Strategic investors bring industry expertise and long-term value beyond just capital, aligning closely with a company's growth objectives. Their involvement can accelerate innovation, expand market reach, and provide competitive advantages within your sector. Discover how partnering with a strategic investor can transform your business by reading the rest of the article.

Table of Comparison

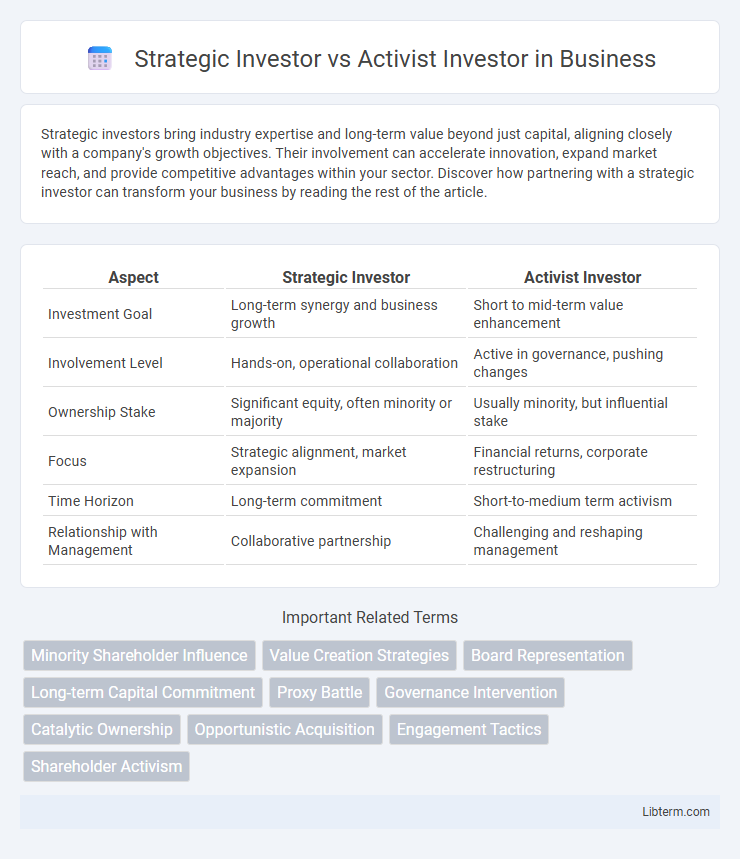

| Aspect | Strategic Investor | Activist Investor |

|---|---|---|

| Investment Goal | Long-term synergy and business growth | Short to mid-term value enhancement |

| Involvement Level | Hands-on, operational collaboration | Active in governance, pushing changes |

| Ownership Stake | Significant equity, often minority or majority | Usually minority, but influential stake |

| Focus | Strategic alignment, market expansion | Financial returns, corporate restructuring |

| Time Horizon | Long-term commitment | Short-to-medium term activism |

| Relationship with Management | Collaborative partnership | Challenging and reshaping management |

Defining Strategic Investors

Strategic investors typically seek long-term partnerships aligned with their core business objectives, aiming to leverage investments for synergies and market expansion. These investors prioritize value creation through collaboration, often bringing industry expertise and operational support to the portfolio company. Unlike activist investors who push for immediate changes, strategic investors focus on sustained growth and integration within broader corporate strategies.

Understanding Activist Investors

Activist investors actively seek to influence a company's management and policies to unlock shareholder value, often by launching proxy battles, proposing strategic changes, or advocating for board seats. Unlike strategic investors who invest primarily for long-term synergies and operational integration, activist investors focus on driving immediate changes in governance, capital allocation, or business strategies. Understanding activist investors requires recognizing their tactical approach to corporate engagement aimed at improving performance and increasing stock value rapidly.

Key Objectives: Strategic vs. Activist Investors

Strategic investors primarily seek long-term value creation by aligning investments with their core business operations to enhance synergies and competitive advantage. Activist investors focus on driving immediate changes in management, governance, or capital structure to unlock shareholder value and influence corporate strategy. Key objectives for strategic investors include market expansion and technological integration, while activist investors prioritize operational improvements and shareholder returns.

Investment Approaches and Methods

Strategic investors typically focus on long-term value creation by aligning investments with their core business objectives, leveraging synergies, and fostering collaborative partnerships. Activist investors employ aggressive tactics to influence management decisions, often through proxy battles, public campaigns, and board representation to unlock shareholder value. While strategic investors emphasize integration and operational improvements, activist investors prioritize governance changes and restructuring to maximize returns.

Impact on Company Management

Strategic investors typically seek long-term alignment with company management to support growth and operational synergies, often participating in board decisions without drastically altering leadership. Activist investors pursue more aggressive changes by pushing for management restructuring, cost-cutting, or shifts in corporate strategy to unlock shareholder value. The impact on company management varies significantly, with strategic investors fostering collaboration, while activist investors may lead to increased management turnover and strategic overhaul.

Influence on Corporate Governance

Strategic investors typically influence corporate governance by aligning management decisions with long-term operational goals and industry expertise, often seeking board representation to drive synergies and sustainable growth. Activist investors exert pressure on companies to implement immediate changes, such as restructuring or cost-cutting, through public campaigns and proxy battles, aiming to unlock shareholder value. Both types of investors impact governance, but strategic investors emphasize collaborative influence, while activists prioritize transformational and often confrontational interventions.

Risk Factors and Potential Returns

Strategic investors typically assume lower risk by leveraging industry expertise and long-term synergies, which can lead to steady, stable returns aligned with business growth. Activist investors face higher risk due to aggressive tactics aimed at restructuring or influencing management decisions, potentially resulting in volatile but substantial returns if their objectives are met. Both investment types require careful assessment of market conditions and company fundamentals to balance risk exposure with expected financial gains.

Examples of Strategic and Activist Investment

Strategic investors typically include companies or entities like Berkshire Hathaway investing in Apple to gain long-term synergy or market influence, while activist investors such as Elliott Management engage with companies like AT&T to push for management changes or asset restructuring. Strategic investments often aim for collaborative growth and competitive advantage, exemplified by Google's investment in Uber to enhance technological innovation. Activist investments focus on unlocking shareholder value through direct intervention, demonstrated by Carl Icahn's involvement with Apple to advocate for stock buybacks and governance reforms.

Pros and Cons for Companies

Strategic investors often bring industry expertise, long-term commitments, and potential synergies, enhancing company growth and market positioning, but their involvement may limit managerial autonomy and prioritize industry-specific goals over broader shareholder interests. Activist investors typically push for operational improvements, governance changes, and increased shareholder value, which can drive short-term performance gains, yet their aggressive tactics might lead to management disruptions and a focus on immediate returns at the expense of sustainable growth. Companies must weigh the benefits of strategic partnerships against the risks of activist pressures to align investor roles with their long-term objectives.

Choosing the Right Investor for Your Business

Choosing the right investor for your business hinges on your long-term goals and desired level of involvement. Strategic investors often bring industry expertise, valuable partnerships, and a collaborative approach to growth, making them ideal for companies seeking synergies and market expansion. Activist investors prioritize governance changes and operational improvements, which can drive rapid transformation but may lead to conflicts if their aggressive tactics clash with the company's vision.

Strategic Investor Infographic

libterm.com

libterm.com