Prepaid expenses represent payments made in advance for goods or services to be received in the future, which are recorded as assets on the balance sheet until they are realized as expenses. Managing prepaid expenses effectively ensures accurate financial reporting and aids in budgeting your business operations. Explore the rest of this article to understand how prepaid expenses impact your financial statements and cash flow.

Table of Comparison

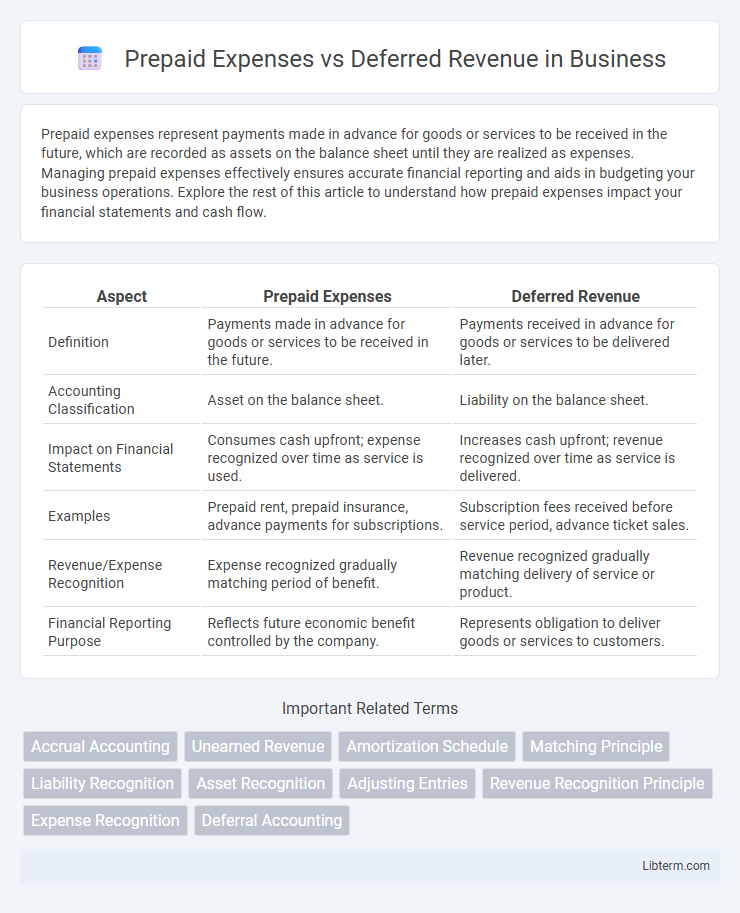

| Aspect | Prepaid Expenses | Deferred Revenue |

|---|---|---|

| Definition | Payments made in advance for goods or services to be received in the future. | Payments received in advance for goods or services to be delivered later. |

| Accounting Classification | Asset on the balance sheet. | Liability on the balance sheet. |

| Impact on Financial Statements | Consumes cash upfront; expense recognized over time as service is used. | Increases cash upfront; revenue recognized over time as service is delivered. |

| Examples | Prepaid rent, prepaid insurance, advance payments for subscriptions. | Subscription fees received before service period, advance ticket sales. |

| Revenue/Expense Recognition | Expense recognized gradually matching period of benefit. | Revenue recognized gradually matching delivery of service or product. |

| Financial Reporting Purpose | Reflects future economic benefit controlled by the company. | Represents obligation to deliver goods or services to customers. |

Understanding Prepaid Expenses

Prepaid expenses represent payments made for goods or services before they are received, classified as current assets on the balance sheet until the benefit is realized. Common examples include prepaid insurance, rent, and subscriptions, which are gradually expensed over the period they cover through amortization. Proper management of prepaid expenses ensures accurate matching of expenses with revenues, enhancing financial reporting accuracy and cash flow forecasting.

What is Deferred Revenue?

Deferred revenue is a liability representing payments received by a company for goods or services yet to be delivered or performed. It reflects the obligation to provide products or services in the future, thus generating revenue recognition only when the earning process is complete. Common examples include subscription fees, advance rent payments, and maintenance contracts, where cash is collected upfront but revenue is earned over time.

Key Differences Between Prepaid Expenses and Deferred Revenue

Prepaid expenses represent payments made in advance for goods or services to be received in the future, classified as assets on the balance sheet until recognized as expenses. Deferred revenue refers to money received before delivering goods or services, recorded as liabilities until the revenue is earned. The key difference lies in prepaid expenses being advance outflows expecting future benefits, while deferred revenue involves advance inflows requiring future obligations.

Examples of Prepaid Expenses

Prepaid expenses include payments made for goods or services before they are received, such as prepaid insurance, prepaid rent, and prepaid subscriptions. These expenses are initially recorded as assets and then expensed over time as the benefits are realized. Unlike deferred revenue, which represents payments received before delivering goods or services, prepaid expenses reflect outflows of cash paid in advance.

Common Scenarios Involving Deferred Revenue

Deferred revenue commonly arises in subscription-based services where customers pay upfront for access over time, such as software licenses or magazine subscriptions. It can also occur in prepaid contracts for annual maintenance or service agreements, where the company records the payment as a liability until the service is delivered. Recognizing deferred revenue accurately ensures compliance with revenue recognition standards and impacts financial reporting by reflecting earned revenue in the correct accounting periods.

Accounting Treatment: Prepaid Expenses

Prepaid expenses represent payments made in advance for goods or services to be received in the future, recorded as current assets on the balance sheet. Accounting treatment involves initially recognizing the payment as an asset and systematically expensing it over the period to reflect the consumption of the prepaid benefit. This amortization process aligns expenses with the corresponding accounting periods to ensure accurate financial reporting.

Accounting Treatment: Deferred Revenue

Deferred revenue represents funds received for goods or services yet to be delivered, recorded as a liability on the balance sheet. Its accounting treatment involves recognizing the cash receipt as deferred revenue and subsequently recognizing revenue in the income statement as the service is performed or the product is delivered. This ensures compliance with the revenue recognition principle under accrual accounting, aligning revenue recognition with the period in which it is earned.

Impact on Financial Statements

Prepaid expenses appear as current assets on the balance sheet, reducing cash and increasing expenses over time as the benefit is realized, which impacts net income gradually. Deferred revenue is recorded as a liability until the service or product is delivered, affecting the balance sheet by increasing liabilities and recognizing revenue on the income statement only upon fulfillment of obligations. Both ensure accurate matching of revenues and expenses, enhancing the precision of financial reporting and compliance with accounting principles like GAAP or IFRS.

Importance for Businesses and Stakeholders

Prepaid expenses represent payments made for goods or services to be received in the future, impacting a company's asset management and cash flow forecasting. Deferred revenue indicates funds received for products or services not yet delivered, essential for recognizing liabilities and ensuring accurate revenue reporting. Both concepts are vital for businesses and stakeholders to maintain transparent financial statements and make informed strategic decisions.

Best Practices for Managing Prepaid Expenses and Deferred Revenue

Effective management of prepaid expenses requires accurate tracking of payment dates and matching expenses to the appropriate accounting periods, ensuring compliance with GAAP for expense recognition. Deferred revenue should be regularly reviewed and adjusted to reflect the delivery of goods or services, maintaining liability accuracy and preventing revenue overstatement. Leveraging automated accounting software enhances the visibility and control of both prepaid expenses and deferred revenue, optimizing financial reporting and cash flow management.

Prepaid Expenses Infographic

libterm.com

libterm.com