Unearned revenue represents money received by a business for goods or services not yet delivered, creating a liability on the balance sheet until the service is performed or product is provided. This accounting concept ensures that revenue is recognized only when earned, maintaining financial accuracy and compliance with revenue recognition standards. Discover how managing unearned revenue effectively can impact your business's financial health by reading the full article.

Table of Comparison

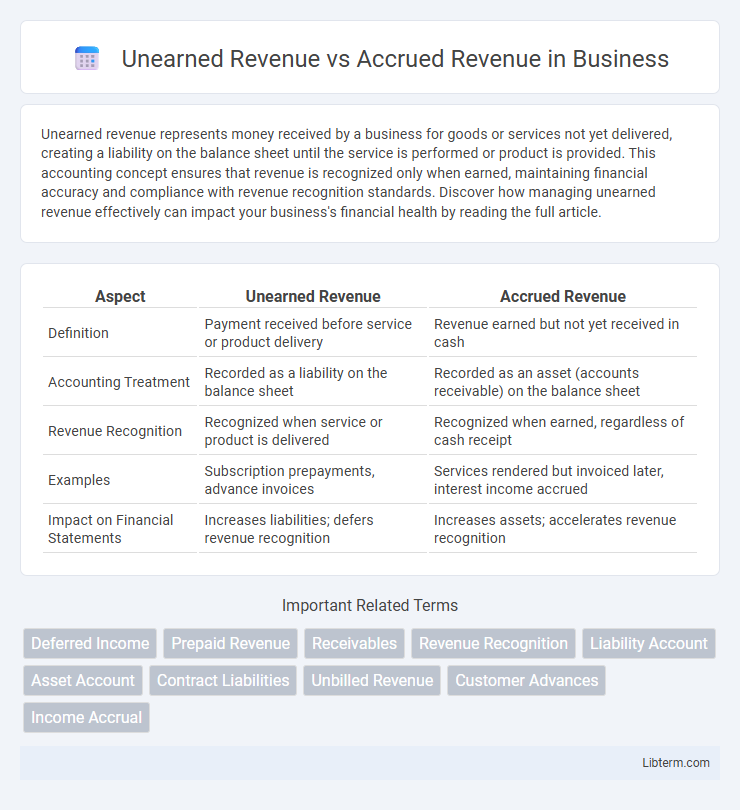

| Aspect | Unearned Revenue | Accrued Revenue |

|---|---|---|

| Definition | Payment received before service or product delivery | Revenue earned but not yet received in cash |

| Accounting Treatment | Recorded as a liability on the balance sheet | Recorded as an asset (accounts receivable) on the balance sheet |

| Revenue Recognition | Recognized when service or product is delivered | Recognized when earned, regardless of cash receipt |

| Examples | Subscription prepayments, advance invoices | Services rendered but invoiced later, interest income accrued |

| Impact on Financial Statements | Increases liabilities; defers revenue recognition | Increases assets; accelerates revenue recognition |

Introduction to Unearned Revenue and Accrued Revenue

Unearned revenue represents payments received by a business before delivering goods or services, creating a liability until the revenue is earned. Accrued revenue refers to income earned for goods or services provided but not yet billed or received, reflecting an asset on the balance sheet. Both concepts are essential for accurate revenue recognition and financial reporting under accounting standards like GAAP and IFRS.

Definition of Unearned Revenue

Unearned revenue refers to payments received by a company for goods or services that have not yet been delivered or performed, representing a liability on the balance sheet until the earning process is complete. This deferred revenue occurs when customers pay in advance, requiring businesses to recognize revenue only after fulfilling their contractual obligations, adhering to the revenue recognition principle under accounting standards such as GAAP and IFRS. Differentiating it from accrued revenue, which involves revenue earned but not yet received, is crucial for accurate financial reporting and compliance.

Definition of Accrued Revenue

Accrued revenue represents income earned by providing goods or services before receiving payment, reflecting completed work not yet billed or collected. It is recorded as a receivable on the balance sheet, indicating the company's right to receive payment in the future. This contrasts with unearned revenue, which is payment received in advance for services or goods yet to be delivered.

Key Differences Between Unearned and Accrued Revenue

Unearned revenue represents payments received in advance for goods or services yet to be delivered, creating a liability on the balance sheet, while accrued revenue refers to earnings recognized before cash is received, recorded as an asset. The timing difference is crucial: unearned revenue involves cash inflow before revenue recognition, whereas accrued revenue reflects revenue recognized prior to cash receipt. Unearned revenue decreases as services are performed, whereas accrued revenue increases as work progresses but payment is pending.

Accounting Treatment for Unearned Revenue

Unearned revenue represents payments received before a product or service delivery and is recorded as a liability on the balance sheet, reflecting the company's obligation to provide future goods or services. Accounting treatment requires recognizing unearned revenue as a liability upon receipt and then systematically recognizing it as revenue in the income statement when the earning process is complete. This approach ensures compliance with the revenue recognition principle under GAAP and IFRS standards, maintaining accurate financial reporting.

Accounting Treatment for Accrued Revenue

Accrued revenue represents income earned but not yet received or recorded at the end of an accounting period, requiring an adjusting journal entry to recognize revenue and a corresponding receivable. The accounting treatment involves debiting Accrued Revenue or Accounts Receivable and crediting Revenue to comply with the accrual basis of accounting. Proper recognition of accrued revenue ensures financial statements accurately reflect earned income and improve matching of revenue with related expenses.

Examples of Unearned Revenue in Business

Unearned revenue examples in business include prepaid subscriptions, where customers pay in advance for magazine delivery or software access, and deposits received for future services, such as event bookings or rental agreements. Another common example is gift cards sold by retail stores before customers redeem them for products. These transactions create liabilities on the balance sheet until the goods or services are delivered to the customer.

Examples of Accrued Revenue in Business

Accrued revenue represents income earned but not yet received or recorded, common in service-based industries like consulting, where services are delivered before payment. Examples include interest revenue earned on loans that has not been collected, or work completed on a project with billing scheduled for a later date. This accounting practice ensures revenue recognition aligns with the period in which it is earned, enhancing financial accuracy and compliance with GAAP standards.

Impact on Financial Statements

Unearned revenue appears as a liability on the balance sheet, representing cash received before goods or services are provided, which defers revenue recognition until earned. Accrued revenue is recorded as an asset, specifically accounts receivable, reflecting earned revenue not yet received in cash, increasing both revenue and net income on the income statement. The timing differences in recognizing these revenues affect cash flow reporting and the matching of revenue with related expenses in financial statements.

Importance of Proper Revenue Recognition

Proper revenue recognition ensures financial statements accurately reflect a company's economic activities, distinguishing Unearned Revenue--payments received before service delivery or product fulfillment--from Accrued Revenue, which represents earned income not yet billed or received. Correctly classifying these revenues impacts cash flow analysis, compliance with accounting standards like GAAP or IFRS, and informs investor decisions by presenting a true picture of financial health. Misstating Unearned or Accrued Revenue can lead to revenue inflation or understatement, risking regulatory penalties and undermining stakeholder trust.

Unearned Revenue Infographic

libterm.com

libterm.com