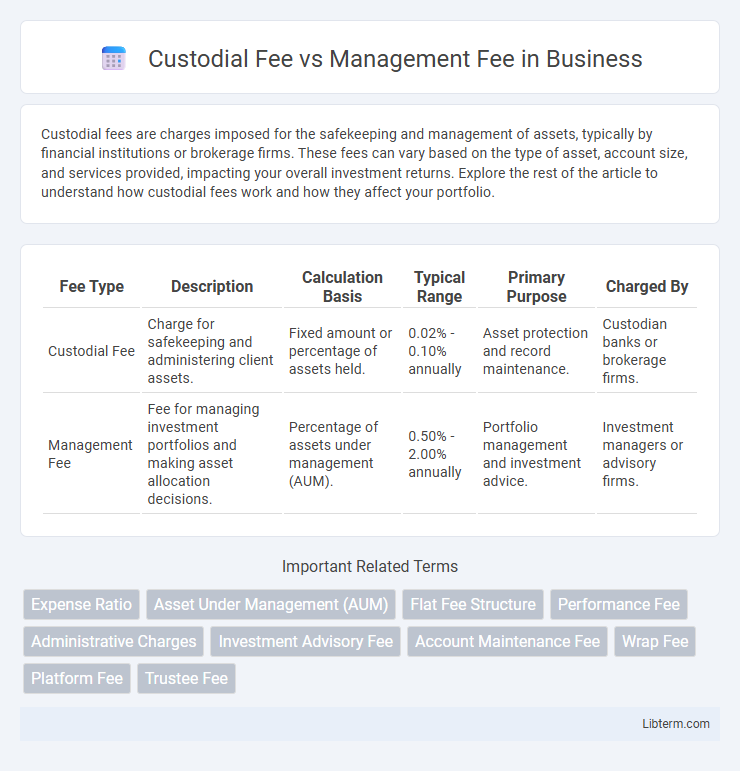

Custodial fees are charges imposed for the safekeeping and management of assets, typically by financial institutions or brokerage firms. These fees can vary based on the type of asset, account size, and services provided, impacting your overall investment returns. Explore the rest of the article to understand how custodial fees work and how they affect your portfolio.

Table of Comparison

| Fee Type | Description | Calculation Basis | Typical Range | Primary Purpose | Charged By |

|---|---|---|---|---|---|

| Custodial Fee | Charge for safekeeping and administering client assets. | Fixed amount or percentage of assets held. | 0.02% - 0.10% annually | Asset protection and record maintenance. | Custodian banks or brokerage firms. |

| Management Fee | Fee for managing investment portfolios and making asset allocation decisions. | Percentage of assets under management (AUM). | 0.50% - 2.00% annually | Portfolio management and investment advice. | Investment managers or advisory firms. |

Introduction to Custodial Fees and Management Fees

Custodial fees are charges levied by financial institutions for safekeeping and administering an investor's assets, including record-keeping and transaction processing. Management fees are fees paid to investment managers for portfolio management services, covering research, strategy development, and ongoing asset allocation. Understanding the distinction between custodial and management fees is crucial for evaluating investment costs and overall portfolio performance.

Definition: What is a Custodial Fee?

A custodial fee is a charge imposed by a financial institution or custodian for safekeeping and administering an investor's assets, such as stocks, bonds, or mutual funds. This fee covers services including asset protection, transaction processing, and record-keeping to ensure the security and accuracy of the investment holdings. Custodial fees differ from management fees, which are paid for professional portfolio management and investment strategy execution.

Definition: What is a Management Fee?

A management fee is a periodic charge levied by investment managers or fund companies to cover the costs of managing an investment portfolio or mutual fund. This fee compensates fund managers for their expertise, research, and administrative services involved in making investment decisions. Management fees are typically expressed as a percentage of the assets under management (AUM) and directly impact the net returns received by investors.

Key Differences Between Custodial and Management Fees

Custodial fees cover the cost of safeguarding an investor's assets within a brokerage or financial institution, ensuring secure record-keeping and transaction processing, whereas management fees are charged by investment managers for actively managing and making investment decisions on a portfolio. Custodial fees are typically flat or fixed charges, often lower in amount, while management fees are usually a percentage of assets under management (AUM), reflecting ongoing portfolio oversight. The key difference lies in custodial fees focusing on account maintenance and asset protection, while management fees compensate for investment strategy and performance management.

How Custodial Fees Are Calculated

Custodial fees are typically calculated based on a percentage of the assets held in custody, often ranging from 0.01% to 0.5% annually, depending on the institution and asset type. Some custodians charge a flat fee or tiered fees, where higher asset values benefit from lower rates. Understanding the fee structure is essential as it directly impacts the net returns of investment accounts.

How Management Fees Are Calculated

Management fees are typically calculated as a fixed percentage of the assets under management (AUM), often ranging from 0.5% to 2% annually, depending on the investment firm and account size. These fees are deducted periodically, usually quarterly or annually, directly from the investment portfolio. Unlike custodial fees, which cover the safekeeping and administration of assets, management fees compensate for investment strategy, portfolio management, and advisory services.

Impact of Fees on Investment Returns

Custodial fees and management fees both reduce net investment returns but affect them differently; custodial fees are typically fixed or transaction-based charges for safekeeping assets, while management fees are a percentage of assets under management, directly impacting compound growth over time. Higher management fees can significantly erode long-term portfolio performance due to their ongoing deduction from the invested capital, whereas custodial fees, although generally lower, add up especially with frequent transactions. Investors should carefully assess these fees, as even small differences in management fees can lead to substantial variations in accumulated wealth over decades.

Common Examples of Custodial and Management Fees

Custodial fees commonly include charges for account maintenance, transaction processing, and safekeeping of assets, often seen in brokerage and retirement accounts. Management fees typically represent a percentage of assets under management (AUM) and are charged by mutual funds, ETFs, and investment advisory services for portfolio oversight and strategy implementation. Examples such as a 0.25% annual fee for ETF management and a $50 quarterly custodial fee for 401(k) plans illustrate the distinct cost structures investors encounter.

How to Minimize Investment Account Fees

To minimize investment account fees, prioritize selecting funds with lower management fees, as these ongoing expenses directly affect your returns. Opt for custodians offering competitive custodial fees or accounts with waived fees for maintaining minimum balances or frequent trades. Regularly review fee disclosures and consider consolidating accounts to reduce overlapping custodial and management costs.

Choosing the Right Investment Account: Fee Considerations

Evaluating custodial fees and management fees is crucial when choosing the right investment account, as custodial fees cover account maintenance costs while management fees relate to portfolio oversight and advisory services. Lower custodial fees may benefit long-term investors by minimizing account holding expenses, whereas competitive management fees ensure expert asset allocation and performance management. Balancing these fees against expected returns and service levels helps investors select an account that aligns with their financial goals and cost sensitivity.

Custodial Fee Infographic

libterm.com

libterm.com