A nominal partner holds a title without bearing the full responsibilities or liabilities typically associated with partnership roles. This arrangement can affect your legal and financial obligations, making it crucial to understand the specific terms and implications involved. Explore the rest of the article to learn how a nominal partner influences business dynamics and what it means for your ventures.

Table of Comparison

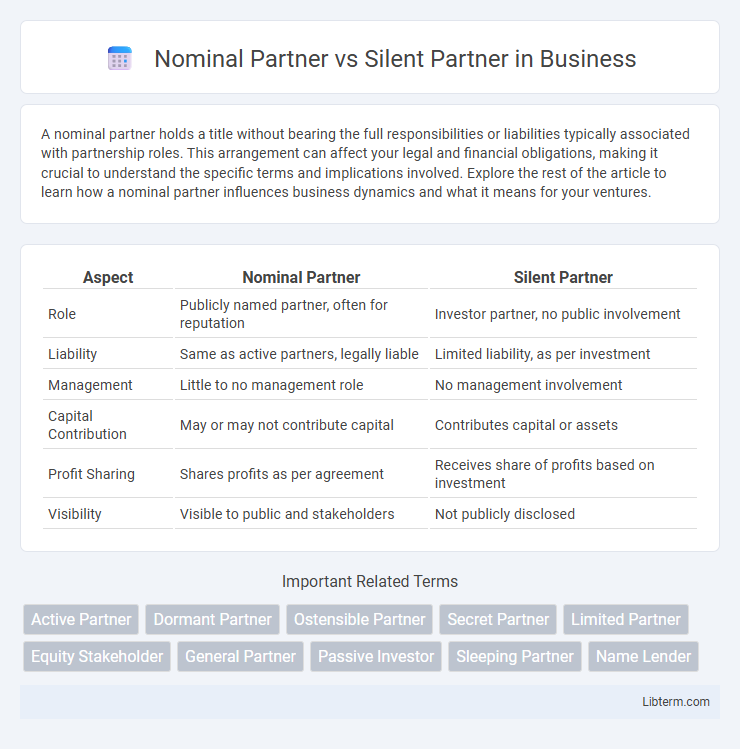

| Aspect | Nominal Partner | Silent Partner |

|---|---|---|

| Role | Publicly named partner, often for reputation | Investor partner, no public involvement |

| Liability | Same as active partners, legally liable | Limited liability, as per investment |

| Management | Little to no management role | No management involvement |

| Capital Contribution | May or may not contribute capital | Contributes capital or assets |

| Profit Sharing | Shares profits as per agreement | Receives share of profits based on investment |

| Visibility | Visible to public and stakeholders | Not publicly disclosed |

Understanding Nominal and Silent Partners

Understanding nominal and silent partners involves recognizing their distinct roles within a business partnership. A nominal partner lends their name to the business without actively managing operations or sharing in profits and losses, primarily enhancing the company's credibility. In contrast, a silent partner invests capital and shares profits but remains uninvolved in daily management and decision-making processes.

Key Responsibilities of a Nominal Partner

A Nominal Partner primarily lends their name and reputation to a business without actively engaging in day-to-day operations or financial liabilities. Key responsibilities include endorsing company documents, representing the firm in public forums, and enhancing credibility to attract investors or clients. Unlike Silent Partners, Nominal Partners do not contribute capital but possess a visible role that supports business legitimacy.

Role and Rights of a Silent Partner

A silent partner contributes capital to a business but remains uninvolved in its daily operations and management, limiting their role to financial support without active decision-making responsibilities. They retain rights to share in the business profits and losses proportional to their investment but typically have no authority to bind the partnership legally or influence its strategic direction. The silent partner's protection relies on the partnership agreement, ensuring they receive financial returns while avoiding managerial risks and liabilities.

Legal Implications for Nominal and Silent Partners

Nominal partners are individuals who lend their name to a partnership without engaging in its active management or bearing liability for its debts, making their legal risk minimal but potentially significant if misrepresentation occurs. Silent partners contribute capital and share profits and losses while remaining uninvolved in daily operations; legally, they typically enjoy limited liability but can be held responsible for partnership obligations depending on the jurisdiction. Understanding the nuanced legal distinctions for nominal and silent partners ensures proper risk management and compliance with partnership laws.

Financial Liability: Nominal vs Silent Partners

Nominal partners hold their name in the business without incurring financial liability for its debts, serving mainly as a figurehead to enhance reputation. Silent partners invest capital and share in the profits and losses but remain financially liable for the partnership's obligations. Understanding the distinction in financial liability helps clarify the roles and risks involved in business partnerships.

Decision-Making Power Explained

Nominal partners hold no real decision-making power and merely lend their name or reputation to a business without participating in daily operations or management. Silent partners contribute capital and share profits but typically do not engage in business decisions or influence company policies. Both roles differ significantly from active partners who possess full decision-making authority and operational control.

Involvement in Daily Business Operations

A Nominal Partner typically has little to no involvement in the daily business operations, serving primarily a lending name or reputation to the partnership. In contrast, a Silent Partner may invest capital and share profits but remains entirely uninvolved in managing day-to-day activities. The distinction lies in the operational participation, where Nominal Partners might engage minimally, whereas Silent Partners deliberately avoid operational roles.

Risks and Rewards for Each Partner Type

Nominal partners face limited financial risks as their primary role is to lend their name without engaging in daily management, yet they gain reputational rewards without liability for business debts. Silent partners contribute capital and share profits while remaining uninvolved in operations, exposing themselves to financial risks proportional to their investment but protecting their personal assets from business liabilities. Both partner types benefit from profit sharing, though the degree of risk and active involvement significantly differs, impacting their overall rewards and legal responsibilities.

Choosing Between Nominal and Silent Partnership

Choosing between a nominal partner and a silent partner depends on the desired level of involvement and liability in the business. A nominal partner lends their name to the firm without sharing profits or losses and typically has limited liability, ideal for enhancing credibility without financial risk. In contrast, a silent partner invests capital, shares profits and losses, and remains inactive in daily operations, balancing financial participation with limited public association.

Case Studies: Real-World Examples

Case studies reveal Nominal Partners often appear in legal documents without active involvement, such as in the Enron scandal where silent names masked true management roles. Silent Partners typically invest capital but abstain from daily operations, exemplified by the Starbucks expansion where silent investors provided funds while founders managed growth. Analyzing these real-world examples highlights how their distinct roles influence business transparency, liability, and strategic control.

Nominal Partner Infographic

libterm.com

libterm.com