Management fees represent the charges levied by asset managers or fund administrators for overseeing investment portfolios or mutual funds, typically calculated as a percentage of assets under management. These fees cover portfolio research, administrative costs, and advisory services, directly impacting your net returns. Discover how understanding management fees can optimize your investment strategy in the rest of this article.

Table of Comparison

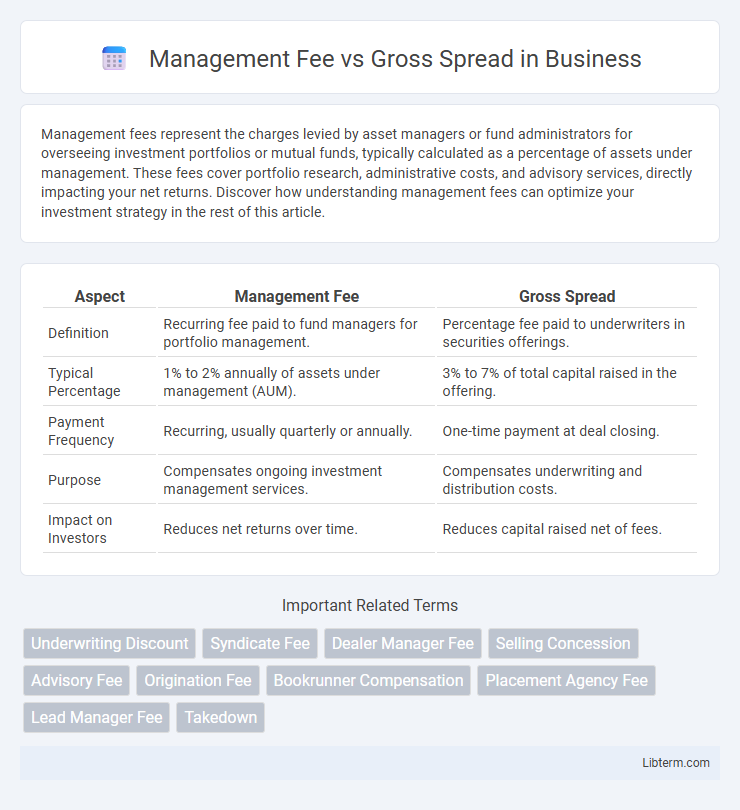

| Aspect | Management Fee | Gross Spread |

|---|---|---|

| Definition | Recurring fee paid to fund managers for portfolio management. | Percentage fee paid to underwriters in securities offerings. |

| Typical Percentage | 1% to 2% annually of assets under management (AUM). | 3% to 7% of total capital raised in the offering. |

| Payment Frequency | Recurring, usually quarterly or annually. | One-time payment at deal closing. |

| Purpose | Compensates ongoing investment management services. | Compensates underwriting and distribution costs. |

| Impact on Investors | Reduces net returns over time. | Reduces capital raised net of fees. |

Introduction to Management Fee and Gross Spread

Management fee refers to the fixed percentage charged by investment managers for overseeing a fund's portfolio, typically ranging from 1% to 2% of assets under management (AUM). Gross spread, on the other hand, represents the total underwriting fee earned by investment banks during securities offerings, usually expressed as a percentage of the deal size, often between 3% and 7%. Understanding the distinction between management fees and gross spreads is essential for evaluating costs in asset management and capital raising transactions.

Definition of Management Fee

The management fee is a fixed percentage charged by an investment manager for overseeing and administering a fund's assets, typically calculated on the total assets under management (AUM). Unlike the gross spread, which represents the total compensation to underwriters in a securities offering, the management fee specifically compensates fund managers for their ongoing operational and strategic services. This fee ensures continuous portfolio management, research, and administrative support crucial for maximizing investment performance.

Definition of Gross Spread

Gross spread represents the total underwriting fees and commissions earned by investment banks during an initial public offering (IPO), encompassing the management fee, underwriting fee, and selling concession. This fee structure compensates banks for the risks and services involved in marketing and distributing the securities to investors. The management fee, a component of the gross spread, specifically covers the lead manager's coordination efforts in the underwriting process.

Key Differences Between Management Fee and Gross Spread

Management fee represents a fixed percentage of assets under management, charged annually by investment managers for ongoing portfolio oversight, while gross spread is a percentage of the total offering amount retained by underwriters as compensation for managing an initial public offering (IPO) or securities issuance. The management fee is primarily associated with asset management services, reflecting continuous operational costs, whereas the gross spread pertains to underwriting services and is a one-time transaction fee linked to capital raising activities. Understanding these distinctions is crucial for investors evaluating fund expenses versus costs related to securities issuance processes.

How Management Fees Are Calculated

Management fees are typically calculated as a fixed percentage of the assets under management (AUM), often ranging from 1% to 2% annually, based on the fund's net asset value. Gross spread, in contrast, represents the difference between the price paid by investors and the price received by the issuer in an offering, usually expressed as a percentage of the total transaction value. While management fees compensate fund managers for ongoing portfolio oversight, gross spread primarily covers underwriting and distribution costs during capital raising processes.

How Gross Spread Is Determined

Gross spread is determined by the underwriting syndicate and reflects the percentage of total capital raised that underwriters retain as compensation for their services, typically ranging from 5% to 7% of the offering size. Factors influencing the gross spread include deal complexity, market conditions, issuer credit quality, and the underwriting risk involved. Unlike the fixed management fee paid to investment managers, the gross spread directly ties to the underwriting process and aligns compensation with the success of the securities offering.

Factors Influencing Management Fee and Gross Spread

Management fees are primarily influenced by the fund size, investment strategy, and operational costs, reflecting ongoing portfolio management and administrative expenses. Gross spread, on the other hand, depends on deal size, investment risk, market conditions, and the underwriter's role in structuring and distributing securities. Both fees are shaped by market competition, regulatory environment, and the complexity of the transaction or fund management involved.

Impact on Investors and Issuers

Management fees directly reduce the net returns for investors by charging a percentage of assets under management, potentially affecting their overall investment gains. Gross spread represents the total underwriting compensation, impacting issuers by increasing the cost of raising capital through securities offerings. Investors face lower proceeds from offerings due to gross spreads, while issuers experience diminished capital efficiency, highlighting the trade-offs in fee structures.

Pros and Cons of Each Structure

Management Fee provides predictable income by charging a fixed percentage of assets under management, ensuring steady cash flow regardless of deal outcomes; however, it may reduce incentives for the manager to maximize investment performance. Gross Spread aligns manager compensation with deal success by taking a percentage of the transaction value, motivating performance-driven results but creating income volatility and potential conflicts during prolonged investment periods. Choosing between Management Fee and Gross Spread depends on balancing risk tolerance, performance incentives, and cash flow stability for both investors and managers.

Choosing Between Management Fee and Gross Spread

Choosing between a management fee and gross spread depends on the alignment of incentives and the investment structure. Management fees provide predictable revenue based on assets under management, ideal for long-term stability, while gross spread offers compensation tied to transaction volume, aligning fees with deal success. Investors often prefer a management fee for consistent expenses, whereas underwriters may favor gross spread to match compensation with performance and risk.

Management Fee Infographic

libterm.com

libterm.com