Operating cost refers to the expenses incurred during the day-to-day functioning of a business, including costs like rent, utilities, salaries, and maintenance. Managing these costs effectively can significantly improve your company's profitability and sustainability. Explore the rest of the article to learn strategies for controlling and reducing operating costs.

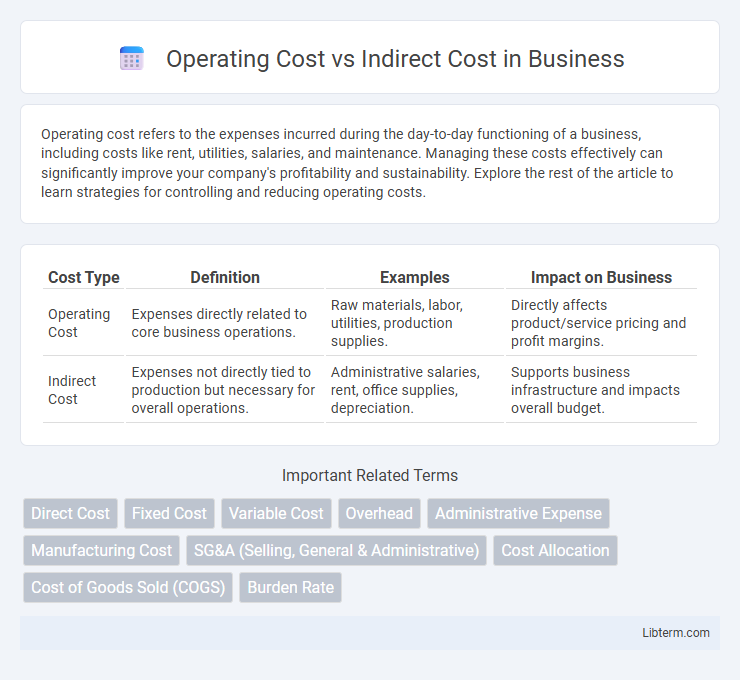

Table of Comparison

| Cost Type | Definition | Examples | Impact on Business |

|---|---|---|---|

| Operating Cost | Expenses directly related to core business operations. | Raw materials, labor, utilities, production supplies. | Directly affects product/service pricing and profit margins. |

| Indirect Cost | Expenses not directly tied to production but necessary for overall operations. | Administrative salaries, rent, office supplies, depreciation. | Supports business infrastructure and impacts overall budget. |

Understanding Operating Costs: Definition and Types

Operating costs encompass all expenses directly related to the day-to-day functioning of a business, including raw materials, labor, and utilities. These costs are categorized into fixed operating costs, such as rent and salaries, and variable operating costs, which fluctuate with production volume like shipping and inventory expenses. Understanding operating costs is essential for budgeting, pricing strategies, and improving overall operational efficiency.

Defining Indirect Costs in Business Finance

Indirect costs in business finance refer to expenses not directly tied to specific business operations or products but necessary for overall functioning, such as rent, utilities, and administrative salaries. These costs differ from operating costs, which encompass direct expenses like raw materials and labor used in production. Properly identifying and allocating indirect costs is crucial for accurate financial analysis and budgeting.

Key Differences Between Operating and Indirect Costs

Operating costs refer to expenses directly associated with the core business activities, such as raw materials, labor, and utilities needed for production. Indirect costs, on the other hand, include overhead expenses like administrative salaries, rent, and office supplies that support operations but are not directly tied to a specific product or service. The key difference lies in traceability: operating costs are directly traceable to products or services, whereas indirect costs are allocated across multiple cost centers due to their generalized nature.

Examples of Operating Costs in Various Industries

Operating costs include expenses directly related to the core activities of a business, such as raw materials, labor, utilities, and maintenance. In manufacturing, examples include raw material purchases and factory worker wages, while in retail, operating costs encompass inventory acquisition and store staffing. Service industries like healthcare incur operating costs through medical supplies and salaried healthcare professionals, distinct from indirect costs like administrative expenses or depreciation.

Common Indirect Costs in Organizational Budgets

Common indirect costs in organizational budgets typically include utilities, rent, administrative salaries, and depreciation expenses. These costs are not directly tied to specific projects or products but support overall business operations, making them essential for accurate financial planning. Understanding the distinction between operating costs and indirect costs helps organizations allocate resources effectively and maintain budget transparency.

Impact of Operating Costs on Profitability

Operating costs, including direct expenses like labor and materials, significantly influence a company's profitability by affecting gross margin and cash flow. Indirect costs, such as administrative expenses and overhead, indirectly impact profit but can be managed to optimize operational efficiency. Effective control of operating costs enhances net income and provides a competitive advantage in financial performance.

Allocating Indirect Costs for Accurate Financial Reporting

Allocating indirect costs accurately is essential for precise financial reporting, as these expenses, unlike direct operating costs, are not easily traceable to a single cost object. Effective allocation methods such as activity-based costing increase transparency by distributing overhead costs based on actual resource usage, improving cost control and profitability analysis. Proper allocation ensures that financial statements reflect the true cost structure, supporting better budgeting and strategic decision-making.

Strategies to Optimize Operating and Indirect Costs

Implementing automation technologies and streamlining workflows reduce operating costs by enhancing efficiency and minimizing manual labor. Conducting regular audits and renegotiating supplier contracts effectively manage indirect costs, ensuring overhead expenses stay within budget. Leveraging data analytics enables precise tracking of cost drivers, facilitating targeted cost-saving strategies for both operating and indirect expenditures.

Operating Cost vs Indirect Cost: Which Matters More?

Operating costs directly impact a company's profitability by encompassing expenses such as wages, raw materials, and utilities essential for daily operations. Indirect costs, including administrative expenses and maintenance, affect overall budgeting but do not correlate as closely with production levels. Understanding the distinction is crucial, yet operating costs typically matter more for assessing operational efficiency and cost control.

Conclusion: Balancing Operating and Indirect Expenses

Balancing operating and indirect expenses is essential for maintaining a company's financial health and optimizing profitability. Effective management requires precise allocation of indirect costs such as administrative salaries, utilities, and rent, alongside direct operating costs like raw materials and labor. Striking the right balance enhances budgeting accuracy, supports informed decision-making, and drives sustainable business growth.

Operating Cost Infographic

libterm.com

libterm.com