White Knight symbolizes a heroic figure offering protection and aid in challenging situations, often depicted as a chivalrous and noble warrior. This archetype appears across literature, business, and mythology, representing courage, integrity, and selflessness. Discover how the concept of the White Knight can inspire your actions and mindset by reading the full article.

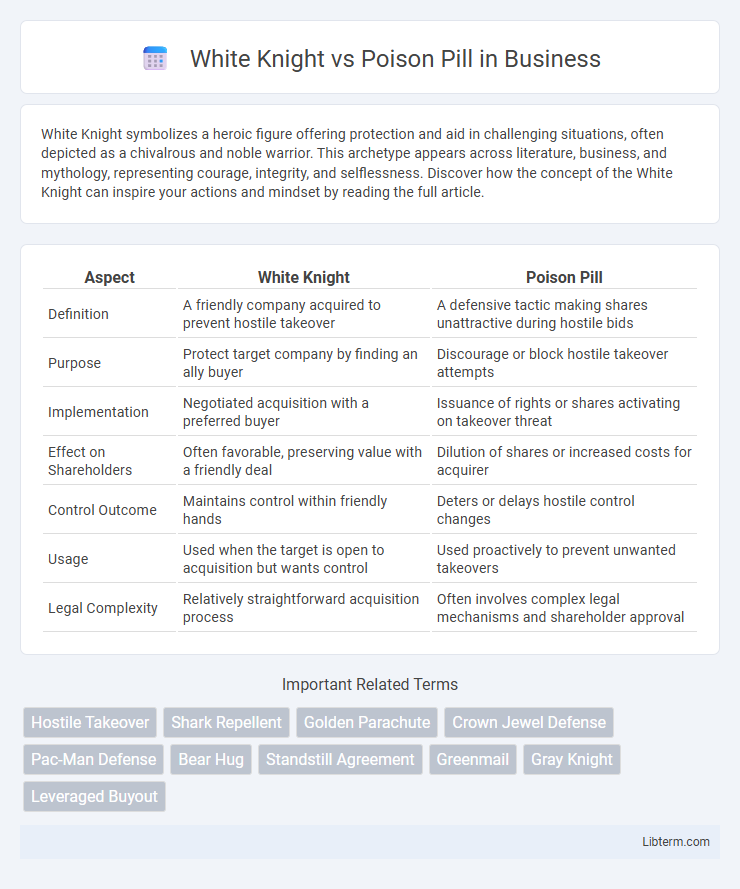

Table of Comparison

| Aspect | White Knight | Poison Pill |

|---|---|---|

| Definition | A friendly company acquired to prevent hostile takeover | A defensive tactic making shares unattractive during hostile bids |

| Purpose | Protect target company by finding an ally buyer | Discourage or block hostile takeover attempts |

| Implementation | Negotiated acquisition with a preferred buyer | Issuance of rights or shares activating on takeover threat |

| Effect on Shareholders | Often favorable, preserving value with a friendly deal | Dilution of shares or increased costs for acquirer |

| Control Outcome | Maintains control within friendly hands | Deters or delays hostile control changes |

| Usage | Used when the target is open to acquisition but wants control | Used proactively to prevent unwanted takeovers |

| Legal Complexity | Relatively straightforward acquisition process | Often involves complex legal mechanisms and shareholder approval |

Understanding the White Knight Strategy

The White Knight strategy involves a friendly investor or company stepping in to acquire a target firm facing a hostile takeover, offering a more favorable alternative than the hostile bidder. This tactic preserves the target company's management and strategic direction while preventing the hostile party from gaining control. By choosing a White Knight, the target avoids the negative impacts of a Poison Pill defense, which typically dilutes shares or imposes restrictions to make hostile takeovers prohibitively expensive.

What is a Poison Pill Defense?

A Poison Pill defense is a corporate strategy used by companies to prevent hostile takeovers by making their stock less attractive or diluting the value for potential acquirers. This tactic often involves issuing new shares or rights to existing shareholders, which can drastically increase the cost of acquisition. White Knight strategies, in contrast, involve a friendly company acquiring the target firm to avoid an unfriendly bidder.

Key Differences: White Knight vs Poison Pill

The key difference between a White Knight and a Poison Pill lies in their roles during corporate takeovers: a White Knight is a friendly investor or company that acquires a target firm to prevent a hostile takeover, whereas a Poison Pill is a defensive strategy employed by the target company itself to make the takeover prohibitively expensive or unattractive. White Knights provide an alternative buyer who often preserves the management and strategic direction, while Poison Pills deter acquirers by diluting shares or creating financial penalties. In essence, White Knights are external saviors, and Poison Pills are internal mechanisms to protect shareholder interests.

How White Knights Prevent Hostile Takeovers

White knights prevent hostile takeovers by offering a friendly acquisition alternative to the target company's management, ensuring business continuity and preserving shareholder value. This strategic move dilutes the hostile bidder's influence, making unwanted mergers costlier or less attractive. By aligning with a white knight, companies maintain greater control over their fate while avoiding aggressive buyout tactics often associated with poison pills.

Poison Pill Tactics and Variations

Poison pill tactics are defensive strategies used by companies to prevent hostile takeovers by making the firm less attractive or more costly to the acquirer. Variations include the flip-in, which allows existing shareholders except the acquirer to buy additional shares at a discount, and the flip-over, enabling shareholders to buy the acquirer's shares post-merger at a reduced price. These mechanisms dilute the potential ownership and increase the financial burden for the hostile bidder, effectively deterring unsolicited takeover attempts.

Advantages of Using a White Knight

A White Knight offers targeted protection by bringing in a friendly investor to acquire a struggling company, preserving management control and corporate culture while deterring hostile takeovers. This strategy enhances shareholder value by fostering collaboration and preventing undervalued buyouts common with Poison Pills. Unlike Poison Pills that dilute ownership, a White Knight provides strategic partnerships that can stabilize the company financially and operationally.

Drawbacks of Poison Pill Strategies

Poison pill strategies can deter hostile takeovers by diluting the acquirer's shares, but they often lead to shareholder dilution and reduced stock value. These tactics may also create negative perceptions among investors, potentially harming a company's market reputation. The complexity and legal challenges of implementing poison pills can incur significant costs and distract management from core business operations.

Real-World Examples: White Knight Interventions

White Knight interventions occur when a friendly investor acquires a struggling company to prevent a hostile takeover, exemplified by Microsoft's 2008 investment in Yahoo to block Google's acquisition attempts. Another notable example is Singapore Airlines' 2000 White Knight role in rescuing Thai Airways during its financial crisis, preserving management control and shareholder value. These interventions highlight the strategic use of White Knights to maintain corporate stability and fend off aggressive takeover bids.

Notable Companies Employing Poison Pills

Notable companies employing poison pills include Netflix, which adopted a shareholder rights plan to prevent hostile takeovers and protect long-term strategic vision. Technology giant Amazon implemented a poison pill strategy in 2018 to deter activist investors and maintain board control. Other major firms like Papa John's and Twitter have also used poison pills effectively to safeguard against unsolicited acquisition attempts and preserve company autonomy.

Choosing the Right Defense: Strategic Considerations

Choosing the right defense against hostile takeovers involves weighing the strategic merits of a White Knight versus a Poison Pill. A White Knight enables a friendly third-party acquisition that preserves company value and management control, often appealing when seeking a collaborative partner. Poison Pills deter hostile bids by diluting shares and making takeover attempts costly, ideal for preserving shareholder value when immediate acquisition threats arise.

White Knight Infographic

libterm.com

libterm.com