Private placement offers a strategic way for companies to raise capital by selling securities directly to a select group of investors, bypassing public markets and regulatory complexities. This method ensures faster access to funds while maintaining confidentiality and reducing costly underwriting fees. Discover how private placement can optimize your fundraising strategy by reading the rest of the article.

Table of Comparison

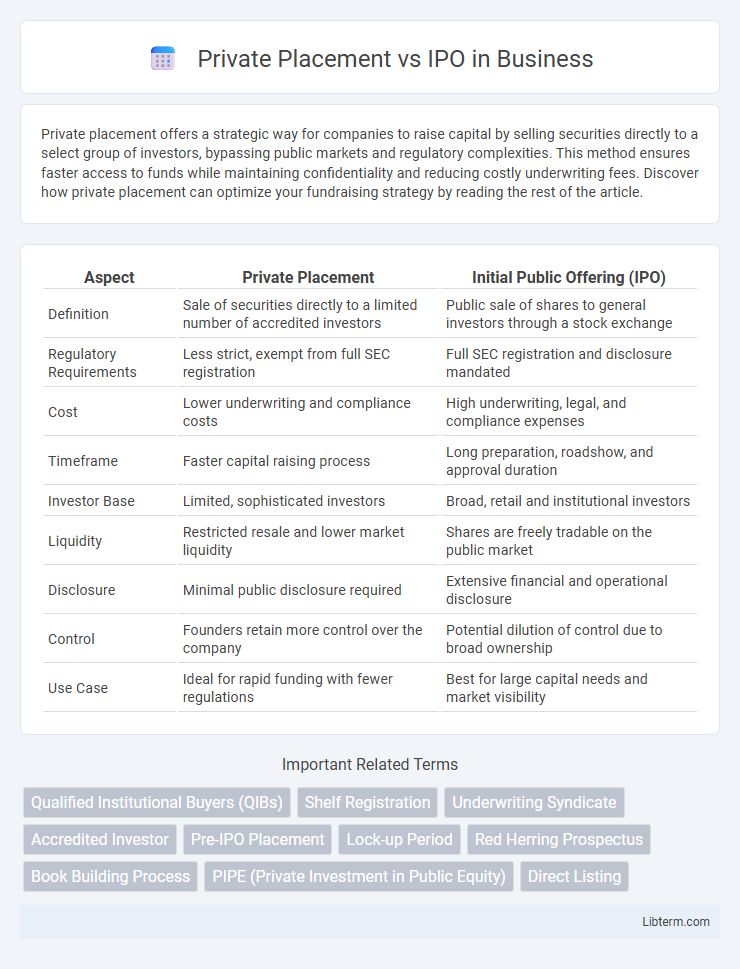

| Aspect | Private Placement | Initial Public Offering (IPO) |

|---|---|---|

| Definition | Sale of securities directly to a limited number of accredited investors | Public sale of shares to general investors through a stock exchange |

| Regulatory Requirements | Less strict, exempt from full SEC registration | Full SEC registration and disclosure mandated |

| Cost | Lower underwriting and compliance costs | High underwriting, legal, and compliance expenses |

| Timeframe | Faster capital raising process | Long preparation, roadshow, and approval duration |

| Investor Base | Limited, sophisticated investors | Broad, retail and institutional investors |

| Liquidity | Restricted resale and lower market liquidity | Shares are freely tradable on the public market |

| Disclosure | Minimal public disclosure required | Extensive financial and operational disclosure |

| Control | Founders retain more control over the company | Potential dilution of control due to broad ownership |

| Use Case | Ideal for rapid funding with fewer regulations | Best for large capital needs and market visibility |

Understanding Private Placement

Private placement involves the sale of securities directly to a select group of investors, such as institutional investors or accredited individuals, bypassing public markets and regulatory requirements associated with an IPO. This funding method allows companies to raise capital more quickly and with less disclosure, maintaining confidentiality and minimizing market volatility risks. Understanding private placement requires knowledge of its benefits, such as flexible terms and lower costs, alongside limitations like restricted liquidity and fewer public market exposure opportunities.

What is an IPO?

An Initial Public Offering (IPO) is the process through which a private company offers its shares to the public for the first time, enabling it to raise capital from a wider investor base. IPOs are typically underwritten by investment banks that help determine the offering price and regulatory compliance with securities authorities such as the SEC. This public listing increases liquidity for existing shareholders and establishes a market-driven valuation for the company's stock.

Key Differences Between Private Placement and IPO

Private placements involve selling securities directly to a select group of investors, often institutional or accredited, without public offering, resulting in faster access to capital and fewer regulatory requirements compared to an IPO. Initial Public Offerings (IPOs) require companies to file extensive disclosures with regulatory bodies like the SEC, offering shares to the general public and increasing liquidity and market exposure. While private placements offer confidentiality and lower costs, IPOs provide greater fundraising potential and enhanced market visibility.

Advantages of Private Placement

Private placements allow companies to raise capital quickly with lower regulatory compliance costs compared to IPOs. This funding method offers greater confidentiality, enabling firms to avoid public disclosure of sensitive financial information. Investors in private placements often experience more flexible terms and stronger negotiating power, improving alignment with the company's strategic goals.

Benefits of an IPO

An IPO offers companies access to significant capital by selling shares to the public, enhancing their financial resources for expansion and innovation. Public listing improves corporate visibility and credibility, attracting more investors, customers, and strategic partners. Furthermore, IPOs provide liquidity to shareholders and create a market valuation for the company's equity, which can facilitate future fundraising and acquisitions.

Disadvantages of Private Placement

Private placements often face limited liquidity since securities are sold to a restricted group of accredited investors, reducing the ease of trading compared to an IPO. The smaller investor base can result in lower valuation and less market visibility, hindering capital raising potential. Regulatory exemptions in private placements may lead to less stringent disclosure, increasing perceived risk for potential investors.

Drawbacks of IPO

IPOs often involve extensive regulatory compliance, leading to high costs and lengthy preparation periods that can strain company resources. Public disclosure requirements during an IPO expose sensitive financial and operational information, potentially affecting competitive advantage. Market volatility on the offering date can also impact stock price performance, causing uncertainty and reduced capital raised compared to initial projections.

Regulatory Requirements: Private Placement vs IPO

Private placements involve fewer regulatory requirements compared to IPOs, as they are exempt from full SEC registration under Regulation D, allowing companies to sell securities to a limited number of accredited investors with reduced disclosure obligations. IPOs require extensive regulatory filings, including a detailed S-1 registration statement, financial audits, and adherence to the Sarbanes-Oxley Act, resulting in greater transparency and investor protection. The increased regulatory scrutiny of IPOs aims to ensure market integrity and protect public investors, whereas private placements enable quicker capital raising with less compliance burden.

Suitability for Companies: When to Choose Private Placement or IPO

Private placements are suitable for companies seeking quick access to capital with less regulatory scrutiny, often preferred by startups and small to mid-sized firms aiming to maintain control and confidentiality. IPOs are ideal for larger, more mature companies looking to raise substantial public funds, enhance market visibility, and provide liquidity for shareholders. Companies choosing between private placement and IPO should assess their growth stage, capital needs, regulatory willingness, and long-term strategic goals to determine the best fundraising method.

Conclusion: Private Placement or IPO—Which is Right for Your Business?

Choosing between private placement and IPO depends on your business goals, capital needs, and regulatory tolerance. Private placement offers faster access to capital with fewer disclosure requirements, ideal for companies seeking targeted investors and maintaining control. An IPO provides broader market exposure and greater capital potential but involves higher costs, extensive regulatory scrutiny, and ongoing public reporting obligations.

Private Placement Infographic

libterm.com

libterm.com