A Certificate of Formation is a crucial legal document filed with the state to officially establish your business as a limited liability company (LLC) or corporation. It outlines essential details such as the company's name, registered agent, and business purpose, ensuring your enterprise is recognized and compliant with state regulations. Learn more about the importance of a Certificate of Formation and how it impacts your business by reading the full article.

Table of Comparison

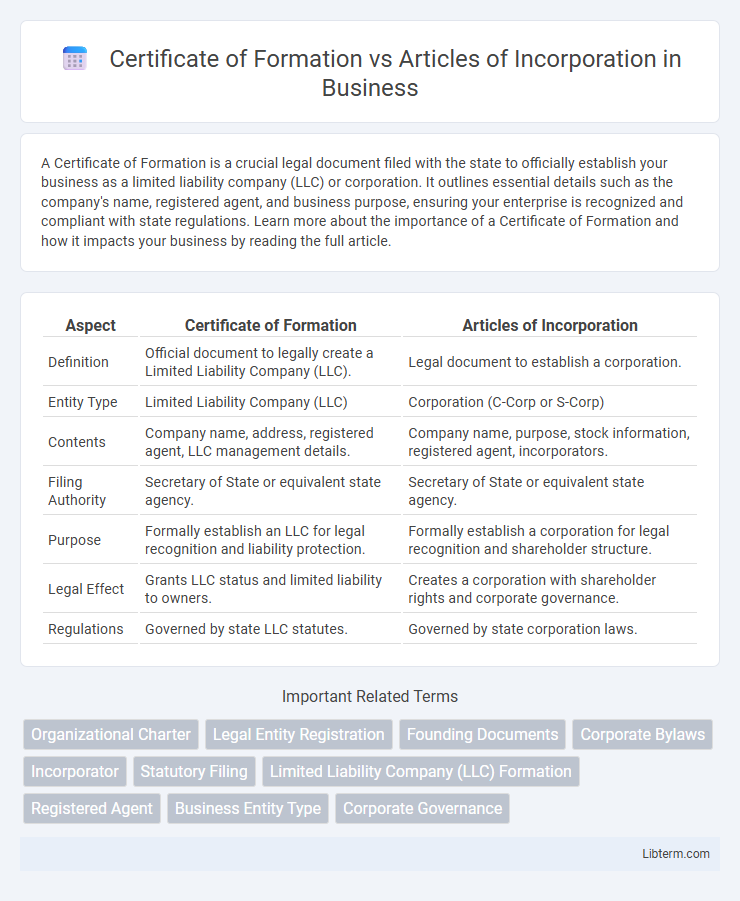

| Aspect | Certificate of Formation | Articles of Incorporation |

|---|---|---|

| Definition | Official document to legally create a Limited Liability Company (LLC). | Legal document to establish a corporation. |

| Entity Type | Limited Liability Company (LLC) | Corporation (C-Corp or S-Corp) |

| Contents | Company name, address, registered agent, LLC management details. | Company name, purpose, stock information, registered agent, incorporators. |

| Filing Authority | Secretary of State or equivalent state agency. | Secretary of State or equivalent state agency. |

| Purpose | Formally establish an LLC for legal recognition and liability protection. | Formally establish a corporation for legal recognition and shareholder structure. |

| Legal Effect | Grants LLC status and limited liability to owners. | Creates a corporation with shareholder rights and corporate governance. |

| Regulations | Governed by state LLC statutes. | Governed by state corporation laws. |

Introduction to Business Formation Documents

Certificate of Formation and Articles of Incorporation are essential business formation documents that legally establish a company within a specific state. The Certificate of Formation, commonly used for limited liability companies (LLCs), outlines basic details like business name, registered agent, and formation date. Articles of Incorporation primarily apply to corporations, detailing shareholder structure, corporate purpose, and the number of authorized shares to comply with state regulations and enable legal recognition.

What is a Certificate of Formation?

A Certificate of Formation is a legal document that officially establishes a limited liability company (LLC) with the state government, outlining basic information such as the company name, address, registered agent, and ownership structure. Unlike Articles of Incorporation, which are used specifically for forming corporations, the Certificate of Formation is tailored for LLCs, serving as proof of their existence and compliance with state regulations. Filing this document is a mandatory step to legally operate as an LLC and gain credibility with clients and investors.

What are Articles of Incorporation?

Articles of Incorporation are legal documents filed with a state government to officially establish a corporation as a separate legal entity. They typically include essential information such as the corporation's name, purpose, registered agent, stock details, and the names of initial directors. These documents serve as a foundation for corporate governance and are required for the corporation to operate legally within the state.

Key Differences Between Certificate of Formation and Articles of Incorporation

The Certificate of Formation serves as the foundational document to legally establish an LLC, detailing essential information such as the company name, registered agent, and management structure, whereas the Articles of Incorporation are filed to create a corporation and include specifics like the number of authorized shares, corporate purpose, and incorporator details. A key difference lies in their applicable business entities--Certificate of Formation is specific to LLCs, while Articles of Incorporation pertain exclusively to corporations. Filing requirements and state-specific terminologies can also vary, with some states using one term over the other but the underlying purpose distinguishing the creation of different business forms.

State-by-State Terminology Variations

Certificate of Formation and Articles of Incorporation are essential documents for establishing a corporation, with terminology varying by state. For instance, Delaware uses "Certificate of Incorporation," while Texas and California refer to similar documents as "Certificate of Formation." Understanding these state-specific terms is crucial for complying with local filing requirements and ensuring the proper legal establishment of a business entity.

Essential Information Included in Each Document

The Certificate of Formation typically includes essential information such as the business name, principal office address, registered agent details, and the purpose of the entity. Articles of Incorporation contain foundational elements like the corporation's name, duration, registered office and agent, the number of authorized shares, and the incorporators' names. Both documents serve to officially establish a business entity with the state but vary slightly depending on jurisdiction and business structure.

Legal Significance and Compliance Requirements

The Certificate of Formation and Articles of Incorporation both serve as foundational legal documents for establishing a business entity, with the former typically used for Limited Liability Companies (LLCs) and the latter for corporations. The Certificate of Formation outlines key information such as the business name, registered agent, and management structure, ensuring compliance with state-specific LLC regulations. Articles of Incorporation include detailed provisions on corporate governance, stock issuance, and shareholder rights, meeting statutory requirements and enabling legal recognition of the corporation.

Filing Process and Associated Fees

The Certificate of Formation and Articles of Incorporation are official documents filed with the state to legally establish a business entity, such as an LLC or corporation respectively. The filing process for a Certificate of Formation typically involves submitting the form to the Secretary of State along with a fee ranging from $50 to $500, depending on the jurisdiction. Articles of Incorporation require detailed company information, and the associated filing fees vary widely, generally between $100 and $500, reflecting differences in state requirements and processing times.

Impact on Business Structure and Operations

A Certificate of Formation establishes a Limited Liability Company (LLC), impacting business structure by offering flexible management and pass-through taxation, which can simplify operations and reduce tax burdens. Articles of Incorporation create a corporation, imposing a formal structure with a board of directors and shareholder requirements, influencing operational complexity and regulatory compliance. Choosing between these documents directly affects governance, liability protection, and tax treatment, shaping the company's long-term strategic direction.

Choosing the Right Document for Your Business Type

Choosing the right document for your business type depends on whether you are forming an LLC or a corporation. A Certificate of Formation is required to legally establish a Limited Liability Company (LLC) and outlines the company's structure, whereas Articles of Incorporation are necessary for forming a corporation and include details like the corporation's name, purpose, and stock information. Understanding the differences ensures proper compliance with state regulations and sets a solid foundation for your business's legal and operational framework.

Certificate of Formation Infographic

libterm.com

libterm.com