Direct listing allows companies to go public without issuing new shares, offering liquidity to existing shareholders while avoiding underwriting fees. This method provides a transparent market-driven price discovery and greater control over the offering process. Explore this article to understand how your business can benefit from a direct listing.

Table of Comparison

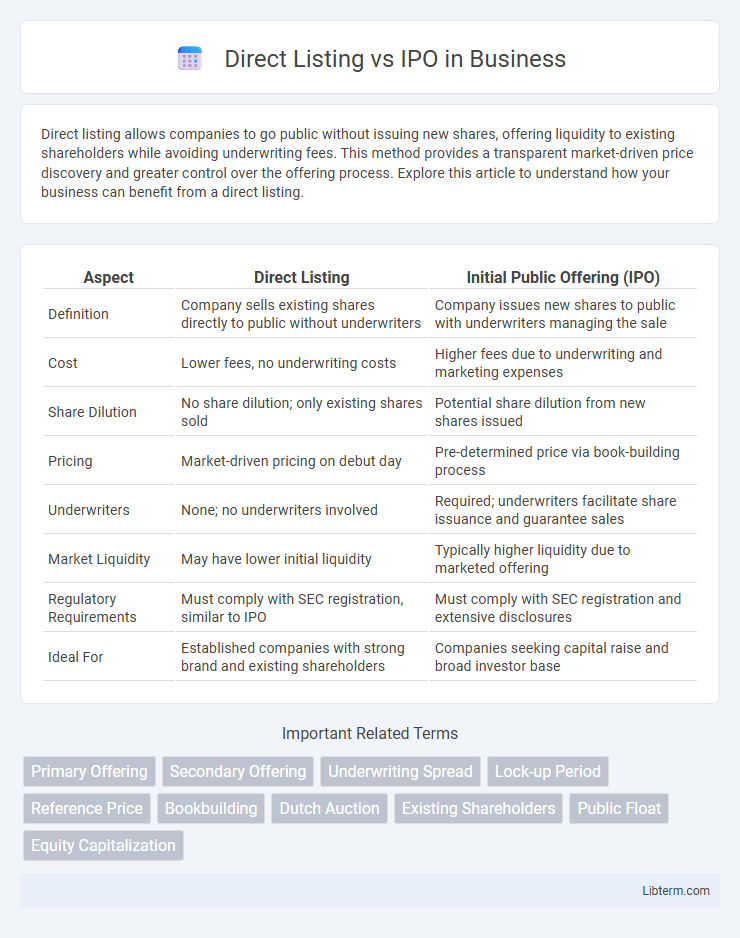

| Aspect | Direct Listing | Initial Public Offering (IPO) |

|---|---|---|

| Definition | Company sells existing shares directly to public without underwriters | Company issues new shares to public with underwriters managing the sale |

| Cost | Lower fees, no underwriting costs | Higher fees due to underwriting and marketing expenses |

| Share Dilution | No share dilution; only existing shares sold | Potential share dilution from new shares issued |

| Pricing | Market-driven pricing on debut day | Pre-determined price via book-building process |

| Underwriters | None; no underwriters involved | Required; underwriters facilitate share issuance and guarantee sales |

| Market Liquidity | May have lower initial liquidity | Typically higher liquidity due to marketed offering |

| Regulatory Requirements | Must comply with SEC registration, similar to IPO | Must comply with SEC registration and extensive disclosures |

| Ideal For | Established companies with strong brand and existing shareholders | Companies seeking capital raise and broad investor base |

Understanding Direct Listings and IPOs

Direct listings allow companies to sell existing shares directly to the public without issuing new shares, avoiding underwriting fees and dilution of ownership, while IPOs involve underwriters who issue new shares to raise capital and provide price support. In a direct listing, pricing is market-driven and determined by supply and demand on the first day of trading, whereas IPO prices are set by underwriters before the shares start trading. Understanding these differences is crucial for companies and investors to choose the appropriate method for going public based on capital needs and market conditions.

Key Differences Between Direct Listings and IPOs

Direct listings bypass underwriters, allowing existing shareholders to sell shares directly to the public, while IPOs involve issuing new shares through underwriters to raise capital. In direct listings, there is often no lock-up period restricting insiders from selling shares immediately, whereas IPOs typically enforce lock-up periods to stabilize stock prices post-launch. Pricing in direct listings is market-driven from the start, contrasting with IPOs where underwriters set an initial offering price through a book-building process.

How Direct Listings Work

Direct listings allow companies to list existing shares directly on a public stock exchange without issuing new shares or raising capital. This process bypasses underwriters, enabling existing shareholders to sell their shares directly to the public, providing greater liquidity and reduced dilution of ownership. Typically, direct listings rely on market demand to determine share prices, contrasting with IPOs that set initial prices through book-building and underwriting.

How IPOs Work

Initial Public Offerings (IPOs) involve a company working with underwriters to set an offering price and allocate shares to institutional investors before trading begins publicly. This process includes rigorous regulatory filing, such as submitting a prospectus to the Securities and Exchange Commission (SEC), to ensure transparency and compliance. IPOs create immediate liquidity for early investors and fund company growth through capital raised from the public market.

Advantages of Direct Listings

Direct listings offer companies the advantage of bypassing underwriters, reducing expensive fees and allowing existing shareholders to sell shares freely, leading to potential cost savings. They provide greater price transparency as the market determines the share price without traditional roadshows or price ranges set by underwriters. This method also enables faster access to public markets, giving companies flexibility in timing and minimizing dilution of ownership.

Advantages of IPOs

IPOs provide companies with a substantial capital influx by offering new shares to the public, facilitating significant growth and expansion opportunities. They enhance market visibility and credibility, attracting institutional investors and increasing stock liquidity. Regulatory scrutiny during IPOs boosts transparency and investor confidence, often leading to higher long-term valuation.

Risks and Challenges of Direct Listings

Direct listings pose risks such as price volatility due to the absence of traditional underwriters stabilizing the stock price, potentially leading to unpredictable market reactions. The lack of a fixed offering price can result in low initial liquidity, creating challenges for investors and companies in accurately gauging market demand. Furthermore, companies bypass the capital-raising component typical in IPOs, which can limit immediate access to new funds and increase reliance on market conditions for future financing.

Risks and Challenges of IPOs

IPOs involve extensive regulatory scrutiny, high underwriting fees, and pricing uncertainty, which can lead to volatile stock performance post-listing. Market conditions at the time of an IPO significantly impact valuation, increasing the risk of undervaluation or overvaluation. Companies also face stringent disclosure requirements and potential loss of control due to shareholder demands and institutional investor influence.

Choosing the Right Route: Factors to Consider

Choosing between a direct listing and an IPO depends on factors such as company goals, capital needs, and market conditions. Direct listings allow existing shareholders to sell shares without raising new capital, ideal for companies with strong brand recognition and stable financials. IPOs are better suited for companies seeking to raise substantial capital while leveraging underwriter support and broader investor access.

Direct Listing vs IPO: Which Is Better for Your Company?

Direct listings offer companies a cost-effective alternative to traditional IPOs by eliminating underwriting fees and allowing existing shareholders to sell shares immediately. IPOs provide price stability through underwriters and raise fresh capital, but involve longer timelines and higher costs. Choosing between a direct listing and an IPO depends on a company's capital needs, market readiness, and desire for control over pricing and share distribution.

Direct Listing Infographic

libterm.com

libterm.com