Invoice financing provides a practical solution for businesses seeking immediate cash flow by leveraging outstanding invoices as collateral. This financial strategy enables companies to maintain steady operations without waiting for client payments. Discover how invoice financing can transform your cash flow management throughout the rest of the article.

Table of Comparison

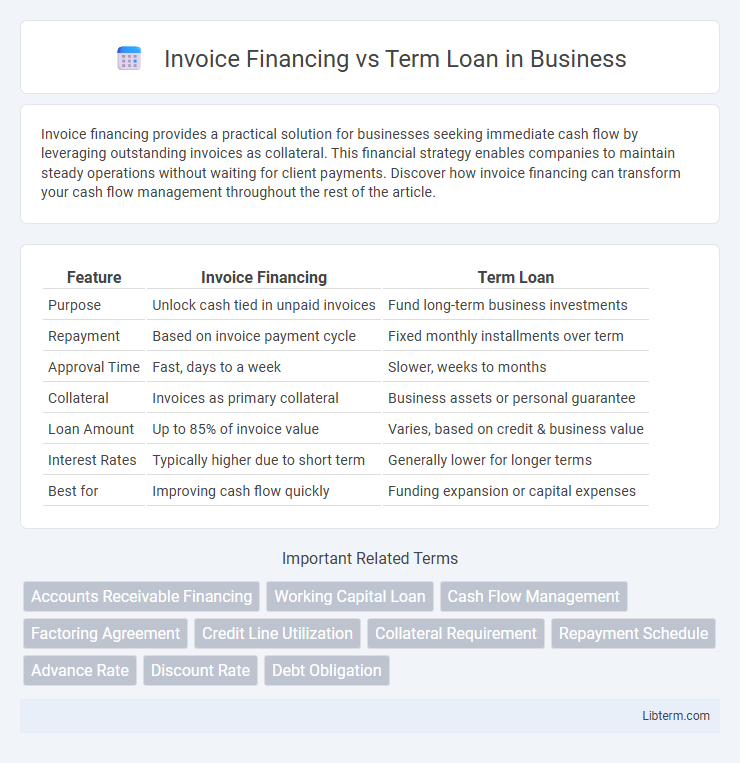

| Feature | Invoice Financing | Term Loan |

|---|---|---|

| Purpose | Unlock cash tied in unpaid invoices | Fund long-term business investments |

| Repayment | Based on invoice payment cycle | Fixed monthly installments over term |

| Approval Time | Fast, days to a week | Slower, weeks to months |

| Collateral | Invoices as primary collateral | Business assets or personal guarantee |

| Loan Amount | Up to 85% of invoice value | Varies, based on credit & business value |

| Interest Rates | Typically higher due to short term | Generally lower for longer terms |

| Best for | Improving cash flow quickly | Funding expansion or capital expenses |

Understanding Invoice Financing

Invoice financing provides businesses with immediate cash by leveraging outstanding invoices as collateral, enhancing cash flow without incurring traditional debt. This financial solution is ideal for companies facing delayed payments, allowing them to access working capital quickly to cover operational expenses or invest in growth. Unlike term loans, which require fixed repayments over a set period, invoice financing offers flexible funding based on sales volume and receivables turnover.

What Is a Term Loan?

A term loan is a fixed amount of money borrowed from a lender, repaid over a set period with a predetermined interest rate, typically used for long-term investments or business expansions. Unlike invoice financing, which is tied to outstanding receivables and offers short-term liquidity, term loans provide stable funding for asset purchases, capital expenditures, or debt refinancing. Businesses often choose term loans for predictable repayment schedules and larger funding amounts, supporting strategic growth initiatives.

Key Differences Between Invoice Financing and Term Loans

Invoice financing provides businesses with immediate cash flow by advancing funds based on outstanding invoices, while term loans offer a lump sum amount repaid over a fixed period with interest. Invoice financing is flexible and tied directly to sales, making it ideal for managing short-term working capital needs, whereas term loans are structured for long-term investments or significant expenses. The primary difference lies in repayment structure and purpose: invoice financing depends on invoice collections, whereas term loans require scheduled repayments regardless of cash inflow timing.

Eligibility Criteria Comparison

Invoice financing eligibility primarily requires businesses to have outstanding invoices from creditworthy customers and a minimum operating period, typically 6-12 months. Term loans demand stronger credit profiles, collateral, and documented financial statements, with lenders often requiring at least two years of consistent revenue history. Small businesses with fluctuating cash flow may find invoice financing more accessible, while established companies with stable finances are better suited for term loans.

Speed of Funding: Which Is Faster?

Invoice financing offers significantly faster funding, often providing cash within 24 to 48 hours by leveraging outstanding invoices as collateral. Term loans typically require a more extensive approval process, including credit checks and financial documentation, extending funding timelines to several weeks. Businesses needing immediate working capital frequently favor invoice financing for its speed and efficiency.

Cost Comparison: Fees and Interest Rates

Invoice financing typically involves fees ranging from 1% to 5% of the invoice value, with interest rates varying between 8% and 15% annually, depending on the lender and invoice terms. Term loans generally feature lower interest rates, often between 5% and 12%, but include origination fees and potential prepayment penalties that can increase overall costs. Businesses should analyze invoice discounting fees alongside monthly or annual interest from term loans to identify the most cost-effective financing option based on cash flow needs and repayment timeline.

Repayment Terms and Flexibility

Invoice financing offers repayment based on the cash flow generated from outstanding invoices, allowing businesses to repay advances as customers pay, providing greater flexibility in timing and amounts. Term loans require fixed monthly payments over a set period, offering predictable repayment schedules but less adaptability in accommodating fluctuating cash flows. Companies with irregular income streams often prefer invoice financing for its adjustable repayment terms aligned with sales cycles.

Risks and Drawbacks of Each Option

Invoice financing often carries risks such as high fees and the potential loss of customer control, as lenders may contact clients directly for payment collection. Term loans present drawbacks including rigid repayment schedules and possible collateral requirements, which can strain cash flow and increase financial vulnerability. Both options require careful consideration of interest rates, hidden charges, and impact on business credit before commitment.

Best Use Cases for Invoice Financing

Invoice financing is ideal for businesses seeking quick access to working capital by leveraging outstanding invoices, especially useful for companies with long payment cycles or seasonal sales fluctuations. It supports cash flow management without increasing debt, enabling small to medium-sized enterprises to cover operational costs or take advantage of growth opportunities promptly. Unlike term loans, it suits businesses needing flexible funding tied directly to sales, rather than fixed repayment schedules over a longer term.

When to Choose a Term Loan Over Invoice Financing

A term loan is ideal for businesses seeking a fixed amount of capital for long-term investments such as equipment purchase or expansion projects, providing predictable repayment schedules and stable cash flow management. When cash flow is steady but additional funds are required for growth or large expenses beyond receivables, term loans offer higher loan amounts and longer repayment terms compared to invoice financing. Businesses with strong credit profiles and reliable income streams often benefit more from term loans due to lower interest rates and better financing conditions.

Invoice Financing Infographic

libterm.com

libterm.com