A Joint Venture Agreement outlines the terms and conditions under which two or more parties collaborate to achieve a specific business goal while sharing profits, losses, and management responsibilities. This legally binding contract addresses key elements such as capital contributions, roles, dispute resolution, and duration of the partnership. Explore the rest of the article to understand how a well-drafted Joint Venture Agreement can protect Your interests and ensure a successful business collaboration.

Table of Comparison

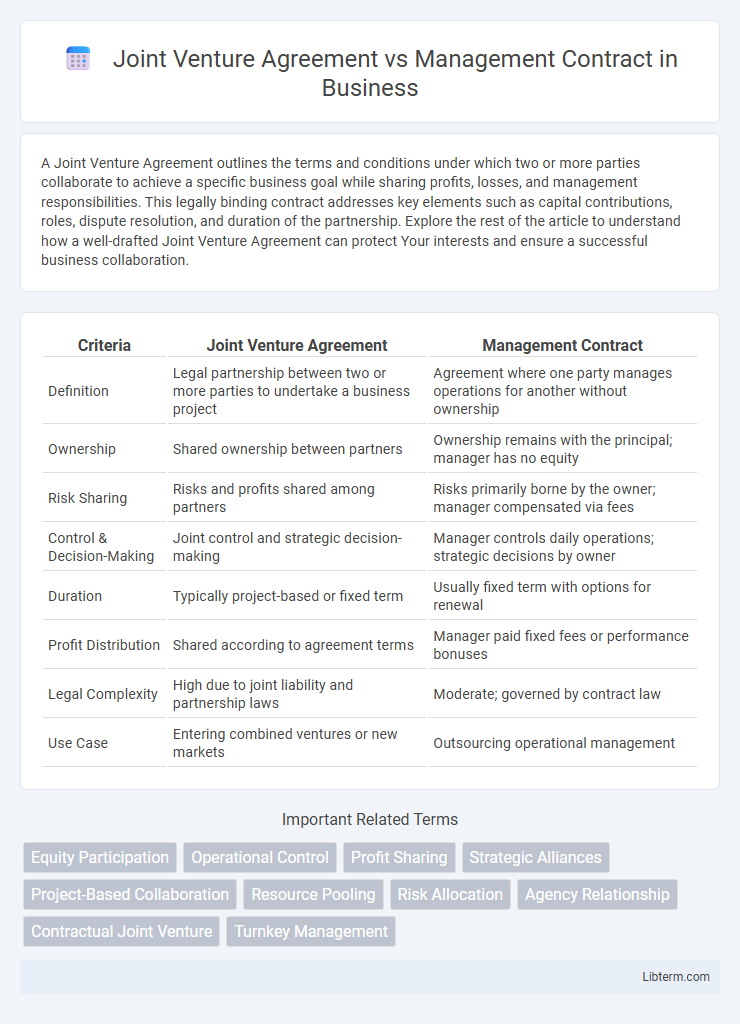

| Criteria | Joint Venture Agreement | Management Contract |

|---|---|---|

| Definition | Legal partnership between two or more parties to undertake a business project | Agreement where one party manages operations for another without ownership |

| Ownership | Shared ownership between partners | Ownership remains with the principal; manager has no equity |

| Risk Sharing | Risks and profits shared among partners | Risks primarily borne by the owner; manager compensated via fees |

| Control & Decision-Making | Joint control and strategic decision-making | Manager controls daily operations; strategic decisions by owner |

| Duration | Typically project-based or fixed term | Usually fixed term with options for renewal |

| Profit Distribution | Shared according to agreement terms | Manager paid fixed fees or performance bonuses |

| Legal Complexity | High due to joint liability and partnership laws | Moderate; governed by contract law |

| Use Case | Entering combined ventures or new markets | Outsourcing operational management |

Introduction to Joint Venture Agreements and Management Contracts

Joint Venture Agreements establish a cooperative relationship between two or more parties to undertake a specific business project, sharing profits, losses, and control according to agreed terms. Management Contracts involve hiring an external entity to manage a business or project for a fixed fee, without ownership or profit sharing in the venture. Understanding the distinctions aids in selecting the appropriate contractual structure based on control, risk, and investment preferences.

Key Definitions and Core Concepts

A Joint Venture Agreement establishes a collaborative business entity where parties share ownership, risks, profits, and decision-making authority, defined by mutual contributions of capital, resources, or expertise. In contrast, a Management Contract grants one party the right to manage and operate a business or project on behalf of another, focusing on service delivery without transferring ownership or equity. Understanding the distinction between shared ownership in joint ventures and operational control in management contracts is essential for defining roles, responsibilities, and legal obligations in strategic partnerships.

Structure and Formation Differences

A Joint Venture Agreement establishes a new, jointly-owned legal entity where two or more parties share resources, risks, and profits, often requiring formal registration and detailed governance structures. In contrast, a Management Contract involves one party providing management services to another without creating a new entity, focusing on operational control rather than ownership, with terms defined by service agreements. The formation of a joint venture demands alignment on equity contributions and joint decision-making mechanisms, whereas a management contract is formed through negotiated service terms and performance criteria without equity stakes.

Legal Rights and Obligations

A Joint Venture Agreement establishes a legally binding partnership where parties share ownership, profits, losses, and decision-making responsibilities, creating fiduciary duties and joint liability for obligations arising from the venture. In contrast, a Management Contract grants one party the authority to operate or manage a business on behalf of the owner without transferring ownership rights, limiting legal obligations primarily to contractual performance and adherence to agreed-upon management standards. The Joint Venture Agreement inherently involves shared risks and legal rights across all partners, while a Management Contract confines liabilities and obligations to the scope defined by the operational agreement between the manager and owner.

Control and Decision-Making Authority

A Joint Venture Agreement typically grants shared control and joint decision-making authority between the involved parties, allowing them to collaboratively manage operations and share risks and rewards. In contrast, a Management Contract vests control primarily with the management company, which oversees daily operations and strategic decisions, while the owner retains ultimate authority but has limited involvement in routine management. The distinction in control and decision-making authority directly impacts the level of involvement, responsibility, and power distribution between participating entities in each arrangement.

Risk and Profit Sharing Mechanisms

A Joint Venture Agreement typically involves shared risk and profit among participating parties based on their equity contributions, fostering mutual commitment and aligned incentives. In contrast, a Management Contract limits risk exposure for the managing party as it usually earns a fixed fee or performance-based remuneration without sharing profits or losses. The Joint Venture structure integrates both operational control and financial stakes, while a Management Contract focuses on service provision with defined responsibilities and minimal financial risk.

Duration and Termination Clauses

Joint Venture Agreements typically specify a fixed duration aligned with the completion of a project or business goal, with termination clauses triggered by mutual consent, breach, or achievement of objectives. Management Contracts often have renewal options and focus on service delivery timelines, including termination clauses based on performance standards, notice periods, or cause. Both contracts emphasize clear terms to manage risks related to duration and termination but differ in their operational focus and legal implications.

Taxation and Financial Implications

A Joint Venture Agreement typically involves shared equity ownership, resulting in profits and losses being allocated according to each party's stake, which directly impacts tax liabilities through pass-through taxation or corporate tax, depending on the entity structure. In contrast, a Management Contract involves a fee-based arrangement where the management company receives fixed payments, which are treated as ordinary income subject to regular corporate or personal income tax, without direct exposure to the financial performance of the business. Financially, Joint Ventures often require capital investment and risk sharing, affecting balance sheets and cash flow, whereas Management Contracts provide predictable revenue streams with limited financial risk for the management party.

Use Cases and Industry Applications

Joint Venture Agreements are ideal for industries like construction, technology, and pharmaceuticals where two or more parties collaborate to share resources, risks, and profits for a specific project or business objective. Management Contracts are commonly used in hospitality, healthcare, and real estate sectors where an owner outsources operational management to an experienced firm while retaining ownership and capital investment. Both instruments enable strategic partnerships but Joint Ventures emphasize equity sharing and joint control, whereas Management Contracts focus on expertise-driven service delivery.

Choosing Between a Joint Venture Agreement and a Management Contract

Choosing between a Joint Venture Agreement and a Management Contract depends on the level of control, risk sharing, and investment each party is willing to undertake. A Joint Venture Agreement involves shared ownership, profit distribution, and joint decision-making, ideal for businesses seeking long-term collaboration and mutual growth. Conversely, a Management Contract assigns operational control to one party without equity sharing, suitable for companies requiring expert management while retaining ownership and risk.

Joint Venture Agreement Infographic

libterm.com

libterm.com