Intrinsic value represents the true, inherent worth of an asset, independent of market fluctuations or external factors. Understanding intrinsic value helps you make informed investment decisions by focusing on fundamental analysis rather than short-term price movements. Discover how to accurately assess intrinsic value and enhance your financial strategy by reading the rest of this article.

Table of Comparison

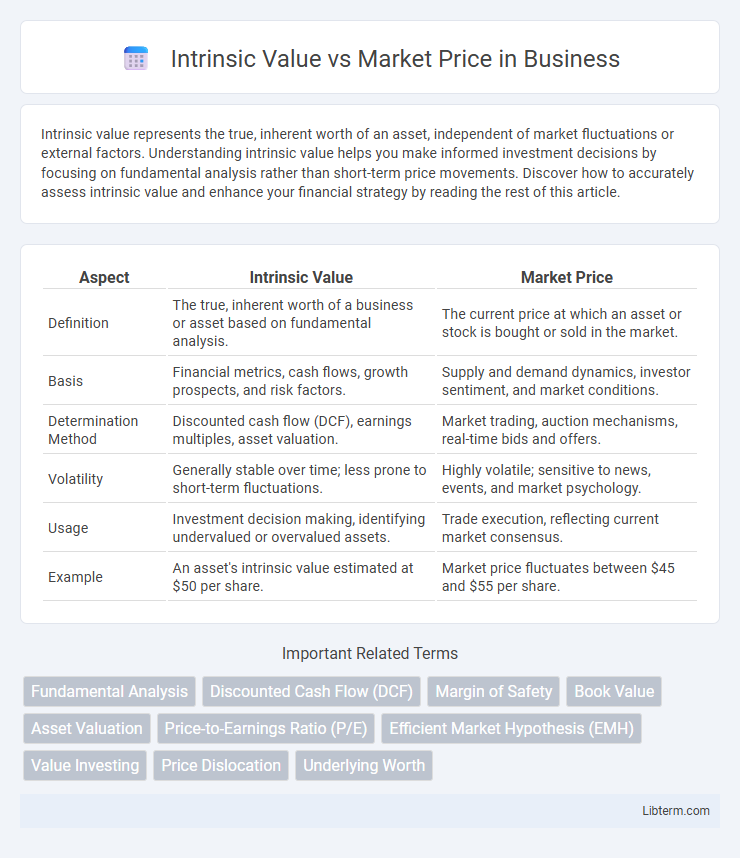

| Aspect | Intrinsic Value | Market Price |

|---|---|---|

| Definition | The true, inherent worth of a business or asset based on fundamental analysis. | The current price at which an asset or stock is bought or sold in the market. |

| Basis | Financial metrics, cash flows, growth prospects, and risk factors. | Supply and demand dynamics, investor sentiment, and market conditions. |

| Determination Method | Discounted cash flow (DCF), earnings multiples, asset valuation. | Market trading, auction mechanisms, real-time bids and offers. |

| Volatility | Generally stable over time; less prone to short-term fluctuations. | Highly volatile; sensitive to news, events, and market psychology. |

| Usage | Investment decision making, identifying undervalued or overvalued assets. | Trade execution, reflecting current market consensus. |

| Example | An asset's intrinsic value estimated at $50 per share. | Market price fluctuates between $45 and $55 per share. |

Understanding Intrinsic Value

Intrinsic value represents the true, inherent worth of an asset based on fundamental analysis, including factors like cash flow, growth potential, and risk. It differs from market price, which reflects the current price at which the asset trades, influenced by supply, demand, and market sentiment. Understanding intrinsic value helps investors make informed decisions by identifying undervalued or overvalued securities relative to their actual worth.

Defining Market Price

Market price represents the current value at which an asset or security is bought and sold in the marketplace, reflecting real-time supply and demand dynamics. It fluctuates constantly based on investor perceptions, market sentiment, and external economic factors. Unlike intrinsic value, market price is influenced by market liquidity, trading volume, and short-term market trends rather than fundamental asset characteristics.

Key Differences Between Intrinsic Value and Market Price

Intrinsic value represents the true, fundamental worth of an asset based on underlying financial metrics, such as discounted cash flows or earnings potential. Market price reflects the current trading value determined by supply and demand dynamics, investor sentiment, and market conditions. Key differences lie in intrinsic value being a stable, analytical measure, while market price is often volatile and driven by external market factors.

Factors Influencing Intrinsic Value

Intrinsic value is determined by analyzing fundamental factors such as a company's earnings, growth prospects, dividend payouts, and risk profile, which reflect its true economic worth. Market price, however, fluctuates based on supply and demand dynamics, investor sentiment, and market conditions that can cause deviations from intrinsic value. Key elements influencing intrinsic value include discounted cash flow projections, competitive advantage, management quality, and industry trends.

What Drives Market Price Movements?

Market price movements are primarily driven by supply and demand dynamics, investor sentiment, and external economic factors such as interest rates, inflation, and geopolitical events. Market participants constantly reassess assets based on new information, causing fluctuations around the intrinsic value, which represents the true, fundamental worth derived from discounted cash flows and tangible asset valuations. Short-term price volatility often reflects psychological biases and market speculation rather than changes in intrinsic value.

The Role of Investor Perception

Investor perception plays a crucial role in the disparity between intrinsic value and market price by influencing demand and supply dynamics in financial markets. While intrinsic value is based on fundamental analysis of a company's cash flows, assets, and growth prospects, market price often reflects collective investor sentiment, news, and behavioral biases. This divergence can create opportunities for arbitrage or risks of mispricing, highlighting the importance of psychological factors in asset valuation.

Methods to Calculate Intrinsic Value

Intrinsic value is calculated using fundamental analysis methods such as discounted cash flow (DCF) analysis, dividend discount models (DDM), and residual income models, which estimate the present value of expected future cash flows or earnings. The DCF method projects free cash flows and discounts them back to their present value using a risk-adjusted discount rate, providing a detailed measure of an asset's worth. Dividend discount models focus on forecasting future dividends and discounting them to present value, especially useful for dividend-paying stocks, while residual income models measure intrinsic value by assessing net income minus a charge for the cost of capital.

Common Market Price Misconceptions

Common misconceptions about market price often confuse it with intrinsic value, but market price reflects current supply and demand dynamics rather than the fundamental worth of an asset. Many investors mistakenly assume that a high market price always indicates a good investment, ignoring factors such as earnings, growth potential, and risk that determine intrinsic value. Understanding this distinction helps avoid overpaying for stocks trading above their intrinsic value or missing opportunities in undervalued securities.

Intrinsic Value vs Market Price in Investment Decisions

Intrinsic value and market price are critical factors in investment decisions, where intrinsic value represents the true, underlying worth of an asset based on fundamentals like cash flow, earnings, and growth potential, while market price reflects the asset's current trading value influenced by supply, demand, and market sentiment. Investors compare intrinsic value to market price to identify undervalued or overvalued securities, guiding buy or sell decisions that optimize returns and manage risk. Accurate assessment of intrinsic value using models such as discounted cash flow (DCF) analysis enables investors to make informed decisions beyond short-term market fluctuations.

Bridging the Gap: Strategies for Savvy Investors

Savvy investors bridge the gap between intrinsic value and market price by employing fundamental analysis and discounted cash flow (DCF) models to identify undervalued stocks. Leveraging financial metrics like price-to-earnings (P/E) ratios and free cash flow estimates helps pinpoint opportunities where market sentiment diverges from a company's true worth. Strategic portfolio diversification and continuous market monitoring minimize risks associated with price volatility while maximizing potential returns based on intrinsic valuation.

Intrinsic Value Infographic

libterm.com

libterm.com