Bank loans offer a reliable way to secure funding for personal needs, business ventures, or major purchases by borrowing a fixed amount with agreed interest rates and repayment terms. Understanding the different types of bank loans, such as personal loans, mortgages, and business loans, helps you choose the best financing option tailored to your financial situation. Explore the full article to learn how to apply for a bank loan, improve your approval chances, and manage repayments effectively.

Table of Comparison

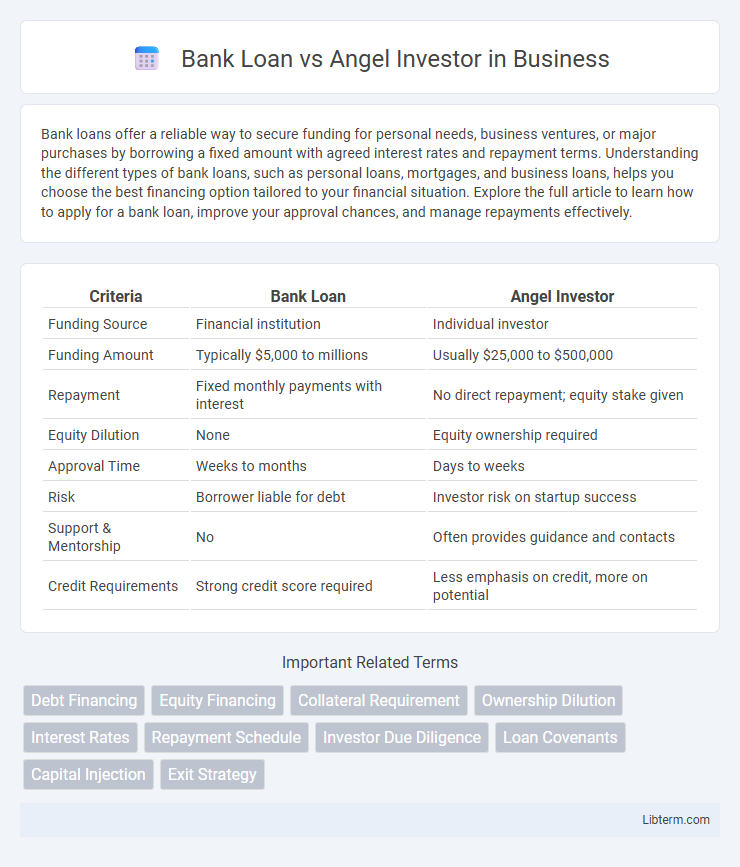

| Criteria | Bank Loan | Angel Investor |

|---|---|---|

| Funding Source | Financial institution | Individual investor |

| Funding Amount | Typically $5,000 to millions | Usually $25,000 to $500,000 |

| Repayment | Fixed monthly payments with interest | No direct repayment; equity stake given |

| Equity Dilution | None | Equity ownership required |

| Approval Time | Weeks to months | Days to weeks |

| Risk | Borrower liable for debt | Investor risk on startup success |

| Support & Mentorship | No | Often provides guidance and contacts |

| Credit Requirements | Strong credit score required | Less emphasis on credit, more on potential |

Introduction to Bank Loan vs Angel Investor

Bank loans provide businesses with a fixed amount of capital repayable over time with interest, often requiring collateral and a strong credit history. Angel investors offer equity financing by investing personal funds in early-stage companies, typically seeking ownership stakes and active involvement in business growth. Choosing between bank loans and angel investors depends on factors like funding needs, repayment capacity, control preferences, and risk tolerance.

Understanding Bank Loans: Key Features

Bank loans typically involve fixed interest rates, defined repayment schedules, and require collateral or strong credit history, making them a structured financing option for businesses. These loans offer predictability in budgeting due to consistent monthly payments, but approval depends heavily on financial statements and creditworthiness. Unlike angel investors, banks do not take equity stakes, allowing business owners to retain full ownership.

Who Are Angel Investors?

Angel investors are affluent individuals who provide capital to startups in exchange for equity or convertible debt, often during early funding rounds. They bring not only financial support but also valuable expertise, mentorship, and industry connections to help entrepreneurs grow their businesses. Unlike bank loans, angel investments usually do not require collateral or fixed repayments, allowing startups more flexibility in managing cash flow and business risks.

Application Process: Bank Loan vs Angel Investment

Applying for a bank loan involves a structured process requiring detailed financial statements, credit history, and collateral evaluation, often resulting in a longer approval time. Angel investor applications emphasize a compelling business pitch and growth potential, with investors conducting due diligence focused on the startup's innovation and market opportunity. Bank loans prioritize creditworthiness and repayment ability, while angel investments depend on the entrepreneur's vision and scalability prospects.

Eligibility Criteria and Requirements

Bank loans require a strong credit score, solid business financial statements, and collateral as eligibility criteria, emphasizing repayment ability and risk mitigation. Angel investors focus on the startup's growth potential, innovative business model, and the entrepreneur's expertise, often requiring a detailed pitch and equity stake negotiation. Banks demand formal documentation and rigid approval processes, while angel investors prioritize personal relationships and strategic alignment with the business vision.

Funding Amounts: How Much Can You Get?

Bank loans typically offer funding amounts ranging from $5,000 to several million dollars, depending on the borrower's creditworthiness, business plan, and collateral. Angel investors generally provide smaller funding amounts, usually between $25,000 and $500,000, targeting early-stage startups with high growth potential. Understanding these differences helps entrepreneurs choose the appropriate funding source based on the scale and purpose of their capital needs.

Repayment Terms and Ownership Implications

Bank loans require fixed repayment schedules with interest, maintaining full ownership for the borrower but adding financial liabilities and potential credit risks. Angel investors provide capital in exchange for equity, meaning no obligatory repayments but a partial transfer of ownership and decision-making control. Choosing between them depends on balancing repayment capacity against willingness to share business control and future profits.

Risk Analysis: Financial and Business Impact

Bank loans impose fixed repayment schedules and interest obligations that increase financial risk, especially for startups with uncertain cash flow, potentially leading to default or bankruptcy. Angel investors provide capital in exchange for equity, sharing business risk but diluting ownership, which can impact control and future profit distribution. Evaluating risk involves assessing cash flow stability, growth potential, and willingness to share decision-making authority to determine the optimal funding source.

Pros and Cons: Bank Loans vs Angel Investors

Bank loans offer fixed interest rates and predictable repayment schedules, providing financial stability but require strong credit history and collateral. Angel investors bring capital and mentorship, boosting startup growth potential but dilute ownership and expect equity returns. Choosing depends on creditworthiness, control preferences, and willingness to share company equity.

Choosing the Best Option for Your Business

Choosing between a bank loan and an angel investor depends on your business's funding needs, repayment capability, and growth potential. Bank loans offer fixed repayment schedules and retain full ownership but require strong credit and collateral, making them suitable for established businesses with predictable cash flow. Angel investors provide capital in exchange for equity, bringing valuable mentorship and networking opportunities ideal for startups seeking rapid expansion without immediate repayment pressure.

Bank Loan Infographic

libterm.com

libterm.com