A reverse merger is a strategic financial process where a private company becomes publicly traded by merging with an existing public company, bypassing the traditional initial public offering (IPO). This method offers faster access to capital markets with reduced regulatory scrutiny, making it an attractive option for businesses seeking liquidity. Explore the full article to understand how a reverse merger could impact your company's growth and market presence.

Table of Comparison

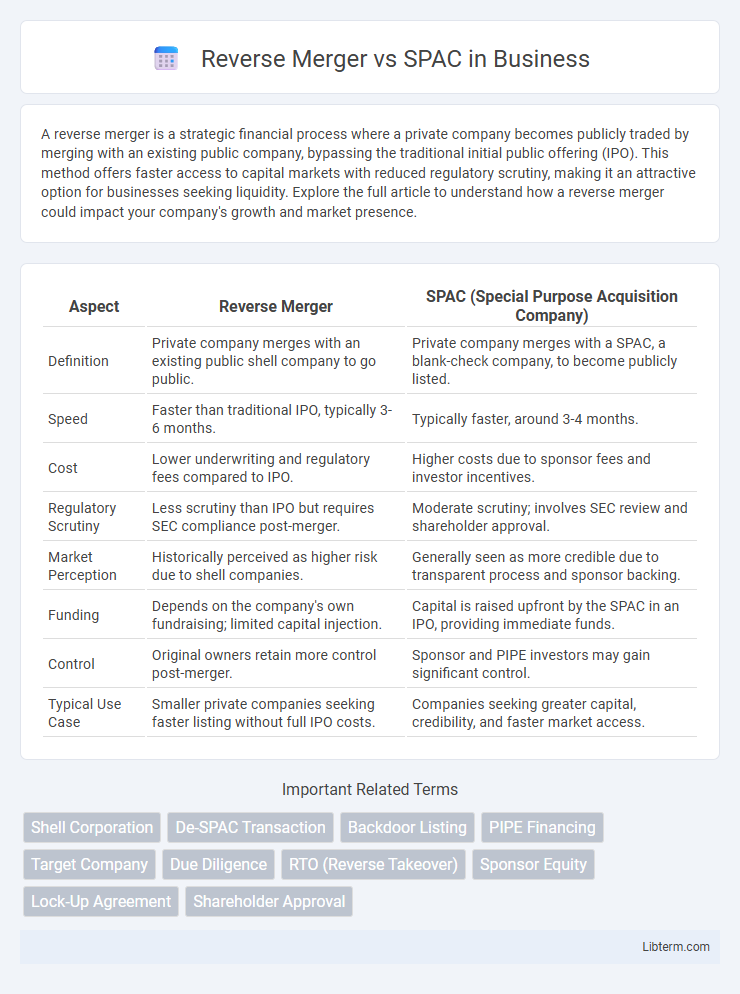

| Aspect | Reverse Merger | SPAC (Special Purpose Acquisition Company) |

|---|---|---|

| Definition | Private company merges with an existing public shell company to go public. | Private company merges with a SPAC, a blank-check company, to become publicly listed. |

| Speed | Faster than traditional IPO, typically 3-6 months. | Typically faster, around 3-4 months. |

| Cost | Lower underwriting and regulatory fees compared to IPO. | Higher costs due to sponsor fees and investor incentives. |

| Regulatory Scrutiny | Less scrutiny than IPO but requires SEC compliance post-merger. | Moderate scrutiny; involves SEC review and shareholder approval. |

| Market Perception | Historically perceived as higher risk due to shell companies. | Generally seen as more credible due to transparent process and sponsor backing. |

| Funding | Depends on the company's own fundraising; limited capital injection. | Capital is raised upfront by the SPAC in an IPO, providing immediate funds. |

| Control | Original owners retain more control post-merger. | Sponsor and PIPE investors may gain significant control. |

| Typical Use Case | Smaller private companies seeking faster listing without full IPO costs. | Companies seeking greater capital, credibility, and faster market access. |

Introduction to Reverse Mergers and SPACs

Reverse mergers enable private companies to become publicly traded by merging with a dormant or shell public company, offering a faster and often less costly alternative to traditional IPOs. Special Purpose Acquisition Companies (SPACs) are publicly listed entities formed specifically to acquire private firms, providing a streamlined route to public markets with pre-raised capital and simplified regulatory processes. Both methods bypass conventional IPO requirements but differ in structure, timing, and investor engagement.

Key Differences Between Reverse Mergers and SPACs

Reverse mergers involve private companies acquiring a public shell to bypass the traditional IPO process, offering faster market entry with fewer regulatory hurdles. SPACs (Special Purpose Acquisition Companies) are publicly listed entities created specifically to merge with private companies, providing a pre-funded route to public markets with enhanced capital access and investor transparency. Key differences include the origin of public status--reverse mergers use dormant public shells, while SPACs are newly formed public vehicles--and the structured capital raise and investor protections inherent in SPAC transactions.

How Reverse Mergers Work

Reverse mergers involve a private company acquiring a publicly traded shell corporation to bypass the traditional initial public offering process and gain immediate public status. This process allows the private entity to merge its assets and operations into the shell company, resulting in a streamlined pathway to public markets with reduced regulatory scrutiny and faster timing. Investors view reverse mergers as a strategic alternative to SPACs, which require raising capital through an initial trust before acquiring a target company.

The SPAC Process Explained

The SPAC process involves a special purpose acquisition company raising capital through an initial public offering (IPO) without commercial operations, followed by identifying a private company to merge with within a set timeframe, typically 18 to 24 months. Upon completing the merger, the private company effectively becomes publicly traded, bypassing the traditional IPO process. This method offers advantages like faster market access and increased certainty of valuation compared to conventional IPOs and reverse mergers.

Regulatory and Compliance Considerations

Reverse mergers involve a private company acquiring a public shell company, triggering SEC registration under the Securities Act of 1933 and ongoing reporting obligations pursuant to the Securities Exchange Act of 1934, which necessitate detailed financial disclosures and adherence to Sarbanes-Oxley Act compliance. SPACs, or Special Purpose Acquisition Companies, face strict SEC scrutiny during the IPO phase, including compliance with Regulation S-X for financial statements and adherence to Nasdaq or NYSE listing standards, alongside the SEC's enhanced focus on PIPE (Private Investment in Public Equity) transactions and de-SPAC merger disclosures. Both structures require rigorous legal due diligence and continuous regulatory compliance to mitigate risks associated with financial misstatements, insider trading, and market manipulation, with SPACs facing heightened examination due to their evolving regulatory environment.

Costs and Timeframes: Reverse Merger vs SPAC

Reverse mergers typically incur lower upfront costs compared to SPACs due to fewer regulatory and underwriting fees but may face hidden expenses in due diligence and integration. SPACs often have higher initial costs, including sponsor fees and underwriting expenses, yet they can offer faster access to public markets, often completing within three to six months. Timeframes for reverse mergers range from six to twelve months, influenced by the complexity of the target company and regulatory approvals.

Benefits of Choosing a Reverse Merger

A Reverse Merger offers faster access to public markets compared to traditional IPOs and SPACs, reducing time-to-market from months to just weeks. Companies maintain greater control and transparency throughout the process, avoiding the dilution and regulatory complexities typical of SPAC deals. Additionally, reverse mergers provide cost-effective capital raising opportunities while allowing private firms to leverage established public company infrastructure.

Advantages of Going Public via SPAC

Going public via a SPAC offers faster access to capital markets, often completing the process within 3 to 6 months compared to the longer timelines of traditional IPOs or reverse mergers. SPACs provide greater certainty of valuation and capital raised by negotiating terms upfront with the sponsors, reducing market volatility risks. The process involves experienced management teams and institutional investors, enhancing credibility and facilitating a smoother transition to public status.

Risks and Challenges of Each Approach

Reverse mergers pose risks including limited liquidity and potential undisclosed liabilities due to less rigorous regulatory scrutiny compared to traditional IPOs. SPACs often face challenges related to market volatility, misaligned incentives between sponsors and shareholders, and post-merger valuation declines. Both approaches require careful due diligence to mitigate financial, legal, and reputational risks inherent in expedited public listing processes.

Which Route is Best for Your Business?

Choosing between a reverse merger and a SPAC depends on your business's specific goals, timeline, and risk tolerance. Reverse mergers offer a quicker, less expensive path to going public but may lack the capital infusion and investor validation that a SPAC provides. SPACs can deliver significant funding and market credibility, especially for companies seeking substantial growth and exposure, but often require longer timelines and more regulatory scrutiny.

Reverse Merger Infographic

libterm.com

libterm.com