Treasury shares refer to a company's own stock that has been repurchased and held in its treasury, effectively reducing the number of outstanding shares on the market. These shares do not pay dividends, have no voting rights, and can be reissued or retired at the company's discretion. Explore the rest of the article to understand how treasury shares impact your investment and corporate financial strategies.

Table of Comparison

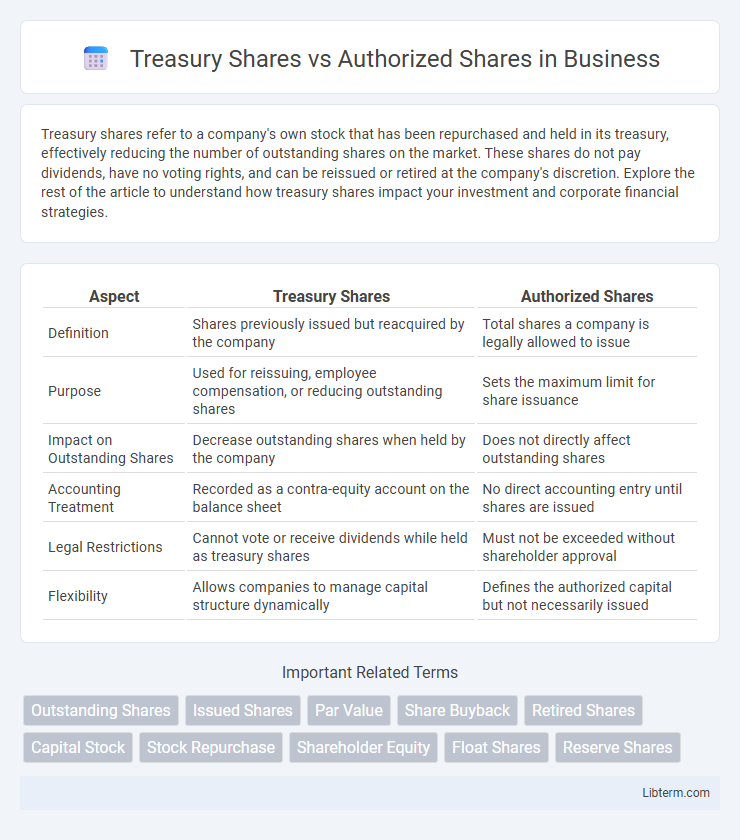

| Aspect | Treasury Shares | Authorized Shares |

|---|---|---|

| Definition | Shares previously issued but reacquired by the company | Total shares a company is legally allowed to issue |

| Purpose | Used for reissuing, employee compensation, or reducing outstanding shares | Sets the maximum limit for share issuance |

| Impact on Outstanding Shares | Decrease outstanding shares when held by the company | Does not directly affect outstanding shares |

| Accounting Treatment | Recorded as a contra-equity account on the balance sheet | No direct accounting entry until shares are issued |

| Legal Restrictions | Cannot vote or receive dividends while held as treasury shares | Must not be exceeded without shareholder approval |

| Flexibility | Allows companies to manage capital structure dynamically | Defines the authorized capital but not necessarily issued |

Introduction to Treasury Shares and Authorized Shares

Treasury shares refer to the portion of a company's stock that has been repurchased and is held in the company's treasury, not considered outstanding or entitled to dividends or voting rights. Authorized shares represent the maximum number of shares a corporation is legally permitted to issue as specified in its articles of incorporation. Understanding the distinction between treasury shares and authorized shares is essential for analyzing a company's capital structure and stock dilution potential.

Defining Treasury Shares

Treasury shares are previously issued company stocks that have been repurchased and held in the company's treasury, not considered outstanding shares in the market. These shares do not confer voting rights or dividend payments but can be reissued or retired at the company's discretion. The distinction from authorized shares lies in that authorized shares represent the maximum number a company can legally issue, while treasury shares are a subset of issued shares currently held by the company.

Understanding Authorized Shares

Authorized shares represent the maximum number of shares that a corporation is legally permitted to issue as specified in its corporate charter. These shares define the upper limit for outstanding shares and treasury shares combined, playing a critical role in capital structure and shareholder equity. Understanding authorized shares is essential for investors and companies to manage dilution, equity financing, and corporate governance effectively.

Key Differences Between Treasury Shares and Authorized Shares

Treasury shares are previously issued shares that a company has repurchased and holds in its own treasury, reducing the number of outstanding shares in the market, while authorized shares represent the maximum number of shares a company is legally permitted to issue as specified in its corporate charter. Treasury shares do not carry voting rights or pay dividends, whereas authorized shares gain these attributes only once issued to shareholders. The key difference lies in their status: authorized shares define the potential share capital, while treasury shares reflect repurchased stock that can be reissued or retired by the company.

Purpose and Uses of Treasury Shares

Treasury shares are repurchased stock held by the issuing company, primarily used to manage equity structure, support stock price, and provide shares for employee compensation plans without issuing new shares. Unlike authorized shares, which represent the total number of shares a company may legally issue, treasury shares are already issued but not considered outstanding, allowing companies to reissue or retire them as needed. This flexibility in treasury shares aids in shareholder value management and capital structure optimization while authorized shares define the potential maximum equity.

Role of Authorized Shares in Corporate Structure

Authorized shares represent the maximum number of shares a corporation is legally permitted to issue as defined in its articles of incorporation, serving as a foundation for raising capital and allocating ownership. These shares establish the framework within which a company can issue stock to investors, employees, or for other purposes without needing immediate regulatory approval for each issuance. Understanding the role of authorized shares is crucial for managing corporate governance and strategic growth options effectively.

Impact on Shareholders’ Equity

Treasury shares reduce shareholders' equity by representing previously issued stock that the company has repurchased and holds, effectively decreasing the total outstanding shares and diluting earnings per share. Authorized shares set the maximum number of shares a company can issue but do not directly impact shareholders' equity until shares are issued or repurchased. Changes in treasury shares affect the equity section by decreasing total common stock and retained earnings, while authorized shares establish potential equity limits without immediate effect.

Accounting Treatment and Reporting Requirements

Treasury shares are previously issued shares reacquired by the company, recorded as a contra-equity account on the balance sheet, reducing total shareholders' equity without affecting the number of authorized shares. Authorized shares represent the maximum number of shares a corporation can issue, disclosed in the notes to financial statements and not recorded on the balance sheet until issued. Accounting treatment requires treasury shares to be reported at cost and excluded from outstanding shares, while authorized shares set the ceiling for issuance and are critical for compliance with corporate governance and regulatory filings.

Implications for Investors and Corporate Strategy

Treasury shares, which are previously issued shares reacquired by the company, reduce the number of outstanding shares, potentially increasing earnings per share and influencing stock price stability, directly impacting investor returns and market perception. Authorized shares represent the maximum number of shares a corporation can issue, providing strategic flexibility for future capital raises, mergers, or stock-based compensation without immediate dilution concerns for current investors. Understanding the balance between treasury and authorized shares helps investors evaluate dilution risks and corporate strategy implications on shareholder value and corporate governance dynamics.

Conclusion: Choosing Between Treasury and Authorized Shares

Choosing between treasury shares and authorized shares depends on a company's capital strategy and financial goals. Treasury shares provide flexibility for future financing, employee compensation, or market repurchases without issuing new shares, while authorized shares define the maximum limit of stock a company can legally issue, ensuring control over dilution and regulatory compliance. Effective management of both types optimizes shareholder value and corporate governance.

Treasury Shares Infographic

libterm.com

libterm.com