Market extension mergers occur when two companies operating in different markets merge to expand their customer base and increase market reach. This strategy allows businesses to enter new geographic areas or target new customer segments, enhancing growth opportunities and competitive advantage. Explore the rest of the article to understand how a market extension merger can transform your business strategy.

Table of Comparison

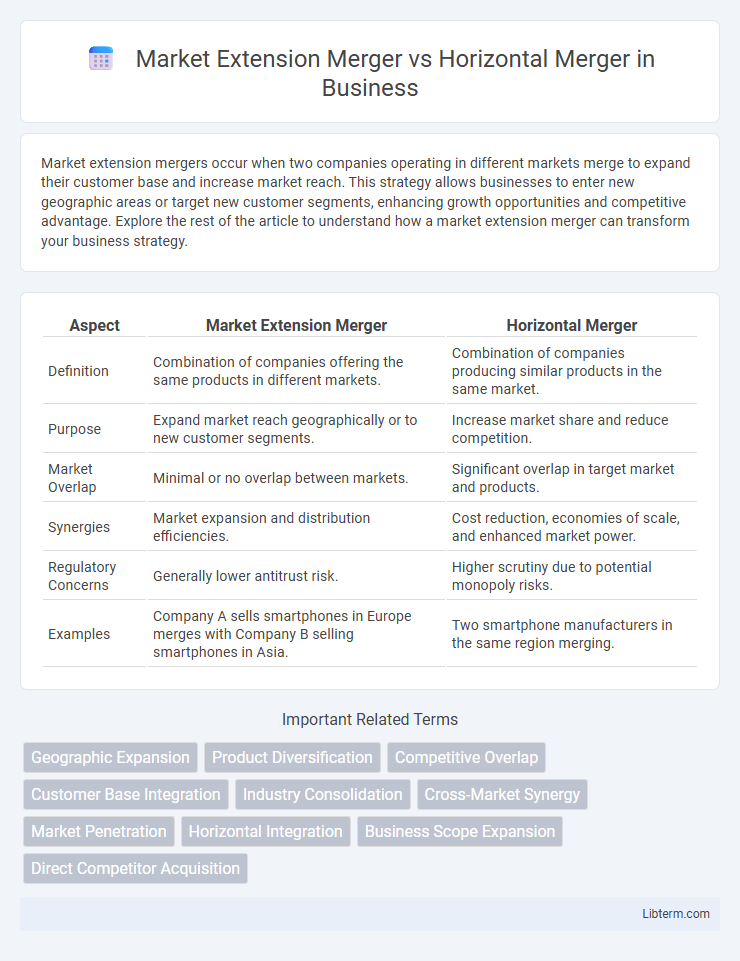

| Aspect | Market Extension Merger | Horizontal Merger |

|---|---|---|

| Definition | Combination of companies offering the same products in different markets. | Combination of companies producing similar products in the same market. |

| Purpose | Expand market reach geographically or to new customer segments. | Increase market share and reduce competition. |

| Market Overlap | Minimal or no overlap between markets. | Significant overlap in target market and products. |

| Synergies | Market expansion and distribution efficiencies. | Cost reduction, economies of scale, and enhanced market power. |

| Regulatory Concerns | Generally lower antitrust risk. | Higher scrutiny due to potential monopoly risks. |

| Examples | Company A sells smartphones in Europe merges with Company B selling smartphones in Asia. | Two smartphone manufacturers in the same region merging. |

Understanding Market Extension Mergers

Market Extension Mergers involve the combination of companies operating in different geographical markets but offering similar products or services, aimed at expanding customer reach and market presence. This contrasts with Horizontal Mergers, which occur between companies in the same market and industry, often to increase market share or reduce competition. Understanding Market Extension Mergers highlights strategic growth through geographical diversification while maintaining product line consistency.

Defining Horizontal Mergers

Horizontal mergers involve the consolidation of companies operating in the same industry and at the same stage of production, aiming to increase market share and reduce competition. These mergers typically occur between direct competitors offering similar products or services, enhancing economies of scale and expanding customer base. Unlike market extension mergers that combine firms in different geographical markets, horizontal mergers focus on strengthening dominance within a single market domain.

Key Differences Between Market Extension and Horizontal Mergers

Market extension mergers combine companies operating in different geographical markets but offering similar products, aiming to expand customer base without changing product lines. Horizontal mergers involve companies competing in the same market segment and product category, focusing on increasing market share and reducing competition. Key differences lie in their strategic goals: market extension mergers pursue market penetration into new locations, while horizontal mergers concentrate on consolidating resources and enhancing economies of scale within the same market.

Objectives of Market Extension Mergers

Market extension mergers aim to expand a company's market reach by acquiring firms operating in different geographical regions but producing similar products or services, thereby increasing customer base and sales volume. These mergers strategically reduce competition by integrating distribution channels and leveraging combined market knowledge to enter new territories efficiently. The primary objective is to achieve rapid market penetration and scale economies without altering the core product offerings.

Strategic Goals of Horizontal Mergers

Horizontal mergers primarily aim to increase market share, reduce competition, and achieve economies of scale within the same industry. They strategically focus on enhancing product offerings, expanding customer base, and improving operational efficiency by combining similar business operations. Market extension mergers, in contrast, target geographic expansion and entry into new markets without necessarily consolidating direct competitors.

Benefits of Market Extension Mergers

Market extension mergers enable companies to expand their customer base by entering new geographical markets, resulting in increased sales and market share without directly increasing production capacity. Firms benefit from combining complementary market reach while maintaining product line similarities, which reduces competition and fosters economies of scale in marketing and distribution. This strategic expansion often leads to enhanced brand recognition and improved bargaining power with suppliers across diverse regions.

Advantages of Horizontal Mergers

Horizontal mergers offer significant advantages such as increased market share, economies of scale, and enhanced competitive positioning within the same industry. These mergers enable companies to reduce operational redundancies, lower costs, and improve bargaining power with suppliers and customers. By combining resources and expertise, horizontal mergers facilitate innovation, expand product lines, and strengthen brand presence.

Risks and Challenges in Market Extension vs Horizontal Mergers

Market extension mergers face risks such as cultural clashes and integration difficulties due to different customer bases and geographic markets, which can lead to inefficiencies and loss of market focus. Horizontal mergers encounter challenges like regulatory scrutiny for anti-competitive behavior, integration of similar operations, and potential customer attrition from reduced competition. Both types of mergers demand careful alignment of strategic goals and operational structures to mitigate risks and achieve desired synergies.

Real-World Examples: Market Extension vs Horizontal Mergers

Market extension mergers occur when companies selling the same products in different markets combine, such as the merger between Amgen and Immunex, allowing Amgen to enter the U.S. market for immune therapeutics. Horizontal mergers involve companies competing in the same market segment, exemplified by Facebook's acquisition of Instagram, which expanded its dominance in social media platforms. These real-world examples highlight how market extension mergers facilitate geographic or customer base expansion, while horizontal mergers aim for increased market share and competitive advantage within the same industry.

Choosing the Right Merger Strategy for Business Growth

Choosing the right merger strategy between market extension mergers and horizontal mergers depends on the business growth goals and market conditions. Market extension mergers expand a company's geographic reach by combining firms operating in different markets, enhancing customer base diversity and reducing market risks. Horizontal mergers, involving competitors in the same industry and market, focus on increasing market share, achieving economies of scale, and strengthening competitive positioning.

Market Extension Merger Infographic

libterm.com

libterm.com