Basel I established the first set of international banking regulations focused on credit risk and capital adequacy, setting minimum capital requirements for banks worldwide. This framework aimed to strengthen the stability and soundness of the global financial system by ensuring banks maintained sufficient capital buffers. Explore the rest of the article to understand how Basel I influenced subsequent regulatory developments and impacts on Your banking operations.

Table of Comparison

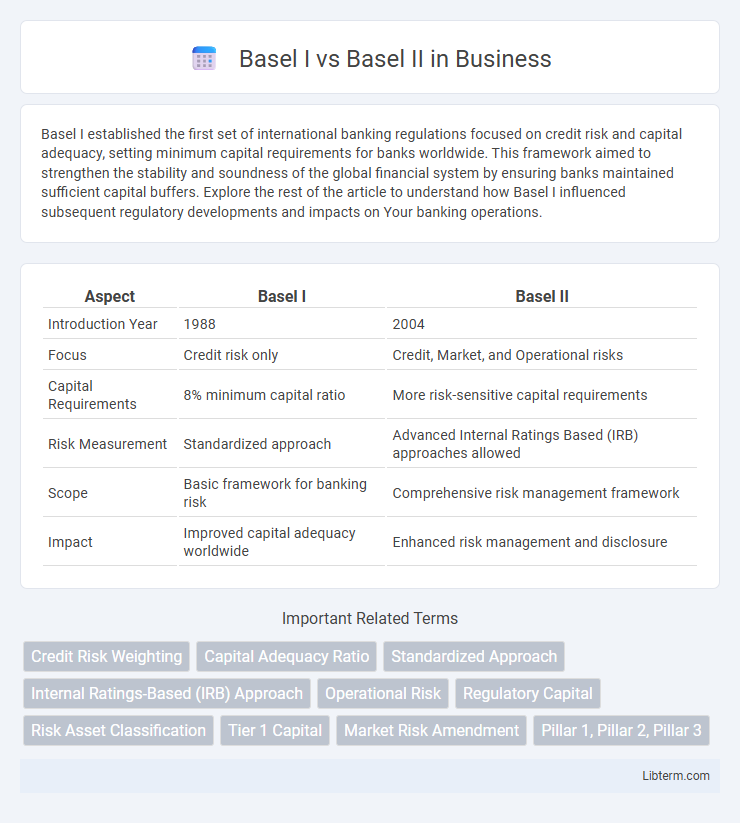

| Aspect | Basel I | Basel II |

|---|---|---|

| Introduction Year | 1988 | 2004 |

| Focus | Credit risk only | Credit, Market, and Operational risks |

| Capital Requirements | 8% minimum capital ratio | More risk-sensitive capital requirements |

| Risk Measurement | Standardized approach | Advanced Internal Ratings Based (IRB) approaches allowed |

| Scope | Basic framework for banking risk | Comprehensive risk management framework |

| Impact | Improved capital adequacy worldwide | Enhanced risk management and disclosure |

Introduction to Basel Accords

Basel I, introduced in 1988 by the Basel Committee on Banking Supervision, established minimum capital requirements primarily based on credit risk to enhance banking sector stability. Basel II, published in 2004, built upon Basel I by introducing a more comprehensive framework addressing credit, market, and operational risks, improving risk sensitivity through three pillars: minimum capital requirements, supervisory review, and market discipline. These international regulatory accords aim to ensure banks maintain adequate capital to safeguard against financial and economic uncertainties.

Historical Background of Basel I and Basel II

Basel I, introduced in 1988 by the Basel Committee on Banking Supervision, established the first comprehensive set of international banking regulations focused on capital adequacy and credit risk, setting a minimum capital requirement of 8% for banks. Basel II, published in 2004, built on Basel I's framework by incorporating a more risk-sensitive approach with three pillars: minimum capital requirements, supervisory review, and market discipline, aiming to improve risk management and regulatory oversight. The historical evolution from Basel I to Basel II reflects the global banking sector's response to increased financial complexity and the need for more sophisticated and comprehensive regulatory standards.

Key Objectives of Basel I

Basel I primarily aimed to establish a minimum capital requirement framework to enhance the stability of international banking by focusing on credit risk and categorizing bank assets into risk-weighted classes. It introduced the concept of risk-weighted assets (RWA) and set a minimum capital adequacy ratio (CAR) of 8% to ensure banks maintained sufficient capital buffers. This framework sought to promote solvency and reduce systemic risk by encouraging banks to hold capital proportional to their risk exposure.

Fundamental Principles of Basel II

Basel II builds upon Basel I by introducing a more comprehensive risk-sensitive framework that encompasses credit, market, and operational risks, enhancing the regulatory capital requirements for banks. The Fundamental Principles of Basel II include minimum capital requirements, supervisory review process, and market discipline through increased disclosure, aiming to ensure banks maintain adequate capital aligned with their risk profiles. This approach promotes stability in the financial system by encouraging better risk management practices and improving transparency compared to the simpler, more uniform capital rules under Basel I.

Capital Adequacy Requirements: Basel I vs Basel II

Basel I established a minimum capital adequacy ratio of 8%, primarily focusing on credit risk with a standardized risk-weighting approach for bank assets. Basel II enhanced these requirements by introducing a three-pillar framework emphasizing risk-sensitive capital calculations, including credit risk, operational risk, and market risk, allowing banks to use internal rating-based models for more accurate capital assessment. Consequently, Basel II's refined capital adequacy requirements aimed to improve risk management and regulatory oversight compared to the more rigid, simplistic Basel I standards.

Risk Measurement Approaches Compared

Basel I primarily used a standardized approach with fixed risk weights based on broad asset categories, offering limited sensitivity to actual risk levels. Basel II introduced more advanced risk measurement approaches, including the Internal Ratings-Based (IRB) methods for credit risk, which allow banks to use internal models to estimate probability of default (PD), loss given default (LGD), and exposure at default (EAD). Operational risk measurement also evolved from a basic indicator approach to more sophisticated methods like the Standardized Approach and Advanced Measurement Approaches, enhancing the precision of capital requirement calculations.

Credit Risk Assessment in Basel I and II

Basel I introduced a standardized approach to credit risk assessment by categorizing assets into broad risk buckets with fixed risk weights, simplifying capital requirement calculations but lacking sensitivity to borrower creditworthiness. Basel II enhanced credit risk assessment by incorporating advanced approaches such as the Internal Ratings-Based (IRB) method, allowing banks to use their own risk models and internal data to estimate Probability of Default (PD), Loss Given Default (LGD), and Exposure at Default (EAD). This shift enabled more risk-sensitive capital allocation and improved alignment between regulatory capital and actual credit risk exposure.

Implementation Challenges of Basel I and II

Basel I implementation faced challenges such as its simplistic risk-weighting approach, which inadequately captured credit risk variations across different asset classes, leading to regulatory arbitrage. Basel II introduced more sophisticated risk-sensitive frameworks, but its complexity required banks to develop advanced internal models and extensive data collection systems, presenting significant operational and compliance burdens. Both frameworks encountered difficulties in globally consistent application due to differing regulatory capacities and interpretations among jurisdictions.

Impact on Global Banking Sector

Basel I established the foundation for risk-based capital requirements, compelling global banks to maintain a minimum capital adequacy ratio and enhancing financial stability by reducing credit risk exposure. Basel II introduced more sophisticated risk assessment methodologies, including operational and market risk frameworks, enabling banks to refine capital allocation and improve risk management practices. The transition from Basel I to Basel II increased regulatory complexity and transparency, fostering a more resilient global banking sector through improved risk sensitivity and supervisory review processes.

Basel I vs Basel II: Key Differences and Future Implications

Basel I introduced a standardized framework primarily focusing on credit risk with fixed risk weights for asset classes, while Basel II enhanced this by incorporating three pillars: minimum capital requirements, supervisory review, and market discipline, along with advanced risk measurement techniques including operational and market risks. Basel II's approach allowed banks to use internal ratings-based models and more sophisticated risk assessment, leading to better alignment of regulatory capital with actual risk profiles. Future implications of Basel II include improved risk management practices, greater emphasis on transparency, and the foundation for subsequent frameworks like Basel III that address systemic risks and financial stability.

Basel I Infographic

libterm.com

libterm.com