery of Working Interest calculations enables accurate financial forecasting and effective management of exploration and production investments.

Role of NRI and WI in Oil and Gas Operations

Net Revenue Interest (NRI) determines the actual percentage of production revenue an owner receives after deducting royalties and overriding interests, directly impacting cash flow and profitability in oil and gas operations. Working Interest (WI) represents an owner's share of exploration, development, and operating costs as well as production revenue, making it crucial for managing operational responsibilities and financial commitments. Understanding the interplay between NRI and WI allows operators and investors to accurately assess their economic stake and operational involvement in oil and gas projects.

Impact of Royalties on NRI and WI

Net Revenue Interest (NRI) represents the owner's share of production revenue after deducting royalties, whereas Working Interest (WI) reflects the owner's percentage of operational costs and revenue before royalties. Royalties reduce the NRI directly as they are paid out of the revenue before it reaches the owner, but do not affect the WI, which dictates the owner's responsibility for expenses and share of production. Understanding the impact of royalties is crucial for accurately assessing profitability and cash flow distributions in oil and gas ventures.

Advantages and Disadvantages of NRI

Net Revenue Interest (NRI) represents the percentage of production revenue an owner receives after deducting burdens like royalties and overriding royalties, providing a clearer picture of actual earnings compared to Working Interest, which reflects ownership before such deductions. An advantage of NRI is that it directly correlates with cash flow, enabling more accurate financial projections and risk assessments for stakeholders. However, a disadvantage is that NRI can vary significantly due to fluctuating royalty burdens and contractual terms, introducing complexity in revenue forecasting and less control over operational decisions compared to Working Interest holders.

Advantages and Disadvantages of WI

Working Interest (WI) grants operators full control over decision-making and operational activities, allowing for direct management of exploration, drilling, and production processes. This control, however, comes with the disadvantage of assuming full responsibility for all costs, liabilities, and risks associated with the project. Compared to Net Revenue Interest (NRI), which limits financial exposure by sharing costs but offers reduced operational control and revenue share, WI provides higher potential returns but increased financial commitment and risk.

Choosing Between Net Revenue Interest and Working Interest

Choosing between Net Revenue Interest (NRI) and Working Interest (WI) depends on risk tolerance and operational involvement in oil and gas projects. NRI provides a passive income stream from a percentage of production revenue after royalties, minimizing operational responsibilities and capital expenditures. WI requires full responsibility for operational costs and liabilities but offers greater control and a larger share of the revenue, suitable for investors seeking active participation in field development.

Net Revenue Interest Infographic

libterm.com

libterm.com