A Public Limited Company (PLC) is a business structure that allows shares to be sold to the public and traded on the stock exchange, offering limited liability to its shareholders. This setup provides opportunities for raising capital through investors while ensuring regulatory compliance and transparency. Explore the article to understand how a PLC can impact your business growth and investment opportunities.

Table of Comparison

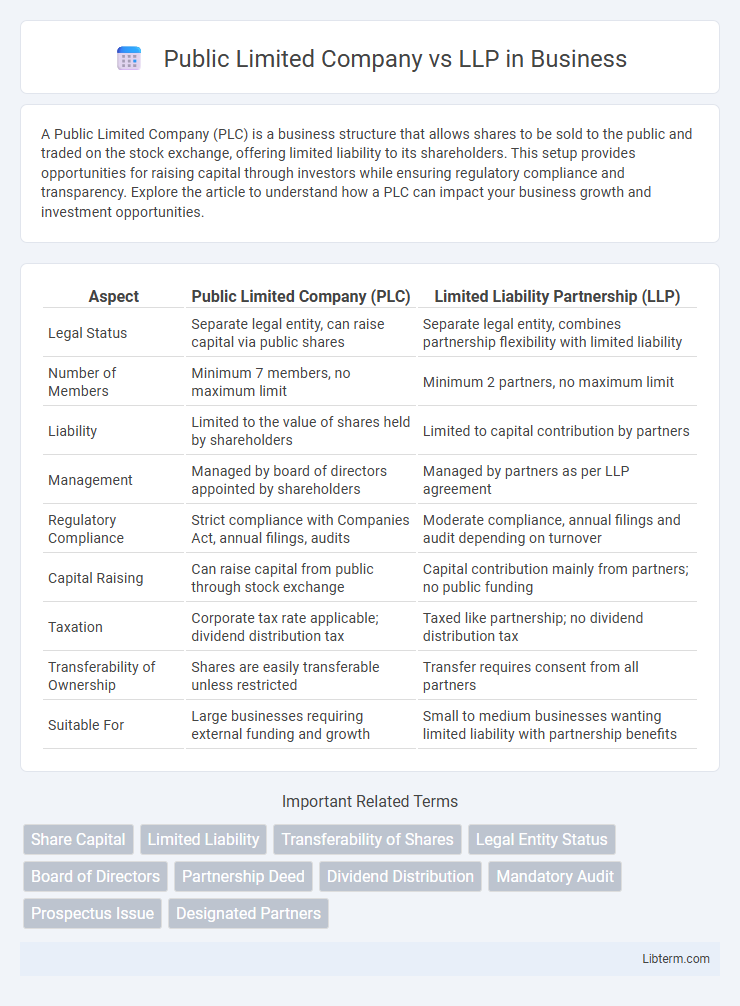

| Aspect | Public Limited Company (PLC) | Limited Liability Partnership (LLP) |

|---|---|---|

| Legal Status | Separate legal entity, can raise capital via public shares | Separate legal entity, combines partnership flexibility with limited liability |

| Number of Members | Minimum 7 members, no maximum limit | Minimum 2 partners, no maximum limit |

| Liability | Limited to the value of shares held by shareholders | Limited to capital contribution by partners |

| Management | Managed by board of directors appointed by shareholders | Managed by partners as per LLP agreement |

| Regulatory Compliance | Strict compliance with Companies Act, annual filings, audits | Moderate compliance, annual filings and audit depending on turnover |

| Capital Raising | Can raise capital from public through stock exchange | Capital contribution mainly from partners; no public funding |

| Taxation | Corporate tax rate applicable; dividend distribution tax | Taxed like partnership; no dividend distribution tax |

| Transferability of Ownership | Shares are easily transferable unless restricted | Transfer requires consent from all partners |

| Suitable For | Large businesses requiring external funding and growth | Small to medium businesses wanting limited liability with partnership benefits |

Definition of Public Limited Company

A Public Limited Company (PLC) is a business entity whose shares are traded publicly on a stock exchange, allowing them to be bought and sold by the general public. It must have a minimum share capital as prescribed by law and complies with strict regulatory and disclosure requirements, promoting transparency and investor protection. PLCs are distinct from Limited Liability Partnerships (LLPs), which combine partnership flexibility with limited liability but do not offer publicly traded shares or raise capital through public markets.

Definition of LLP

A Limited Liability Partnership (LLP) is a business structure combining elements of partnerships and corporations, offering limited liability protection to its partners while allowing flexible internal management. Unlike a Public Limited Company (PLC), an LLP is not publicly traded and is primarily formed for professional services or small to medium-sized enterprises. The LLP model ensures that partners are not personally liable for the firm's debts beyond their investment, blending operational flexibility with legal protections.

Key Legal Differences

A Public Limited Company (PLC) is regulated under the Companies Act, requiring a minimum of seven shareholders and allowing the public to trade its shares, while a Limited Liability Partnership (LLP) combines partnership flexibility with limited liability protection and mandates at least two designated partners. PLCs must adhere to stricter compliance norms, including filing annual returns and holding shareholder meetings, whereas LLPs have simpler compliance and fewer statutory requirements. The transferability of shares in a PLC is unrestricted and highly liquid, contrasting with the restricted transfer of ownership interests in an LLP as stipulated in the LLP agreement.

Ownership Structure Comparison

A Public Limited Company (PLC) allows ownership through publicly traded shares, enabling a large number of shareholders and ease of capital accumulation, while an LLP (Limited Liability Partnership) restricts ownership to partners with no public share issuance. PLC shareholders have transferable shares, providing liquidity and marketability, whereas LLP partners hold ownership stakes that are typically not transferable without consent. The PLC model supports broader ownership dispersion, contrasting with the LLP's concentrated control among a limited number of partners.

Liability Implications

A Public Limited Company (PLC) offers limited liability protection where shareholders' personal assets are not at risk beyond their share capital. In contrast, a Limited Liability Partnership (LLP) provides limited liability to all partners, shielding them from personal liability for business debts and other partners' negligence. Both structures protect personal assets, but LLPs allow operational flexibility with fewer compliance requirements compared to PLCs.

Capital Raising Potential

Public Limited Companies (PLCs) have a significant advantage in capital raising potential due to their ability to offer shares to the general public through stock exchanges, attracting a broader investor base and large-scale funding. In contrast, Limited Liability Partnerships (LLPs) rely mainly on contributions from existing partners or private investors, limiting their access to public capital markets. PLCs also benefit from greater liquidity and visibility, making them more attractive to institutional investors and facilitating easier capital accumulation for expansion and operations.

Regulatory Requirements

Public Limited Companies (PLCs) must comply with stringent regulatory requirements, including mandatory minimum share capital, extensive disclosure norms, and adherence to the Companies Act, 2013, as well as regular filings with the Registrar of Companies (RoC). Limited Liability Partnerships (LLPs) operate under the Limited Liability Partnership Act, 2008, which imposes comparatively simpler compliance obligations such as maintaining LLP agreements, annual returns, and statements of accounts, without the need for minimum capital subscription. PLCs face stricter governance standards, mandatory board meetings, and audit requirements, whereas LLPs benefit from flexible management structures and less rigorous regulatory scrutiny.

Taxation Differences

A Public Limited Company (PLC) is subject to corporate tax rates on its profits, generally around 19-25%, with dividends distributed to shareholders potentially facing double taxation. In contrast, a Limited Liability Partnership (LLP) is typically treated as a pass-through entity for tax purposes, where profits are taxed only at the partners' individual income tax rates, avoiding corporate tax. LLPs benefit from flexibility in profit distribution without triggering additional tax liabilities, making them advantageous for tax efficiency compared to PLCs.

Suitability for Different Businesses

Public Limited Companies (PLCs) are ideal for large-scale businesses seeking to raise capital from the public through stock exchanges, benefiting sectors like manufacturing, banking, and technology. Limited Liability Partnerships (LLPs) suit professional services firms, startups, and small to medium enterprises needing flexible management structures and limited liability without the regulatory burdens of a PLC. The choice between PLC and LLP depends on factors such as capital requirements, compliance obligations, and the desired degree of management control.

Pros and Cons Summary

A Public Limited Company (PLC) offers easy access to capital through public share issuance, enhanced credibility, and limited liability, but involves stringent regulatory compliance, higher disclosure requirements, and potential loss of control due to shareholder influence. An LLP (Limited Liability Partnership) provides flexibility in management, limited liability protection for partners, and simpler regulatory obligations, yet may face challenges in raising large-scale capital and limited public recognition. Choosing between PLC and LLP depends on factors like funding needs, regulatory tolerance, and desired operational structure.

Public Limited Company Infographic

libterm.com

libterm.com