Accurate accounting is essential for maintaining financial health and ensuring compliance with tax regulations. Proper bookkeeping helps you track income, expenses, and profitability, enabling informed business decisions. Explore the rest of the article to discover key accounting practices that can benefit your financial management.

Table of Comparison

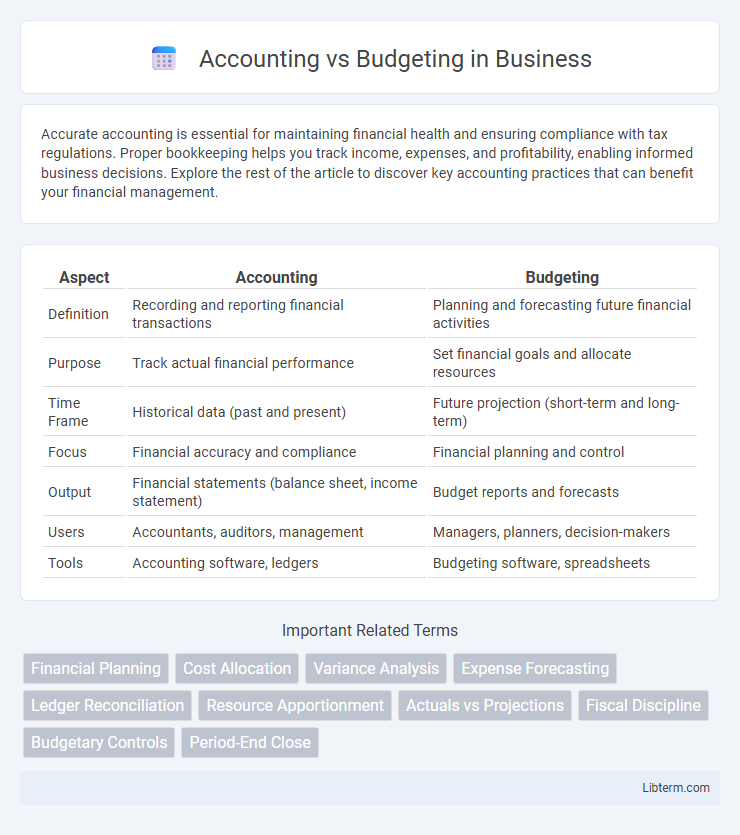

| Aspect | Accounting | Budgeting |

|---|---|---|

| Definition | Recording and reporting financial transactions | Planning and forecasting future financial activities |

| Purpose | Track actual financial performance | Set financial goals and allocate resources |

| Time Frame | Historical data (past and present) | Future projection (short-term and long-term) |

| Focus | Financial accuracy and compliance | Financial planning and control |

| Output | Financial statements (balance sheet, income statement) | Budget reports and forecasts |

| Users | Accountants, auditors, management | Managers, planners, decision-makers |

| Tools | Accounting software, ledgers | Budgeting software, spreadsheets |

Introduction to Accounting and Budgeting

Accounting involves systematically recording, classifying, and reporting financial transactions to provide accurate financial statements and insights. Budgeting is the process of planning future income and expenditures to allocate resources effectively and achieve financial goals. Both accounting and budgeting are essential for informed decision-making and financial management in businesses.

Defining Accounting: Purpose and Scope

Accounting involves systematically recording, classifying, and summarizing financial transactions to provide accurate reports on a company's financial position and performance. Its purpose is to ensure compliance with regulatory standards, facilitate informed decision-making, and support financial transparency through detailed statements such as the balance sheet, income statement, and cash flow statement. The scope of accounting covers various activities including bookkeeping, auditing, financial analysis, and tax preparation, which collectively enable organizations to track assets, liabilities, revenues, and expenses precisely.

Understanding Budgeting: Goals and Objectives

Budgeting involves setting clear financial goals and objectives to guide resource allocation and spending decisions within an organization. It focuses on forecasting revenues and expenses to ensure effective financial planning and control, enabling businesses to achieve strategic priorities. Unlike accounting, which records past financial transactions, budgeting proactively shapes future financial outcomes by aligning expenditures with organizational goals.

Key Differences Between Accounting and Budgeting

Accounting tracks and records financial transactions to provide accurate historical data through financial statements like balance sheets and income statements. Budgeting plans future income and expenditures to guide financial decision-making, ensuring resources align with organizational goals. The key difference lies in accounting's retrospective analysis of actual financial performance versus budgeting's forward-looking financial projections.

The Role of Accounting in Financial Management

Accounting provides accurate financial records essential for tracking income, expenses, assets, and liabilities, enabling informed decision-making in financial management. It ensures compliance with regulatory standards through systematic recording and reporting of financial transactions. These detailed insights allow businesses to monitor financial performance, assess liquidity, and support strategic planning efforts effectively.

The Importance of Budgeting for Business Success

Budgeting plays a critical role in business success by enabling precise financial planning and resource allocation, which accounting alone cannot provide. Businesses that implement effective budgeting strategies experience improved cash flow management, reduced unnecessary expenses, and enhanced profitability. Accurate budgeting supports informed decision-making, forecasting, and goal tracking, making it an essential tool for sustainable growth and operational efficiency.

Tools and Techniques Used in Accounting vs Budgeting

Accounting primarily uses tools such as general ledgers, accounting software (QuickBooks, SAP, Xero), and financial statements to record and analyze past financial transactions. Budgeting relies on forecasting models, spreadsheet programs like Microsoft Excel, and budgeting software like Adaptive Insights or Anaplan to allocate resources and predict future financial performance. Both disciplines employ variance analysis to compare actual results against planned budgets, ensuring effective financial management.

Integrating Accounting and Budgeting Processes

Integrating accounting and budgeting processes enhances financial accuracy by aligning actual expenditures with forecasted budgets, enabling real-time financial monitoring. This integration leverages accounting software that merges transaction data with budget controls, reducing discrepancies and improving decision-making efficiency. Streamlined workflows between accounting and budgeting facilitate better resource allocation, financial planning, and compliance with organizational financial policies.

Common Challenges in Accounting and Budgeting

Common challenges in accounting and budgeting include inaccurate data entry, which can lead to discrepancies in financial reports and hinder effective decision-making. Both processes often face difficulties in forecasting due to market volatility and unexpected expenses, complicating the maintenance of accurate budgets and financial statements. Ensuring compliance with regulatory standards and integrating advanced financial software are critical obstacles that organizations must address to improve accuracy and efficiency.

Conclusion: Choosing the Right Approach for Your Organization

Accounting provides an accurate record of financial transactions essential for compliance and reporting, while budgeting offers a forward-looking framework to allocate resources and guide decision-making. Organizations aiming for comprehensive financial management should integrate both practices to optimize performance and strategic planning. Selecting the right approach depends on the organization's size, complexity, and financial goals to ensure effective control and growth.

Accounting Infographic

libterm.com

libterm.com